Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Your installment in loan You borrow BDT 2 0 , 0 0 0 today at 1 2 % compound annual interest rate for five years.

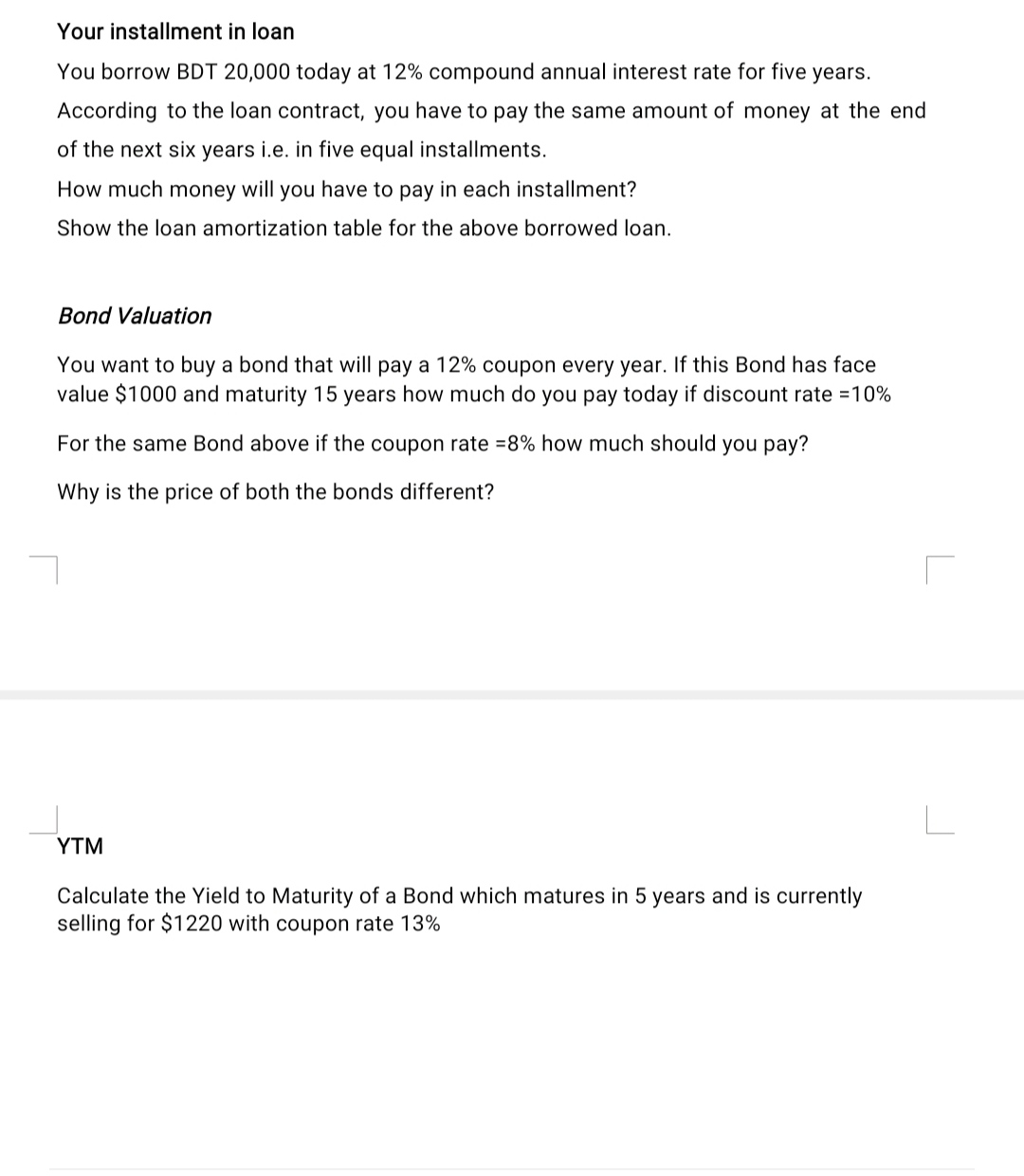

Your installment in loan

You borrow BDT today at compound annual interest rate for five years.

According to the loan contract, you have to pay the same amount of money at the end

of the next six years ie in five equal installments.

How much money will you have to pay in each installment?

Show the loan amortization table for the above borrowed loan.

Bond Valuation

You want to buy a bond that will pay a coupon every year. If this Bond has face

value $ and maturity years how much do you pay today if discount rate

For the same Bond above if the coupon rate how much should you pay?

Why is the price of both the bonds different?

YTM

Calculate the Yield to Maturity of a Bond which matures in years and is currently

selling for $ with coupon rate Expansion of Kate Winslets businessOn September Kate Winslet started a new business with the capital of $ Now, she wants to expand her business. For this purpose she needs to buy or lease one machine.Option to buy: You must decide whether or not to purchase new capital equipment. The cost of the machine is $ It will produce the following cash flows. The appropriate discount rate is percent.Year Cash Flow $ Option to lease: She is considering leasing equipment where she has to pay $ for the next years each year. This lease amount will provide at the beginning of each year.Considering all the aspect, should she purchase the equipment or should go for the lease?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started