Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Your instructors want to see your work, even if it is imperfect. We want you to use the resources provided in Canvas and your

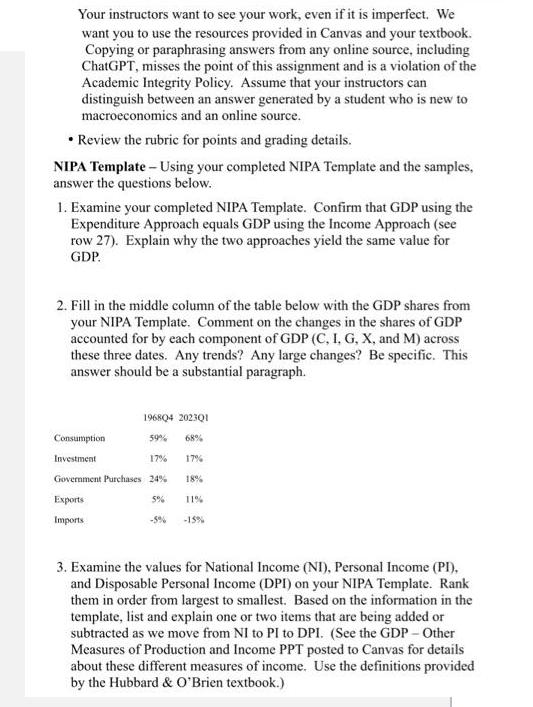

Your instructors want to see your work, even if it is imperfect. We want you to use the resources provided in Canvas and your textbook. Copying or paraphrasing answers from any online source, including ChatGPT, misses the point of this assignment and is a violation of the Academic Integrity Policy. Assume that your instructors can distinguish between an answer generated by a student who is new to macroeconomics and an online source. Review the rubric for points and grading details. NIPA Template - Using your completed NIPA Template and the samples, answer the questions below. 1. Examine your completed NIPA Template. Confirm that GDP using the Expenditure Approach equals GDP using the Income Approach (see row 27). Explain why the two approaches yield the same value for GDP. 2. Fill in the middle column of the table below with the GDP shares from your NIPA Template. Comment on the changes in the shares of GDP accounted for by each component of GDP (C, I, G, X, and M) across these three dates. Any trends? Any large changes? Be specific. This answer should be a substantial paragraph. 1968Q4 202301 59% 68% 17% 17% 18% Consumption Investment Government Purchases 24% Exports Imports 5% -15% 3. Examine the values for National Income (NI), Personal Income (PI), and Disposable Personal Income (DPI) on your NIPA Template. Rank them in order from largest to smallest. Based on the information in the template, list and explain one or two items that are being added or subtracted as we move from NI to PI to DPI. (See the GDP - Other Measures of Production and Income PPT posted to Canvas for details about these different measures of income. Use the definitions provided by the Hubbard & O'Brien textbook.)

Step by Step Solution

★★★★★

3.54 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started