Question

. Your investment horizon is IH = 6 years, Invest the amount of 3 000 000 CZK to be hedged against interest rate risk having

. Your investment horizon is IH = 6 years, Invest the amount of 3 000 000 CZK to be hedged against interest rate risk having 2 zero-coupon-bonds (c=0%) A, B with the parameters:

A... FV = 1000 CZK, y = 3 %, n = 1 year;

B... FV = 1000 CZK, y = 3 %, n = 7 years.

One day after the relevant portfolio was built, interest rates fell by 1%:

a) Build a portfolio immunized against interest rate risk - how much CZK do you bonds A, B?

b) Calculate the future value of the portfolio for the investment horizon at changed rates

c) Calculate the yield Y. (p. a.) to the investment horizon under the above conditions .

help please. All explanation please. thank you.

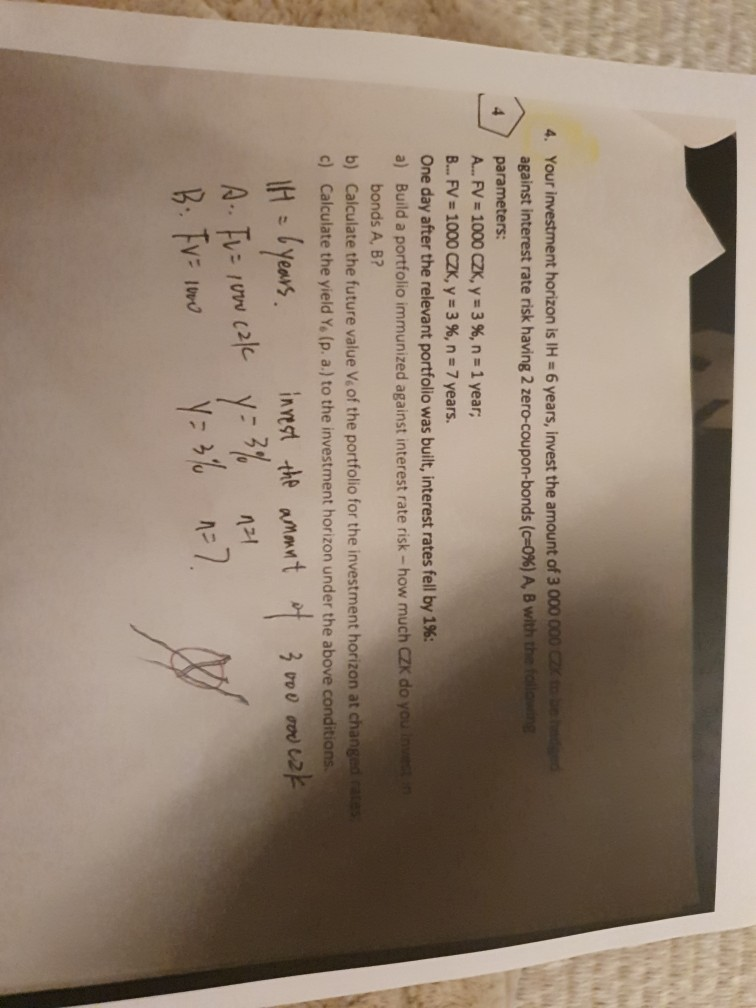

4. Your investment horizon is IH = 6 years, invest the amount of 3 000 000 CZK to be hedeed against interest rate risk having 2 zero-coupon-bonds (c=0%) A, B with the following parameters: A. FV = 1000 CZK, y = 3 %, n = 1 year; B... FV = 1000 CZK, y = 3 %, n = 7 years. One day after the relevant portfolio was built, interest rates fell by 1%: a) Build a portfolio immunized against interest rate risk - how much CZK do you investn bonds A, B? b) Calculate the future value Ve of the portfolio for the investment horizon at changed rates c) Calculate the yield Y, (p. a.) to the investment horizon under the above conditions. IH = lyears. invrest the ammnt y= % y: 3% n=7. A- Fu= 1ow cale (2/k 121 B. Fv= 1moStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started