Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Your investment management firm, Albers Investment Group, is considering making a significant investment in Nike, Inc. (NYSE: NKE) and is currently in the process

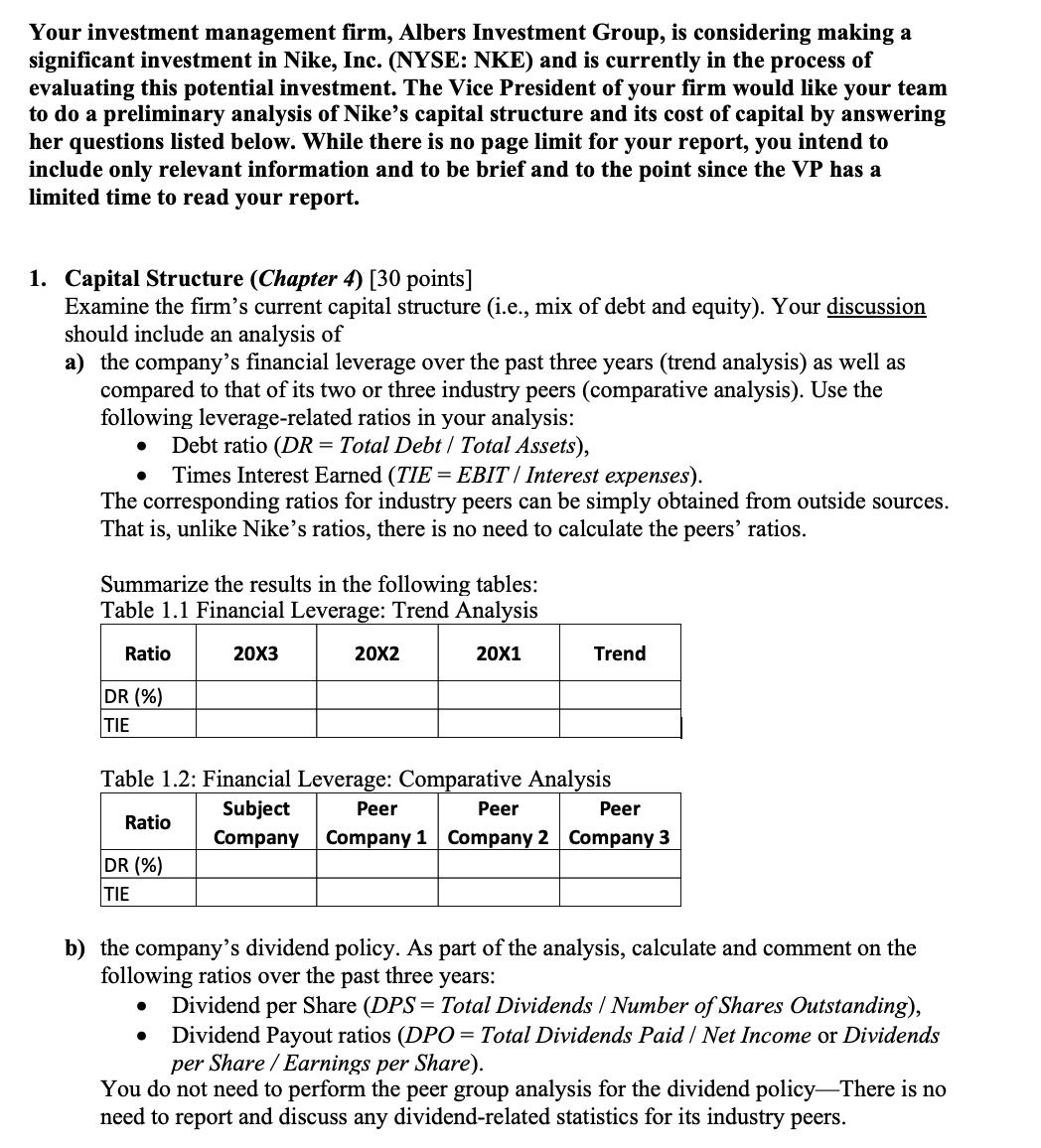

Your investment management firm, Albers Investment Group, is considering making a significant investment in Nike, Inc. (NYSE: NKE) and is currently in the process of evaluating this potential investment. The Vice President of your firm would like your team to do a preliminary analysis of Nike's capital structure and its cost of capital by answering her questions listed below. While there is no page limit for your report, you intend to include only relevant information and to be brief and to the point since the VP has a limited time to read your report. 1. Capital Structure (Chapter 4) [30 points] Examine the firm's current capital structure (i.e., mix of debt and equity). Your discussion should include an analysis of a) the company's financial leverage over the past three years (trend analysis) as well as compared to that of its two or three industry peers (comparative analysis). Use the following leverage-related ratios in your analysis: Debt ratio (DR = Total Debt / Total Assets), Times Interest Earned (TIE = EBIT/ Interest expenses). The corresponding ratios for industry peers can be simply obtained from outside sources. That is, unlike Nike's ratios, there is no need to calculate the peers' ratios. Summarize the results in the following tables: Table 1.1 Financial Leverage: Trend Analysis 20X3 20X1 Ratio DR (%) TIE DR (%) TIE Table 1.2: Financial Leverage: Comparative Analysis Subject Peer Peer Peer Ratio Company Company 1 Company 2 Company 3 20X2 Trend b) the company's dividend policy. As part of the analysis, calculate and comment on the following ratios over the past three years: Dividend per Share (DPS = Total Dividends/ Number of Shares Outstanding), Dividend Payout ratios (DPO = Total Dividends Paid / Net Income or Dividends per Share / Earnings per Share). You do not need to perform the peer group analysis for the dividend policy-There is no need to report and discuss any dividend-related statistics for its industry peers. Your investment management firm, Albers Investment Group, is considering making a significant investment in Nike, Inc. (NYSE: NKE) and is currently in the process of evaluating this potential investment. The Vice President of your firm would like your team to do a preliminary analysis of Nike's capital structure and its cost of capital by answering her questions listed below. While there is no page limit for your report, you intend to include only relevant information and to be brief and to the point since the VP has a limited time to read your report. 1. Capital Structure (Chapter 4) [30 points] Examine the firm's current capital structure (i.e., mix of debt and equity). Your discussion should include an analysis of a) the company's financial leverage over the past three years (trend analysis) as well as compared to that of its two or three industry peers (comparative analysis). Use the following leverage-related ratios in your analysis: Debt ratio (DR = Total Debt / Total Assets), Times Interest Earned (TIE = EBIT / Interest expenses). The corresponding ratios for industry peers can be simply obtained from outside sources. That is, unlike Nike's ratios, there is no need to calculate the peers' ratios. Summarize the results in the following tables: Table 1.1 Financial Leverage: Trend Analysis 20X3 20X1 Ratio DR (%) TIE DR (%) TIE Table 1.2: Financial Leverage: Comparative Analysis Subject Peer Peer Peer Ratio Company Company 1 Company 2 Company 3 20X2 Trend b) the company's dividend policy. As part of the analysis, calculate and comment on the following ratios over the past three years: Dividend per Share (DPS = Total Dividends / Number of Shares Outstanding), Dividend Payout ratios (DPO = Total Dividends Paid / Net Income or Dividends per Share / Earnings per Share). You do not need to perform the peer group analysis for the dividend policy-There is no need to report and discuss any dividend-related statistics for its industry peers.

Step by Step Solution

★★★★★

3.44 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Solution Here is my analysis of Nikes capital structure and cost of capital Table 11 Financial Lever...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started