Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Your investment strategy is to maximize expected return but with a risk level (standard deviation) that does not exceed 15%. Since you are a

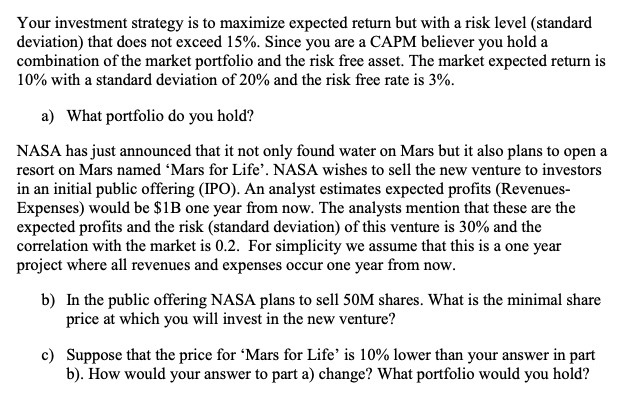

Your investment strategy is to maximize expected return but with a risk level (standard deviation) that does not exceed 15%. Since you are a CAPM believer you hold a combination of the market portfolio and the risk free asset. The market expected return is 10% with a standard deviation of 20% and the risk free rate is 3%. a) What portfolio do you hold? NASA has just announced that it not only found water on Mars but it also plans to open a resort on Mars named 'Mars for Life'. NASA wishes to sell the new venture to investors in an initial public offering (IPO). An analyst estimates expected profits (Revenues- Expenses) would be $1B one year from now. The analysts mention that these are the expected profits and the risk (standard deviation) of this venture is 30% and the correlation with the market is 0.2. For simplicity we assume that this is a one year project where all revenues and expenses occur one year from now. b) In the public offering NASA plans to sell 50M shares. What is the minimal share price at which you will invest in the new venture? c) Suppose that the price for 'Mars for Life' is 100% lower than your answer in part b). How would your answer to part a) change? What portfolio would you hold?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a To determine the portfolio you would hold we need to find the optimal allocation between the market portfolio and the riskfree asset that maximizes ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started