Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Your job as a financial analyst is to make projections and evaluations of your firm's business decisions. Your firm is weighing a purchase of new

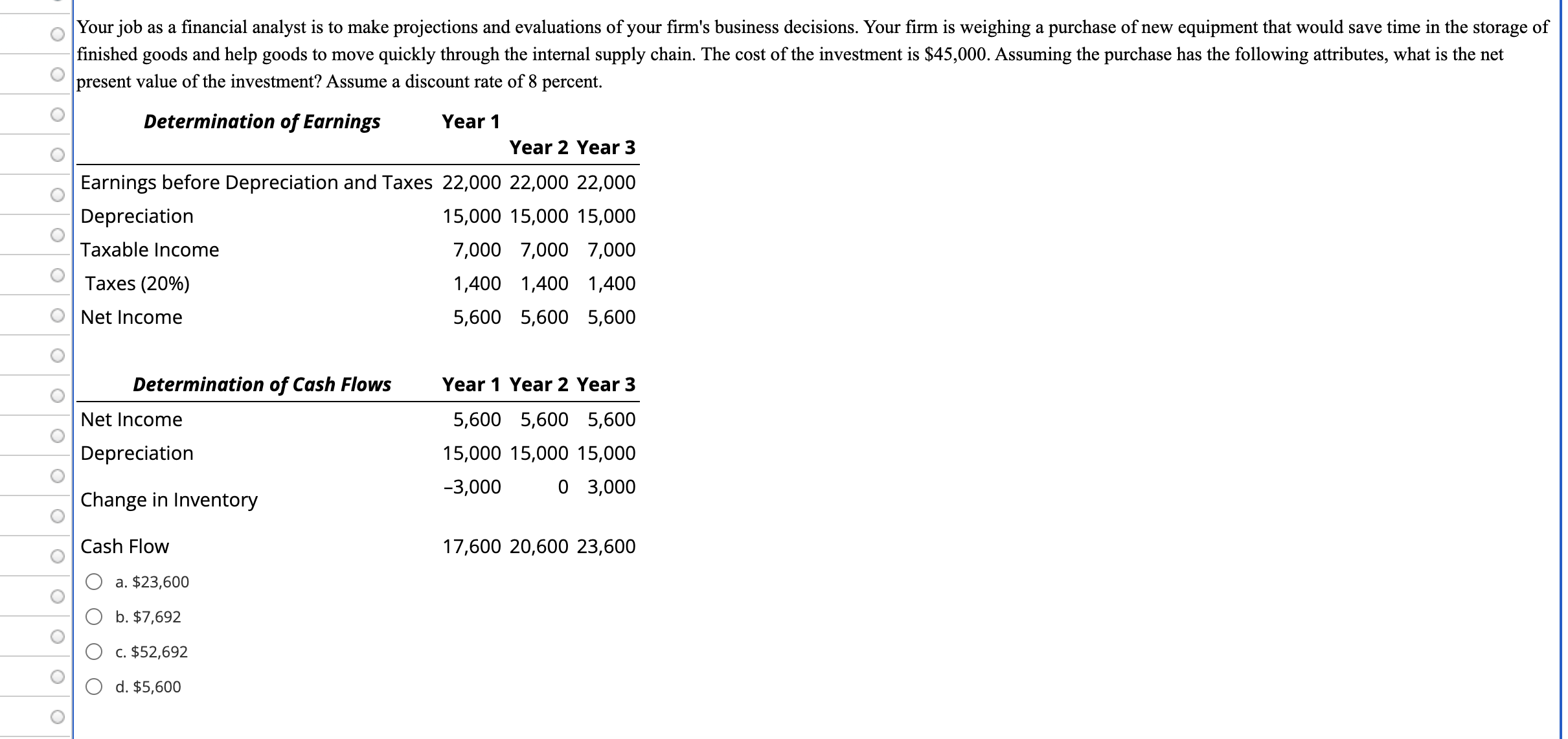

Your job as a financial analyst is to make projections and evaluations of your firm's business decisions. Your firm is weighing a purchase of new equipment that would save time in the storage of

finished goods and help goods to move quickly through the internal supply chain. The cost of the investment is $ Assuming the purchase has the following attributes, what is the net

present value of the investment? Assume a discount rate of percent.

Determination of Earnings

Earnings before Depreciation and Taxes

Depreciation

Taxable Income

Taxes

Net Income

Year

Year Year

Year Year

Year Year Year

Net Income

Depreciation

Change in Inventory

Cash Flow

a $

b $

c $

d $

PLEASE DO IN EXCEL

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started