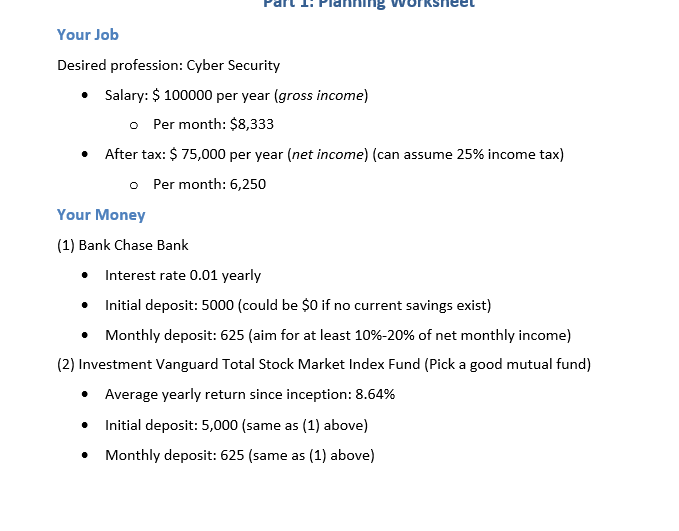

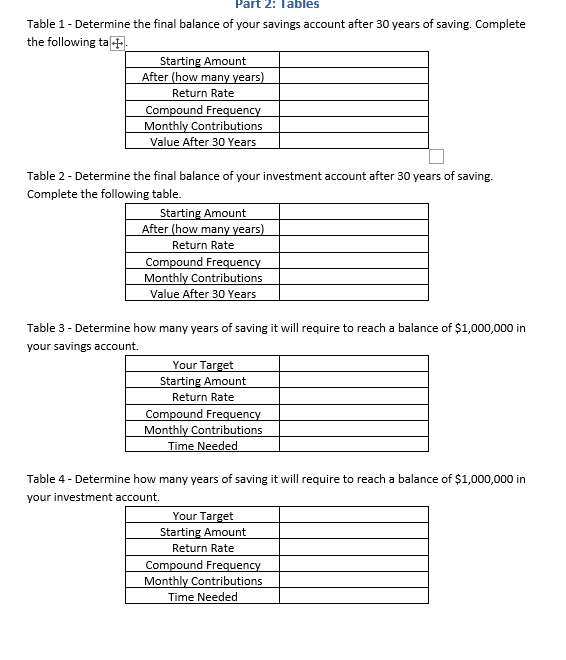

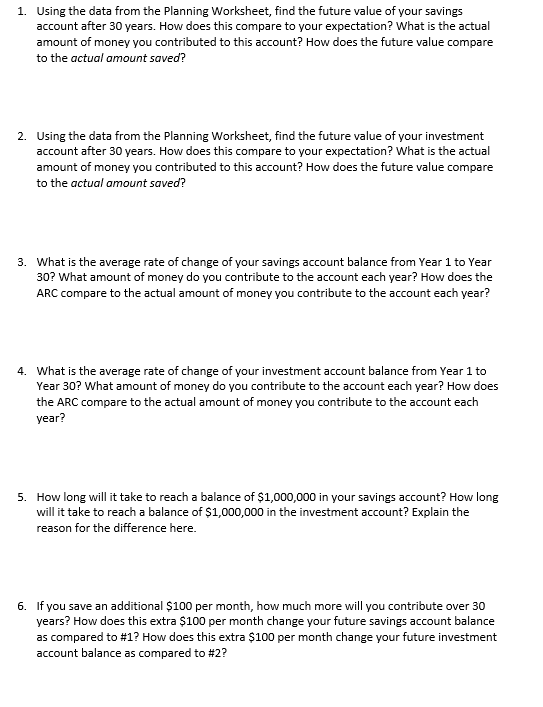

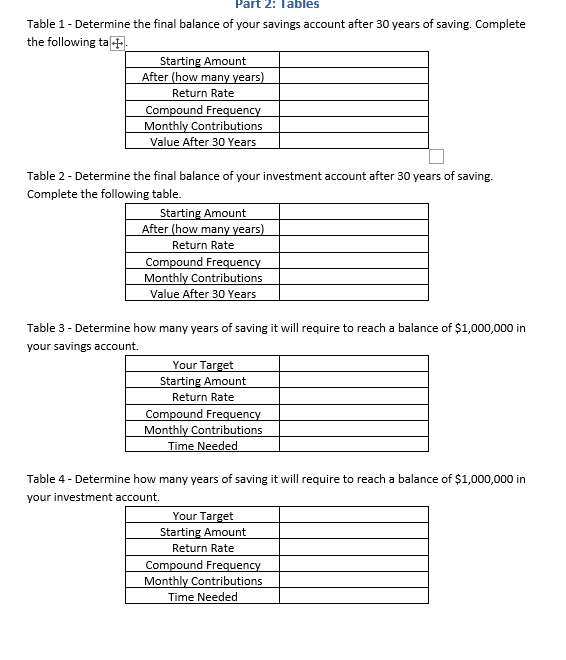

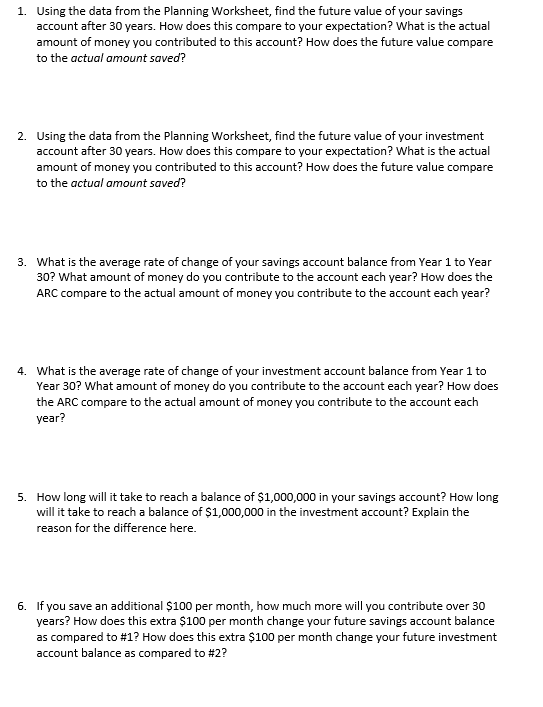

Your Job Desired profession: Cyber Security - Salary: \$100000 per year (gross income) - Per month: $8,333 - After tax: $75,000 per year (net income) (can assume 25% income tax) 0 Per month: 6,250 Your Money (1) Bank Chase Bank - Interest rate 0.01 yearly - Initial deposit: 5000 (could be $0 if no current savings exist) - Monthly deposit: 625 (aim for at least 10\%-20\% of net monthly income) (2) Investment Vanguard Total Stock Market Index Fund (Pick a good mutual fund) - Average yearly return since inception: 8.64% - Initial deposit: 5,000 (same as (1) above) - Monthly deposit: 625 (same as (1) above) Table 1 - Determine the final balance of your savings account after 30 years of saving. Complete the following ta Table 2 - Determine the final balance of your investment account after 30 years of saving. Complete the following table. Table 3 - Determine how many years of saving it will require to reach a balance of $1,000,000 in your savings account. Table 4 - Determine how many years of saving it will require to reach a balance of $1,000,000 in your investment account. 1. Using the data from the Planning Worksheet, find the future value of your savings account after 30 years. How does this compare to your expectation? What is the actual amount of money you contributed to this account? How does the future value compare to the actual amount saved? 2. Using the data from the Planning Worksheet, find the future value of your investment account after 30 years. How does this compare to your expectation? What is the actual amount of money you contributed to this account? How does the future value compare to the actual amount saved? 3. What is the average rate of change of your savings account balance from Year 1 to Year 30 ? What amount of money do you contribute to the account each year? How does the ARC compare to the actual amount of money you contribute to the account each year? 4. What is the average rate of change of your investment account balance from Year 1 to Year 30 ? What amount of money do you contribute to the account each year? How does the ARC compare to the actual amount of money you contribute to the account each year? 5. How long will it take to reach a balance of $1,000,000 in your savings account? How long will it take to reach a balance of $1,000,000 in the investment account? Explain the reason for the difference here. 6. If you save an additional $100 per month, how much more will you contribute over 30 years? How does this extra $100 per month change your future savings account balance as compared to #1 ? How does this extra $100 per month change your future investment account balance as compared to #2