Question

Your job will be to design a compensation package for the Fitness 123 Company. Fitness 123 spends $120,000 per year on its managers. The expenditure

Your job will be to design a compensation package for the Fitness 123 Company. Fitness 123 spends $120,000 per year on its managers. The expenditure includes some salary, as well as appropriate choices of the fringe benefits listed below. Your task includes one major complexity: you have managers in two different countries. Specifically, there is a division in Adamskia and another in Manerus.

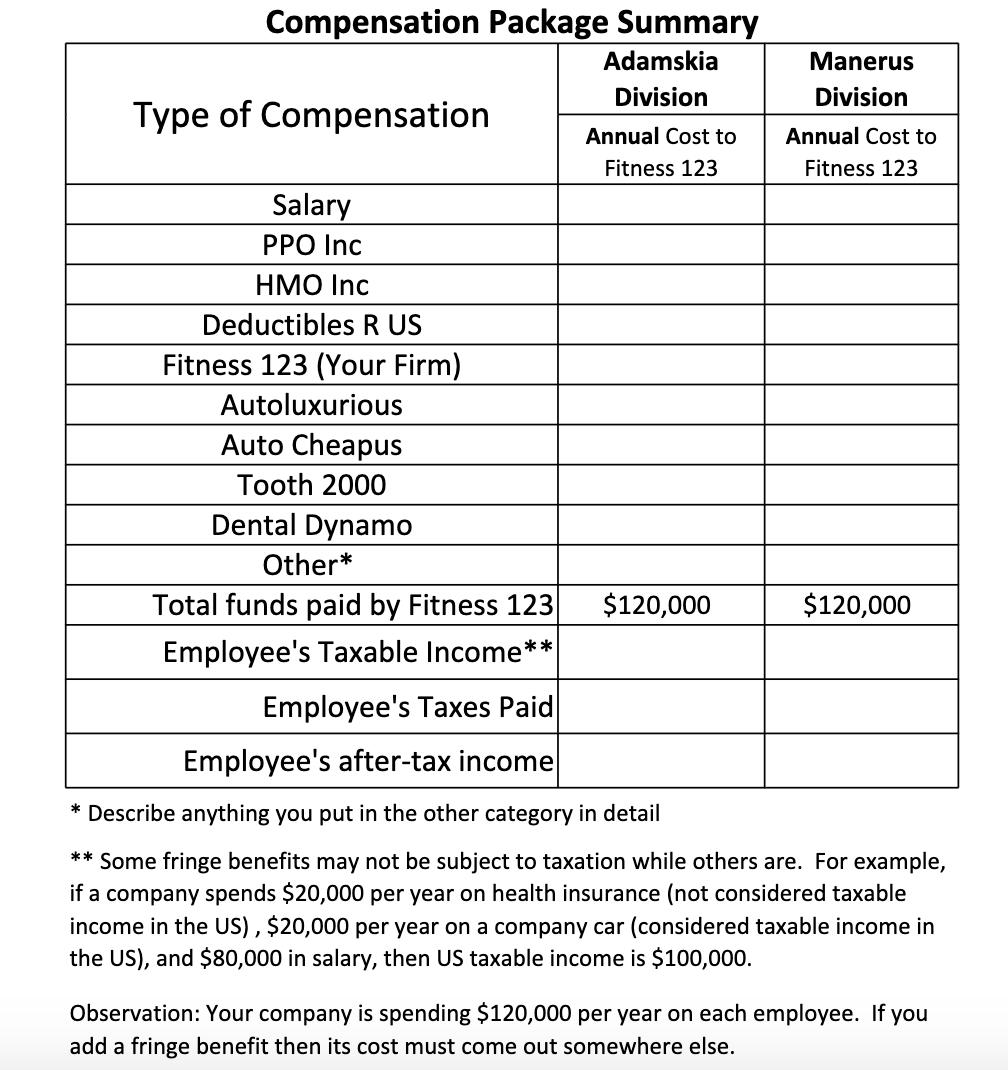

- Fill out the Compensation Package Worksheet describing the combination of salary and fringe benefits you would provide to workers in Adamskia and Manerus.

- Write a 1 page essay that uses concepts developed in class and in the text to explain why you have selected that particular compensation package. Explain why you would want different packages for workers in different countries.

Description of Your Company

Fitness 123

Your company runs luxury health clubs in medium to large cities. It charges $100 per month for a membership to its members. The marginal cost per customer per month is about $10. Many employees lead active, fitness-oriented, lifestyles, but there are significant exceptions…particularly among senior administrators. Approximately 60% of employees are married. Half of the married employees have at least 2 children.

Description of the Countries

Adamskia

The income tax rate is a flat 20% on all income in Adamskia. All money spent by a company for employee benefits is considered taxable – with no exceptions. The government provides no national health insurance. GDP per capita in Adamskia is in the bottom third of all countries in the world.

Manerus

For every dollar earned less than $100,000 must pay 10% of their income in tax, but for every dollar earned beyond $100,000 must pay 80% in tax. Most money spent by a company for employee benefits is taxable, but there are exceptions made for health insurance, dental insurance and vision care insurance. There is no national health insurance. GDP per capita in Manerus is among the highest in the world.

Possible Fringe Benefits

Preferred Provider Organization Inc (PPO Inc) Health insurance

This health insurance plan costs $2000 per month when the company buys it and $2,200 per month when a private individual buys it. It lets customers choose primary care physicians from a long list and provides very generous benefits for the insured and their families.

HMO Inc

This health insurance costs $1000 per month when the company buys it and $1,200 per month when a private individual buys it. Customers are assigned a doctor and that doctor must approve all subsequent care. Coverage for ordinary problems is generous, but coverage of unusual problems is spotty at best.

Deductibles R Us

This insurance pays for any health insurance expenditure above a $1000 deductible each year. It costs $1,200 per month when your employer buys it and the same when private individuals buy it.

Fitness 123

This is your company. You could give employees free membership in Fitness 123. The company usually charges $100 per month for this, but the marginal cost of a membership is $10.

Auto Luxurius

This company will rent cars to the company for $600 per month. They’re stylish, filled with leather and drive like a luxury tank. Their safety record is great. Cost to private customers is the same as what your employer would have to pay.

Auto Cheapus

This company will rent cars to the company for $400 per month, which is the same price they will rent them to private customers. The cars are clean, and efficient, but fairly ugly.

Tooth 2000

The company will provide up to a maximum of $2000 per enrollee family member of dental care each year. They charge the company $100 per month per employee. Cost to private customers is the same as the company.

Dental Dynamo (DD)

The company covers serious dental problems. It has a $800 deductible, but will cover any non-cosmetic dentistry required. They charge $100 per month per employee. Cost to private customers is the same as your employer would have to pay.

Fill out the compensation worksheet and briefly explain why selected that particular compensation package. Also explain why you would want different packages for workers in different countries.

Compensation Package Summary Adamskia Manerus Division Division Type of Compensation Annual Cost to Annual Cost to Fitness 123 Fitness 123 Salary PPO Inc HMO Inc Deductibles R US Fitness 123 (Your Firm) Autoluxurious Auto Cheapus Tooth 2000 Dental Dynamo Other* Total funds paid by Fitness 123 $120,000 $120,000 Employee's Taxable Income** Employee's Taxes Paid Employee's after-tax income * Describe anything you put in the other category in detail ** Some fringe benefits may not be subject to taxation while others are. For example, if a company spends $20,000 per year on health insurance (not considered taxable income in the US), $20,000 per year on a company car (considered taxable income in the US), and $80,000 in salary, then US taxable income is $100,000. Observation: Your company is spending $120,000 per year on each employee. If you add a fringe benefit then its cost must come out somewhere else.

Step by Step Solution

3.43 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Compensation package for the Fitness 123 company 1 Since Fitness 123 runs luxury health clubs in medium to large cities So while taking decisions abou...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started