Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Your line manager wants to assess your understanding and ability to prepare and produce the Trial Balance by using the following ledger accounts of

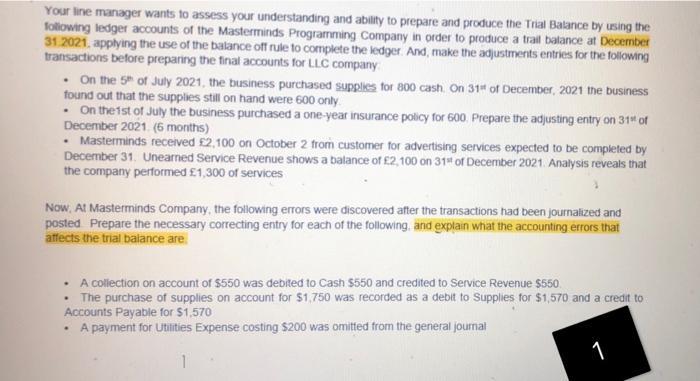

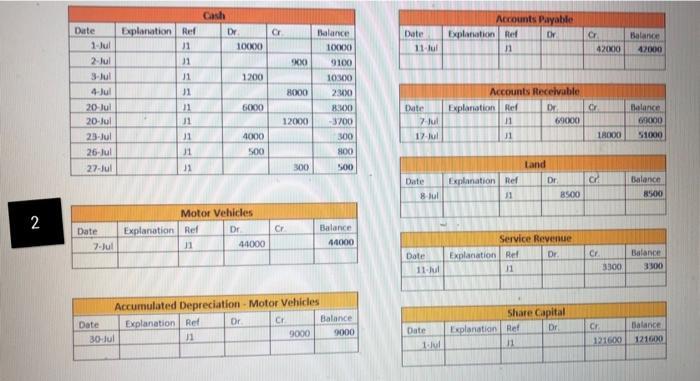

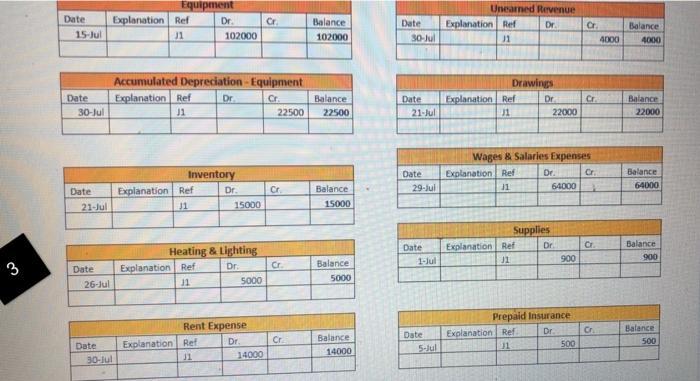

Your line manager wants to assess your understanding and ability to prepare and produce the Trial Balance by using the following ledger accounts of the Masterminds Programming Company in order to produce a trail balance at December 31.2021, applying the use of the balance off rule to complete the ledger. And, make the adjustments entries for the following transactions before preparing the final accounts for LLC company . On the 5th of July 2021, the business purchased supplies for 800 cash. On 31" of December, 2021 the business found out that the supplies still on hand were 600 only . On the 1st of July the business purchased a one-year insurance policy for 600. Prepare the adjusting entry on 31st of December 2021. (6 months) Masterminds received 2,100 on October 2 from customer for advertising services expected to be completed by December 31. Unearned Service Revenue shows a balance of 2,100 on 31st of December 2021. Analysis reveals that the company performed 1,300 of services Now, At Masterminds Company, the following errors were discovered after the transactions had been journalized and posted Prepare the necessary correcting entry for each of the following, and explain what the accounting errors that affects the trial balance are A collection on account of $550 was debited to Cash $550 and credited to Service Revenue $550. The purchase of supplies on account for $1,750 was recorded as a debit to Supplies for $1,570 and a credit to Accounts Payable for $1,570 A payment for Utilities Expense costing $200 was omitted from the general journal 1 . . 2 Date 1-Jul 2-Jul 3-Jul 4-Jul 20-Jul 20-Jul 23-Jul 26-Jul 27-Jul Date 7-Jul Date Explanation Ref 11 31 30-Jul J1 J1 11 11 J1 J1 J1 Cash Explanation Ref 11 Dr. 10000 1200 6000 4000 500 Motor Vehicles Dr. 44000 8 Cr 900 Cr 8000 12000 300 Accumulated Depreciation - Motor Vehicles Explanation Ref Dr. Cr 11 Balance 10000 9100 10300 2300 8300 -3700 300 800 500 9000 Balance 44000 Balance 9000 Date 11-Jul Date 7-Jul 17-Jul Date Date 11-Jul Date 1.Jul Accounts Payable Dr Explanation Ref 11 Accounts Receivable Dr. Explanation Ref 11 31 Explanation Ref 11 Explanation Ref 11 Land 69000 Explanation Ref 11 Dr. Service Revenue Dr. 8500 Share Capital Dr. Balance 42000 47000 Cr Cr 18000 a Cr Cr 3300 121600 Balance 69000 51000 Balance 8500 Balance 3300 Balance 121600 3 Date 15-Jul Date 30-Jul Date 21-Jul Date 26-jul Date Explanation Ref J1 30-Jul Equipment Dr. Accumulated Depreciation Explanation Ref J1 Explanation Ref J1 Explanation 102000 Explanation Dr. Inventory Dr. Heating & Lighting Ref Dr. 11 15000 Equipment Cr. 5000 Rent Expense Ref Dr. 31 Cr. 14000 Balance 22500 22500 Cr Cr. Balance 102000 Cr Balance 15000 Balance 5000 Balance 14000 Date 30-Jul Date 21-Jul Date 29-Jul Date 1-Jul Date 5-Jul Unearned Revenue Dr. Explanation Ref 11 Drawings Explanation Ref 11 Explanation Ref 11 Dr. Explanation Ref J1 Wages & Salaries Expenses Cr. Supplies 22000 Explanation Ref 11 Dr. 64000 Dr. 900 Prepaid Insurance Dr. Cr. 500 Cr. Cr. Cr. 4000 Balance 4000 Balance 22000 Balance 64000 Balance 900 Balance 500

Step by Step Solution

★★★★★

3.48 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started