Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Your local bank has offered you a loan of $11,000 with a fat processing fee of $66.00 and an origination fee of 1.00x of the

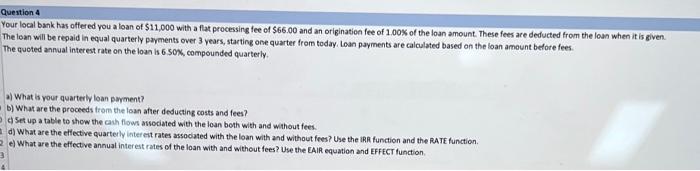

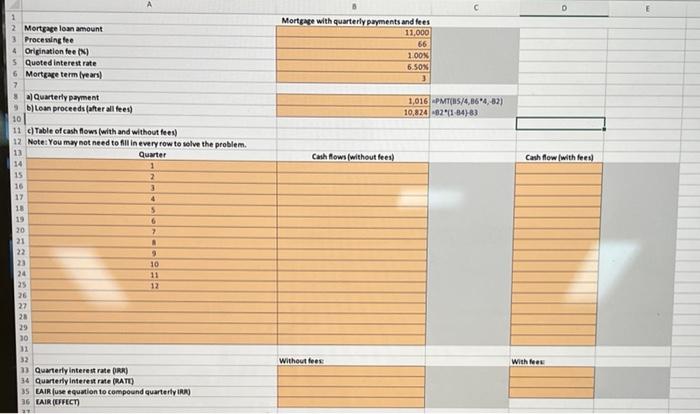

Your local bank has offered you a loan of $11,000 with a fat processing fee of $66.00 and an origination fee of 1.00x of the loan amount. These fees are deducted from the loan when it is given. The loan will be repaid in equal quarterly payments over 3 years, starting one quarter from today. Loan payments are calculated based on the loan amount belore fees. The quoted annwal interest rate on the loan is 6.50, compounded quarterly. a) What is your quartery loan payment? b) What are the proceeds from the loan after deducting costs and fees? c) Set up a table to show the cash flows associated with the loan both with and wasthout fees. d) What are the eflective quartely interet rates associated with the loan with and without fees? Use the inh function and the RATE function. e) What are the effective annual interest rates of the loan with and without fees? Use the EAIR equation and EFFECT function

Your local bank has offered you a loan of $11,000 with a fat processing fee of $66.00 and an origination fee of 1.00x of the loan amount. These fees are deducted from the loan when it is given. The loan will be repaid in equal quarterly payments over 3 years, starting one quarter from today. Loan payments are calculated based on the loan amount belore fees. The quoted annwal interest rate on the loan is 6.50, compounded quarterly. a) What is your quartery loan payment? b) What are the proceeds from the loan after deducting costs and fees? c) Set up a table to show the cash flows associated with the loan both with and wasthout fees. d) What are the eflective quartely interet rates associated with the loan with and without fees? Use the inh function and the RATE function. e) What are the effective annual interest rates of the loan with and without fees? Use the EAIR equation and EFFECT function

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started