Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Your long term clients and married couple, David and Diana started D&D Corporation. D&D Corporation is a service based company and has been successful

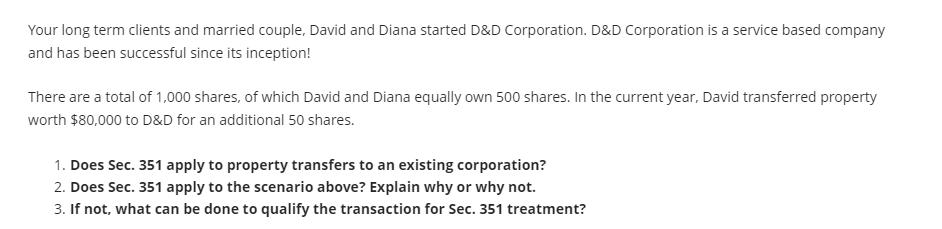

Your long term clients and married couple, David and Diana started D&D Corporation. D&D Corporation is a service based company and has been successful since its inception! There are a total of 1,000 shares, of which David and Diana equally own 500 shares. In the current year, David transferred property worth $80,000 to D&D for an additional 50 shares. 1. Does Sec. 351 apply to property transfers to an existing corporation? 2. Does Sec. 351 apply to the scenario above? Explain why or why not. 3. If not, what can be done to qualify the transaction for Sec. 351 treatment?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started