Answered step by step

Verified Expert Solution

Question

1 Approved Answer

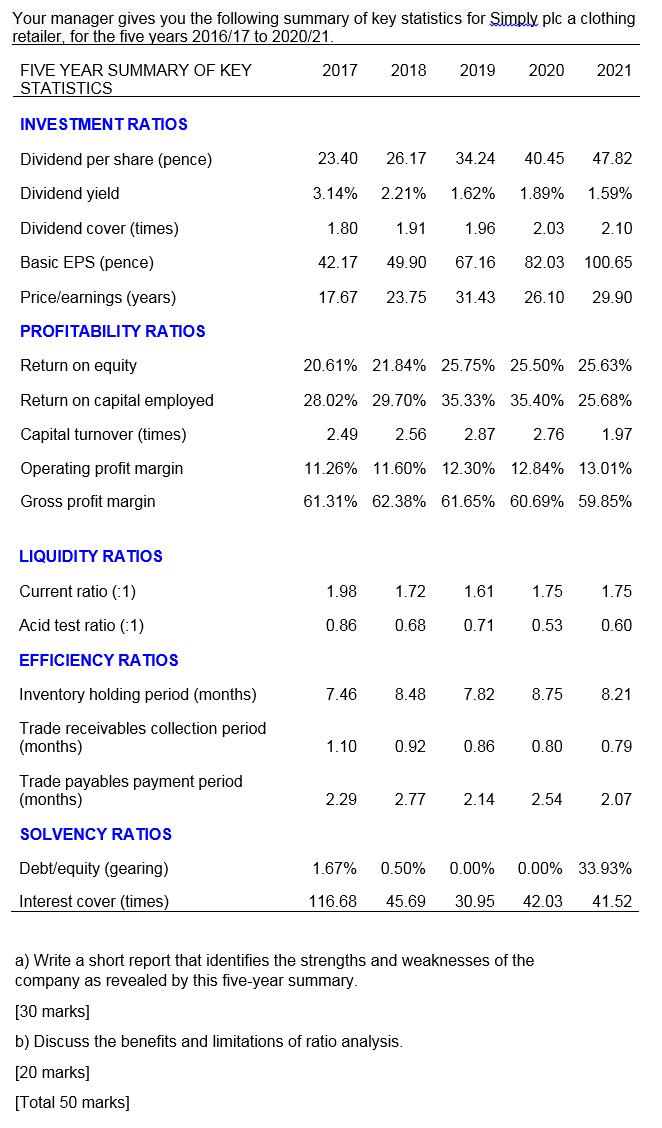

Your manager gives you the following summary of key statistics for Simply plc a clothing retailer, for the five years 2016/17 to 2020/21. FIVE

Your manager gives you the following summary of key statistics for Simply plc a clothing retailer, for the five years 2016/17 to 2020/21. FIVE YEAR SUMMARY OF KEY STATISTICS INVESTMENT RATIOS Dividend per share (pence) Dividend yield Dividend cover (times) Basic EPS (pence) Price/earnings (years) PROFITABILITY RATIOS Return on equity Return on capital employed Capital turnover (times) Operating profit margin Gross profit margin LIQUIDITY RATIOS Current ratio (:1) Acid test ratio (:1) EFFICIENCY RATIOS Inventory holding period (months) Trade receivables collection period (months) Trade payables payment period (months) SOLVENCY RATIOS Debt/equity (gearing) Interest cover (times) 2017 2018 2019 2020 2021 26.17 34.24 40.45 2.21% 1.62% 1.89% 1.80 1.91 1.96 42.17 49.90 67.16 82.03 100.65 17.67 23.75 31.43 26.10 29.90 23.40 3.14% 1.98 0.86 7.46 20.61% 21.84% 25.75% 25.50% 25.63% 28.02% 29.70% 35.33% 35.40% 25.68% 2.49 2.56 2.87 2.76 1.97 11.26% 11.60% 12.30% 12.84% 13.01% 61.31% 62.38% 61.65% 60.69% 59.85% 1.10 1.67% 116.68 1.72 1.61 1.75 0.68 0.71 0.53 0.92 2.29 2.77 2.03 0.86 47.82 1.59% 8.48 7.82 8.75 8.21 [30 marks] b) Discuss the benefits and limitations of ratio analysis. [20 marks] [Total 50 marks] 2.10 1.75 a) Write a short report that identifies the strengths and weaknesses of the company as revealed by this five-year summary. 0.60 0.80 0.79 2.14 2.54 2.07 0.50% 0.00% 0.00% 33.93% 45.69 30.95 42.03 41.52 Your manager gives you the following summary of key statistics for Simply plc a clothing retailer, for the five years 2016/17 to 2020/21. FIVE YEAR SUMMARY OF KEY STATISTICS INVESTMENT RATIOS Dividend per share (pence) Dividend yield Dividend cover (times) Basic EPS (pence) Price/earnings (years) PROFITABILITY RATIOS Return on equity Return on capital employed Capital turnover (times) Operating profit margin Gross profit margin LIQUIDITY RATIOS Current ratio (:1) Acid test ratio (:1) EFFICIENCY RATIOS Inventory holding period (months) Trade receivables collection period (months) Trade payables payment period (months) SOLVENCY RATIOS Debt/equity (gearing) Interest cover (times) 2017 2018 2019 2020 2021 26.17 34.24 40.45 2.21% 1.62% 1.89% 1.80 1.91 1.96 42.17 49.90 67.16 82.03 100.65 17.67 23.75 31.43 26.10 29.90 23.40 3.14% 1.98 0.86 7.46 20.61% 21.84% 25.75% 25.50% 25.63% 28.02% 29.70% 35.33% 35.40% 25.68% 2.49 2.56 2.87 2.76 1.97 11.26% 11.60% 12.30% 12.84% 13.01% 61.31% 62.38% 61.65% 60.69% 59.85% 1.10 1.67% 116.68 1.72 1.61 1.75 0.68 0.71 0.53 0.92 2.29 2.77 2.03 0.86 47.82 1.59% 8.48 7.82 8.75 8.21 [30 marks] b) Discuss the benefits and limitations of ratio analysis. [20 marks] [Total 50 marks] 2.10 1.75 a) Write a short report that identifies the strengths and weaknesses of the company as revealed by this five-year summary. 0.60 0.80 0.79 2.14 2.54 2.07 0.50% 0.00% 0.00% 33.93% 45.69 30.95 42.03 41.52

Step by Step Solution

★★★★★

3.49 Rating (169 Votes )

There are 3 Steps involved in it

Step: 1

1 The weaknesses of the companies are as follows A The liquidity ratio of the company is not efficie...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started