Question

Your memorandum should thoroughly explain the tax benefits of your retirement plans and any assumptions that you use to arrive at your results. Please include

a. What is an IRA? What are the two types of IRAs? Also, fully explain the second type of retirement plan you selected.

b. The maximum annual investment amount for your plans.

c. Your age upon initial investment

d. Your projected retirement age

e. Your projected salary or income in you will be self-employed (you must use realistic amounts nothing greater than $70,000)

f. Information on the firm(s) you selected and why you selected them over others

g. Information on the investment accounts/vehicles you selected and why you selected them over others.

h. Tax implications of your plan.

i. Briefly explain what options are available to your Keogh, 401 (k) or 457 plans if you change jobs/careers, etc.

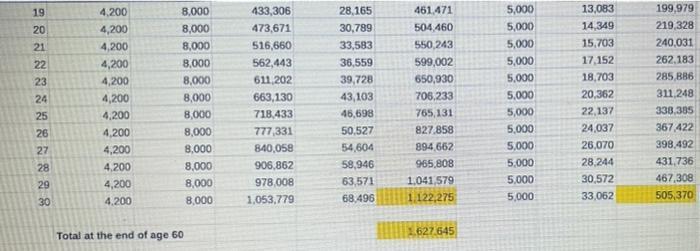

j. Total retirement income available upon your retirement.

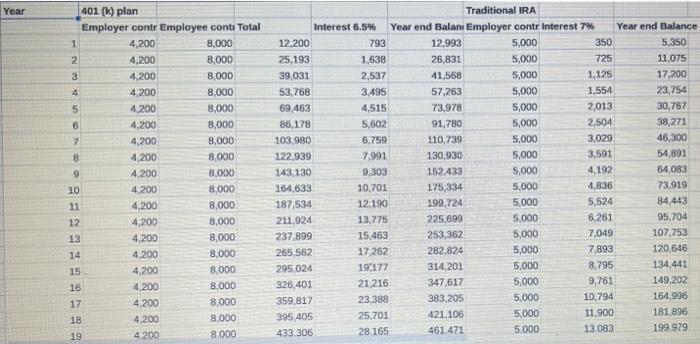

401 (k) plan Traditional IRA Year Employer contr Employee conti Total Interest 6.5% Year end Balan Employer contr Interest 7% Year end Balance 1 4,200 8,000 12,200 793 12,993 5,000 350 5,350 2. 4,200 8,000 25,193 1,638 26,831 5,000 725 11,075 3. 4,200 8,000 39,031 2,537 41,568 5,000 1,125 17,200 4 4,200 8,000 53,768 3,495 57,263 5,000 1,554 23,754 4,200 8,000 69,463 4,515 73,978 5,000 2,013 30,767 2,504 3,029 6. 4,200 8,000 86,178 5,602 91,780 5,000 38,271 4,200 8,000 103,980 6,759 110,739 5,000 46,300 4,200 8,000 122,939 7,991 130,930 5,000 3,591 54,891 4,200 8,000 143,130 9,303 152,433 5,000 4,192 64,083 10 4,200 8,000 164,633 10,701 175,334 5,000 4,836 73,919 11 4,200 8,000 187,534 12.190 199,724 5,000 5,524 84,443 4,200 8,000 211,924 13,775 225,699 5,000 6,261 95,704 12 4,200 8,000 237,899 15,463 253,362 5,000 7,049 107,753 13 8,000 265,562 17,262 282,824 5,000 7,893 120,646 14 4,200 4,200 8,000 295.024 19177 314.201 5,000 8,795 134,441 15 4,200 8,000 326,401 21.216 347,617 5,000 9,761 149,202 16 23,388 383,205 5,000 10,794 164,996 17 4,200 8,000 359,817 25,701 421,106 5,000 11,900 181,896 18 4,200 8,000 395,405 4.200 8.000 433.306 28.165 461.471 5.000. 13.083 199.979 19

Step by Step Solution

3.51 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

a An Individual Retirement Account IRA is an account that allows individuals to save for retirement with taxfree growth or on a taxdeferred basis Ther...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started