Answered step by step

Verified Expert Solution

Question

1 Approved Answer

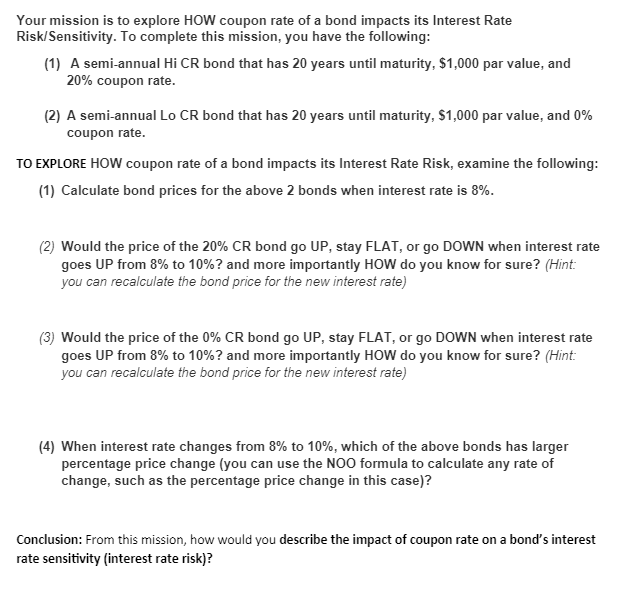

Your mission is to explore HOW coupon rate of a bond impacts its Interest Rate Risk / Sensitivity . To complete this mission, you have

Your mission is to explore HOW coupon rate of a bond impacts its Interest Rate

RiskSensitivity To complete this mission, you have the following:

A semiannual HiCR bond that has years until maturity, $ par value, and

coupon rate.

A semiannual Lo CR bond that has years until maturity, $ par value, and

coupon rate.

TO EXPLORE HOW coupon rate of a bond impacts its Interest Rate Risk, examine the following:

Calculate bond prices for the above bonds when interest rate is

Would the price of the CR bond go UP stay FLAT, or go DOWN when interest rate

goes UP from to and more importantly HOW do you know for sure? Hint:

you can recalculate the bond price for the new interest rate

Would the price of the CR bond go UP stay FLAT, or go DOWN when interest rate

goes UP from to and more importantly HOW do you know for sure? Hint:

you can recalculate the bond price for the new interest rate

When interest rate changes from to which of the above bonds has larger

percentage price change you can use the NOO formula to calculate any rate of

change, such as the percentage price change in this case

Conclusion: From this mission, how would you describe the impact of coupon rate on a bond's interest

rate sensitivity interest rate risk

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started