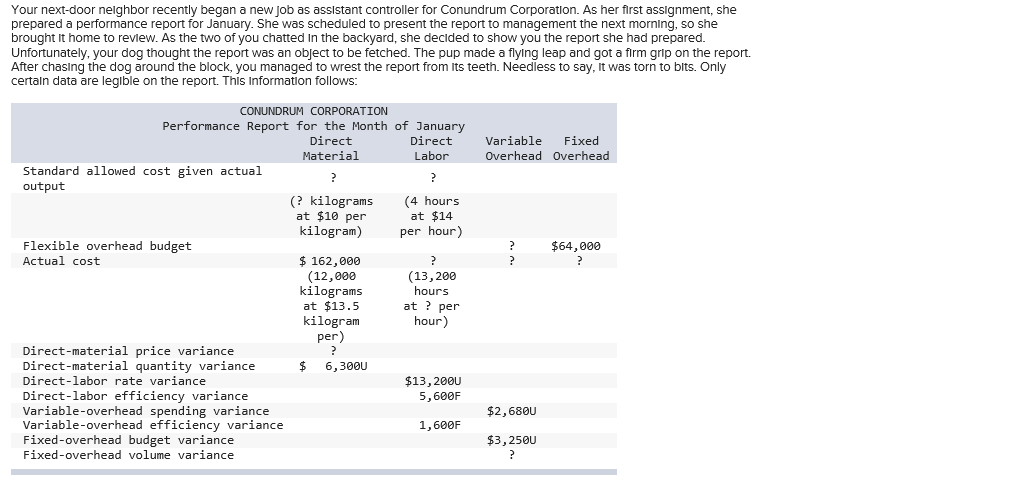

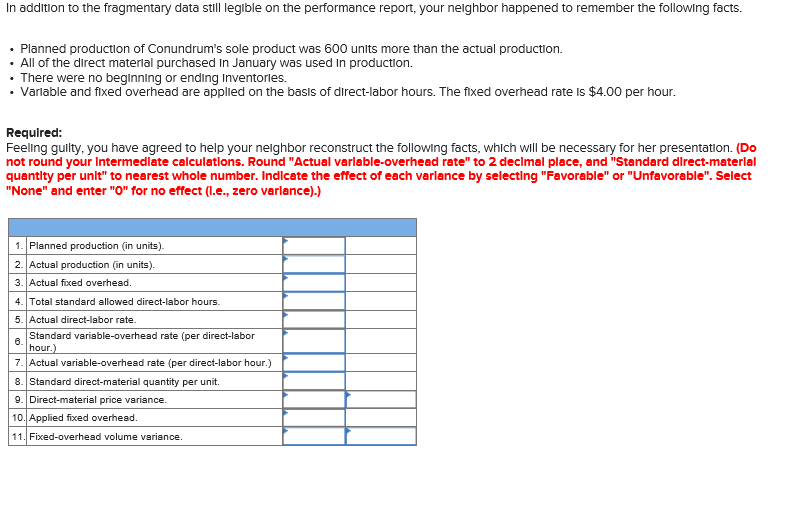

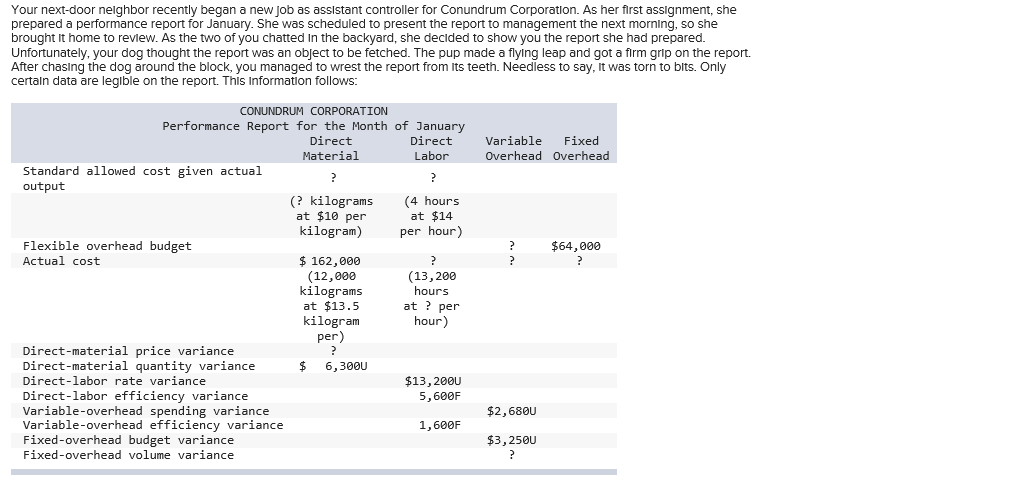

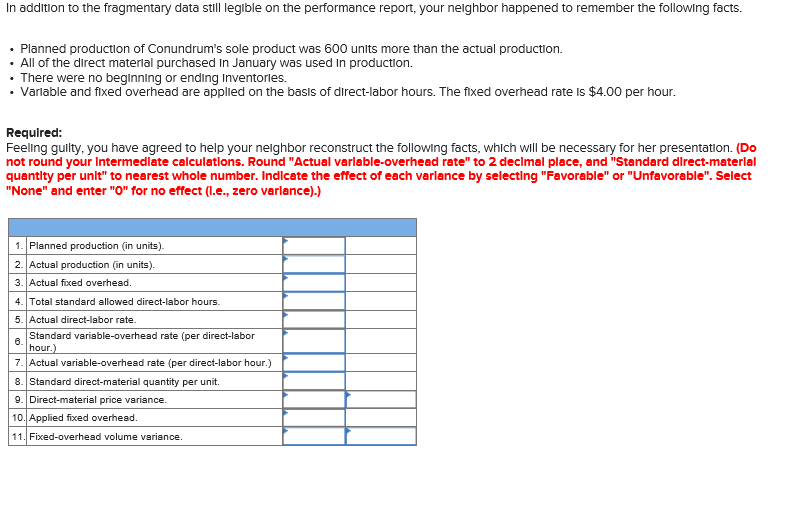

Your next-door nelghbor recently began a new Job as assistant controller for Conundrum Corporation. As her first assignment, she prepared a performance report for January. She was scheduled to present the report to management the next morning, so she brought It home to review. As the two of you chatted In the backyard, she decided to show you the report she had prepared. Unfortunately, your dog thought the report was an object to be fetched. The pup made a flying leap and got a flrm grip on the report. After chasing the dog around the block, you managed to wrest the report from Its teeth. Needless to say, It was torn to blts. Only certaln data are legible on the report. Thls Information follows: CONUNDRUM CORPORATION Performance Report for the Month of January Direct Material Direct Labor Variable Fixed Overhead Overhead Standard allowed cost given actual output (? kilograms at $10 per (4 hours at $14 kilogram) per hour) Flexible overhead budget Actual cost $64,000 $ 162,000 (12,000 kilograms at $13.5 kilogram per) (13,200 hours at ? per hour Direct-material price variance Direct-material quantity variance Direct-labor rate variance Direct-labor efficiency variance Variable-overhead spending variance Variable-overhead efficiency variance Fixed-overhead budget variance Fixed-overhead volume variance $6,300u $13,200U 5,600F $2,680U 1,600F $3,250U In addltion to the fragmentary data still legible on the performance report, your neighbor happened to remember the following facts. Planned production of Conundrum's sole product was 600 units more than the actual production. All of the direct materlal purchased In January was used In production. There were no beginning or ending Inventorles. variable and fixed overhead are applied on the basis of direct-labor hours. The fixed overhead rate is $4.00 per hour. Required: Feeling gullty, you have agreed to help your neighbor reconstruct the following facts, which will be necessary for her presentation. (Do not round your Intermedlate calculatlons. Round "Actual varlable-overhead rate" to 2 declmal place, and "Standard direct-material quantlty per unlt" to nearest whole number. Indicate the effect of each verlance by selecting "Favorable" or "Unfavorable". Select "None" and enter "O" for no effect (1.e., zero varlance).) 1. Planned production (in units). 2. Actual production (in units) 3. Actual fixed overhead. 4. Total standard allowed direct-labor hours. 5. Actual direct-labor rate. Standard variable-overhead rate (per direct-labor hour 7. Actual variable-overhead rate (per direct-labor hour.) 8. Standard direct-material quantity per unit. 9. Direct-material price variance. 10. Applied fixed overhead. 11. Fixed-overhead volume variance