Question

Your on-the-job training has now ended. You are on your own. You may begin recording the remaining transactions for May. Good Luck! Use this to

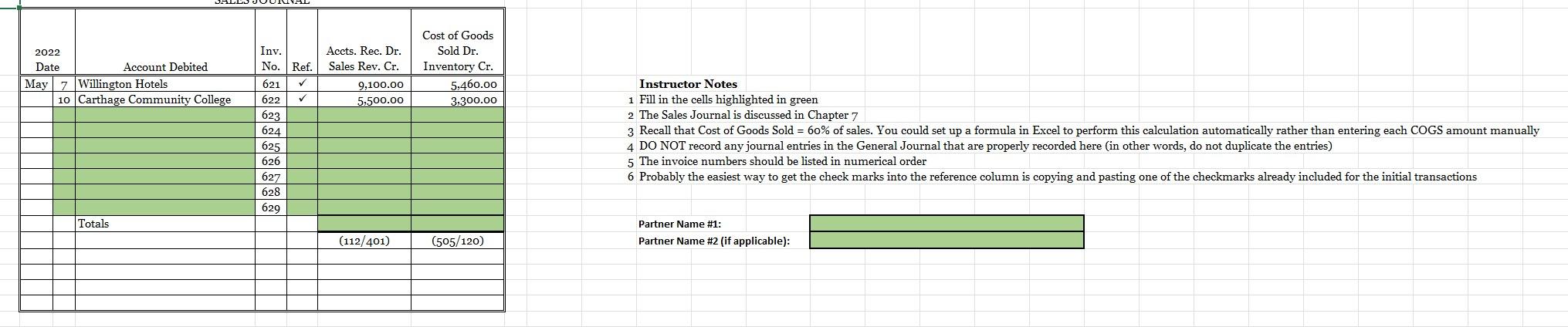

Your on-the-job training has now ended. You are on your own. You may begin recording the remaining transactions for May. Good Luck! Use this to fill out the green blanks of the sale journal.

May 13 Issued Check No. 529 to Lexis Fine Furniture in payment on account, April 14 purchase, $17,100 less 2% discount.

May 13 Received a check for $4,400 from Wallton Apartments Inc., as payment on their account, Sales Invoice No. 620.

May 13 Sold merchandise to Salem Hotel for $12,000 on account, Sales Invoice No. 623. Terms 2/10, n/30.

May 14 Received a check for $5,000 from Brent Davis, the owner, as an additional investment in the business.

May 14 Issued Check No. 530 to Old Hickory Furniture, Inc. in payment on account, April 30 purchase, $8,350 less 2% discount.

May 15 The semimonthly payroll ending May 15 is as follows:

Gross salaries $40,200

FICA taxes withholdings (3,256)

Federal income taxes (7,421)

Net Salaries/Wages Payable $29,523

(Enter the payroll in the general journal and credit Salaries and Wages Payable for the net amount of the payroll.)

May 15 Issued Check No. 531 for $29,523 to Brent Davis for the semi-monthly payroll. Debit Salaries and Wages Payable. Mr. Davis cashes the check and distributes the salaries to the employees.

May 15 Recorded the following employer payroll taxes in the general journal.

FICA taxes $3,256

Federal unemployment taxes 202

State unemployment taxes 1,264

Total employer payroll taxes $4,722

May 15 Issued Check No. 532 for $28,000 payable to Ohio State Bank for Aprils Federal Income Taxes Payable, $16,100; and FICA Taxes Payable, $11,900.

May 16 Received a check for $8,918 from Willington Hotels as payment on their account less discount, Sales Invoice No. 621.

May 17 Recorded cash sales for the week ending May 17:

Cash sales $14,750

Maxicard sales 7,000

Total cash sales $21,750

May 17 Cash deposited in the bank, $40,068. Enter this amount on a separate line in the cash receipts journal under the Bank Deposit column. All the cash making up this deposit was already recorded when the items were received.

May 17 Issued Check No. 533 for $6,800 to American Mattress Company in payment on account, April 18 purchase.

Posting Post all journals to the individual accounts in the accounts receivable and accounts payable subsidiary ledgers. Do not post the general ledger until the end of the month.

May 20 Issued Check No. 534 to Georgia Carpet Mills in payment on account, April 18 purchase, $4,800 less 2% discount.

May 20 Sold merchandise to Wallton Apartments, Inc., for $28,350 on account, Sales Invoice No. 624. Terms: 2/10, n/30.

May 20 Issued Check No. 535 for $1,500 to the Daily Advocate Newspaper for advertising supplement that ran in the newspaper.

May 20 Issued Check No. 536 to Lexis Fine Furniture in payment on account, May 7 purchase, $22,200 less 1% discount.

May 20 Purchased merchandise on account for $23,000 from Lexis Fine Furniture. Terms: 3/15, n/30.

May 20 Issued Check No. 537 to Austin Cabinet Makers in payment on account, April 22 purchase, $19,100, less 2% discount.

May 20 Received a check for $5,390 from Carthage Community College as payment on their account less discount, Sales Invoice No. 622.

1 Fill in the cells highlighted in green 2 The Sales Journal is discussed in Chapter 7 3 Recall that Cost of Goods Sold =60% of sales. You could set up a formula in Excel to perform this calculation automatically rather than entering each COGS amount manually 4 DO NOT record any journal entries in the General Journal that are properly recorded here (in other words, do not duplicate the entries) 5 The invoice numbers should be listed in numerical order 6 Probably the easiest way to get the check marks into the reference column is copying and pasting one of the checkmarks already included for the initial transactions 1 Fill in the cells highlighted in green 2 The Sales Journal is discussed in Chapter 7 3 Recall that Cost of Goods Sold =60% of sales. You could set up a formula in Excel to perform this calculation automatically rather than entering each COGS amount manually 4 DO NOT record any journal entries in the General Journal that are properly recorded here (in other words, do not duplicate the entries) 5 The invoice numbers should be listed in numerical order 6 Probably the easiest way to get the check marks into the reference column is copying and pasting one of the checkmarks already included for the initial transactions

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started