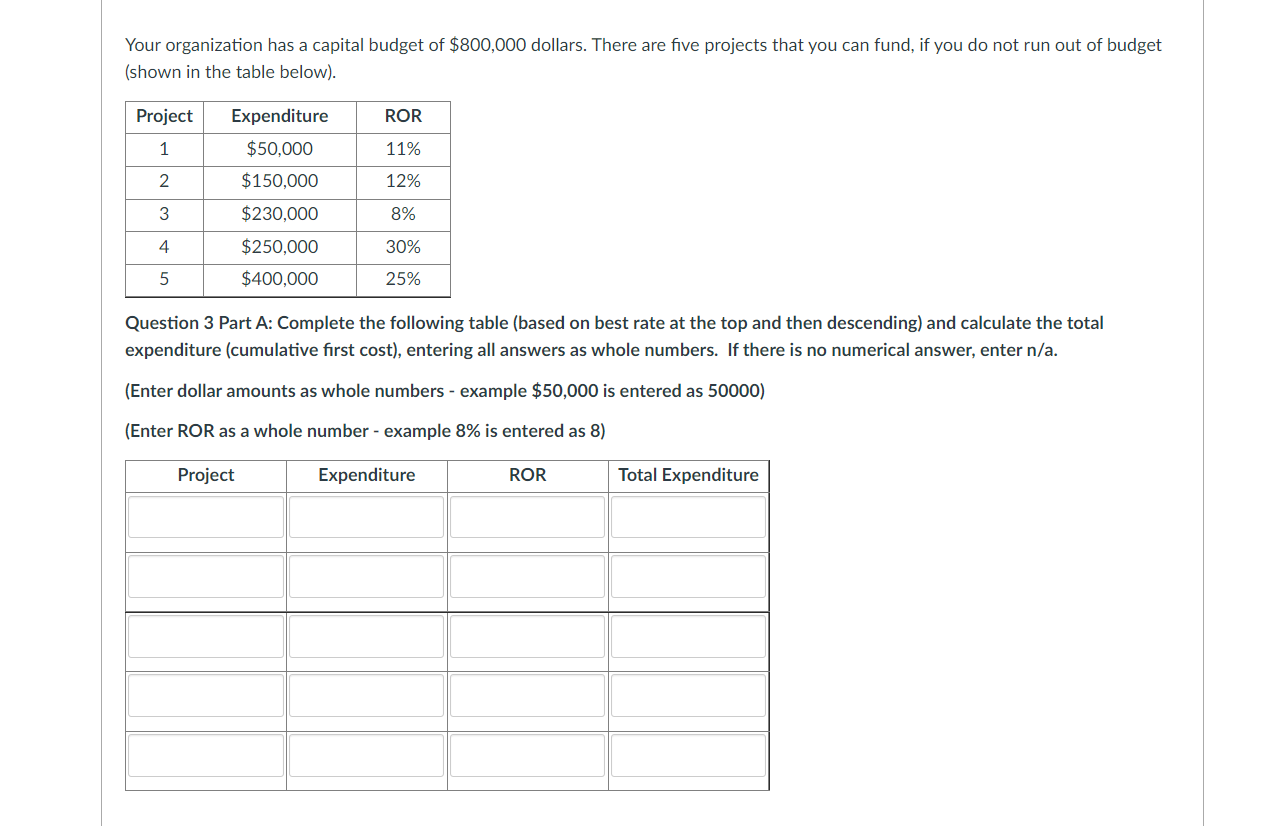

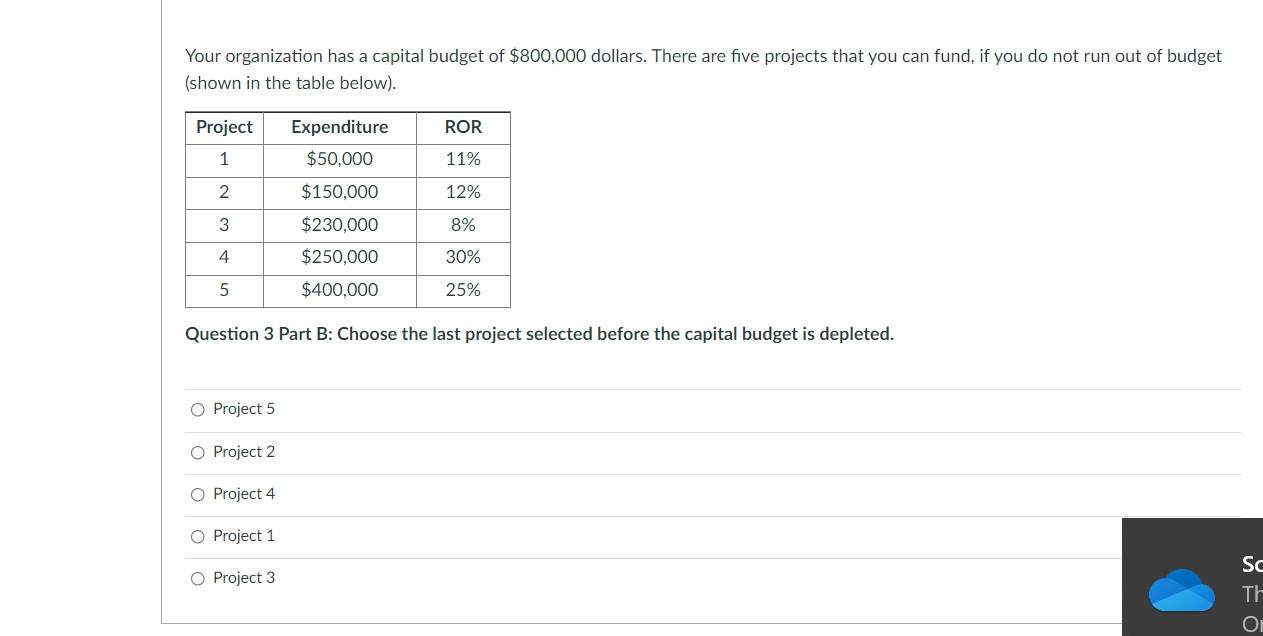

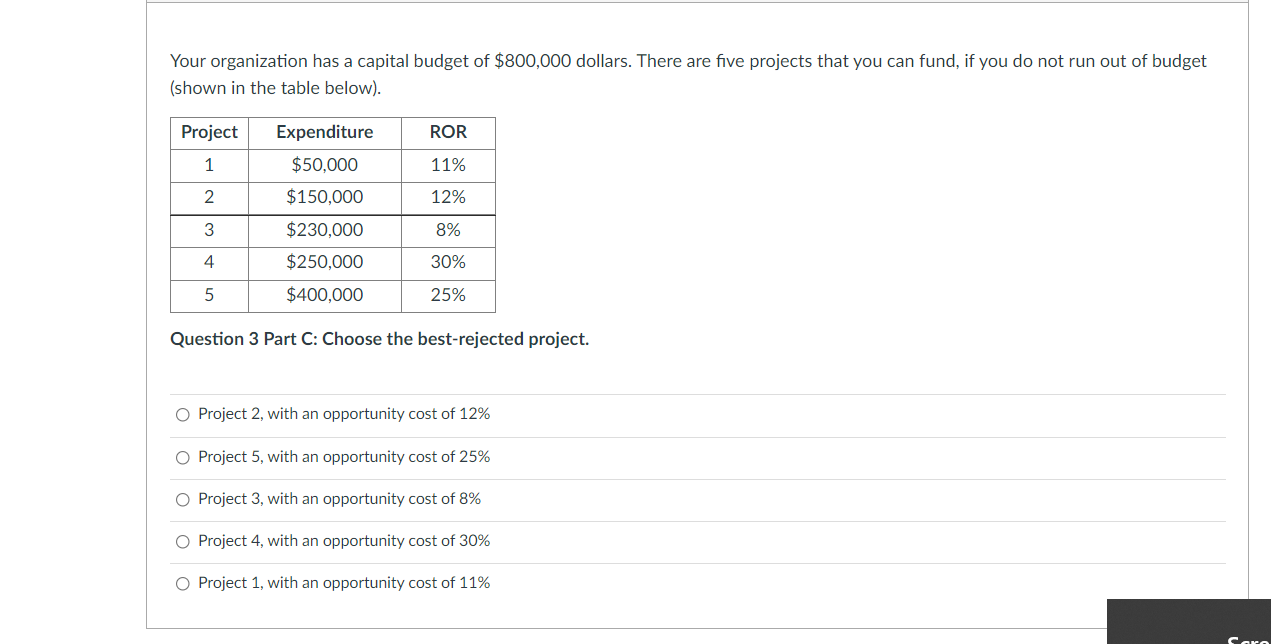

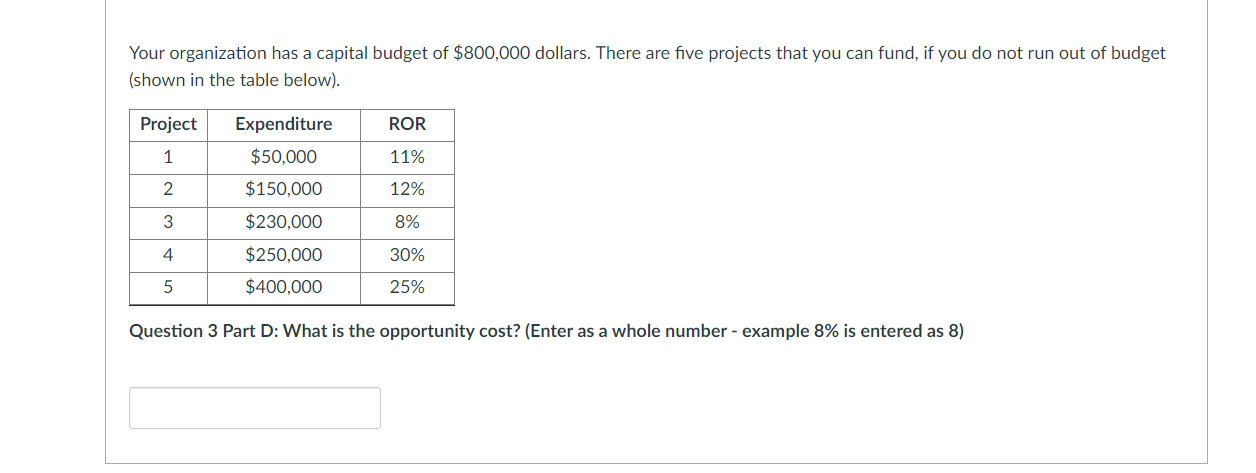

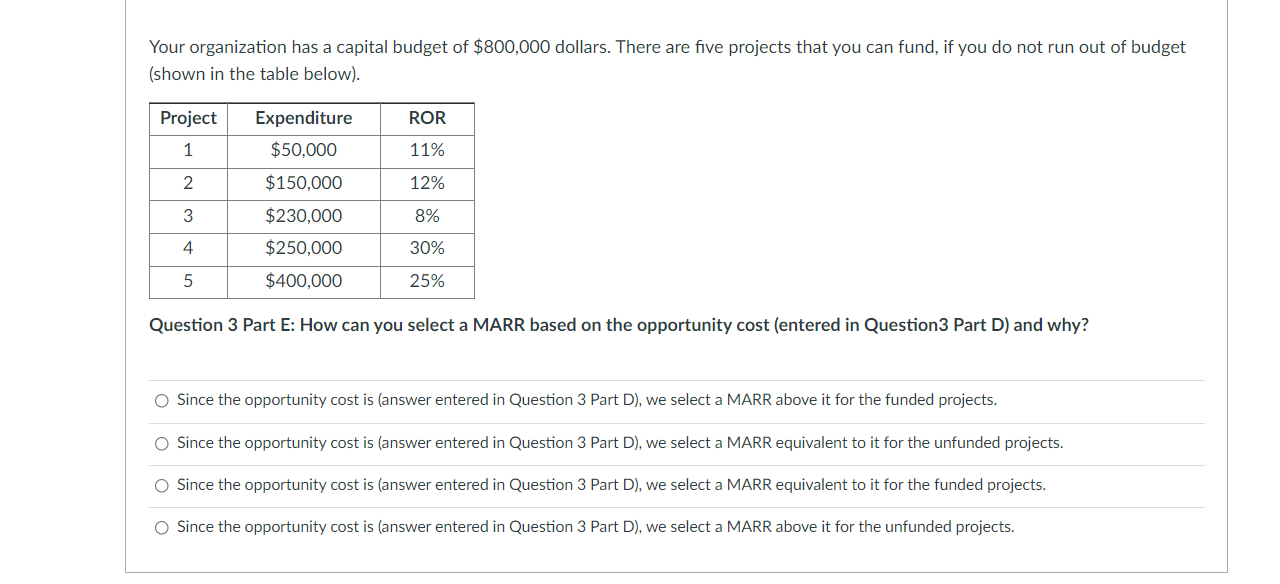

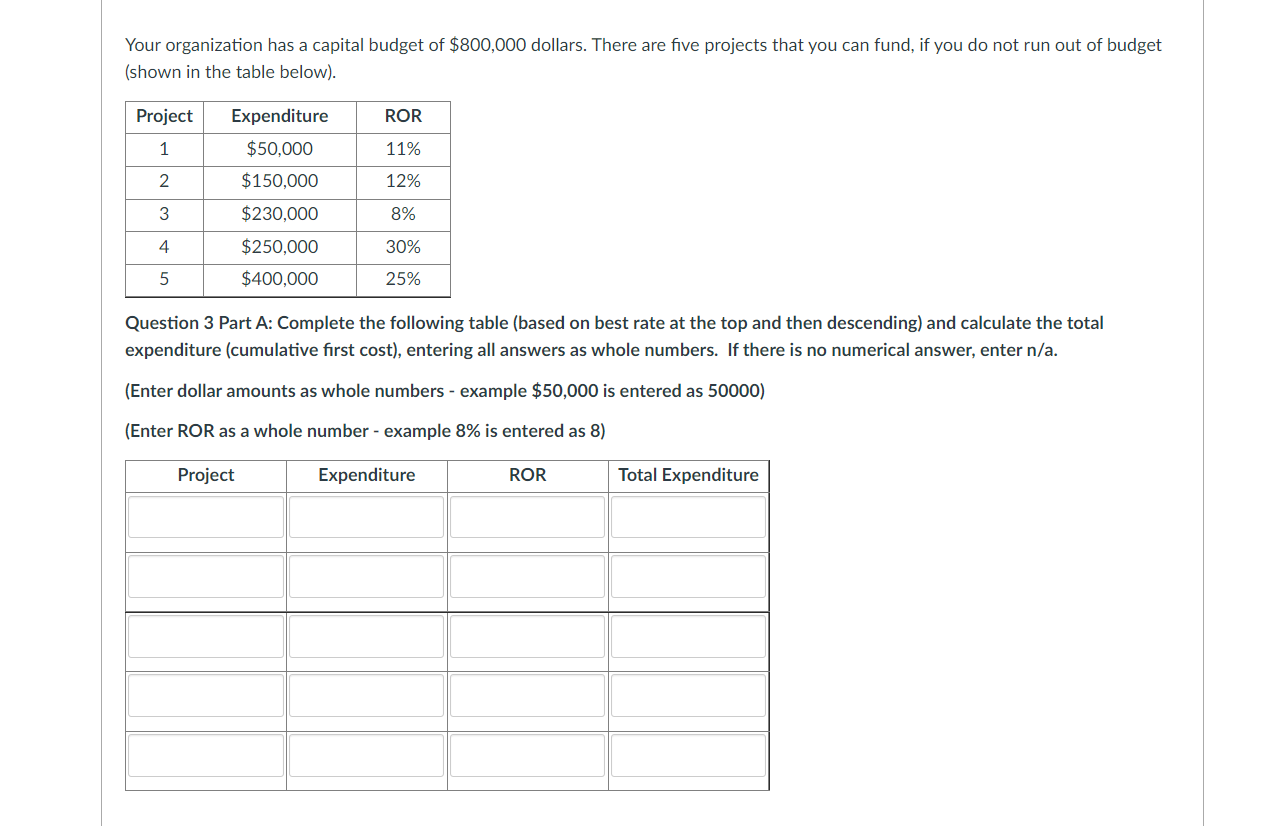

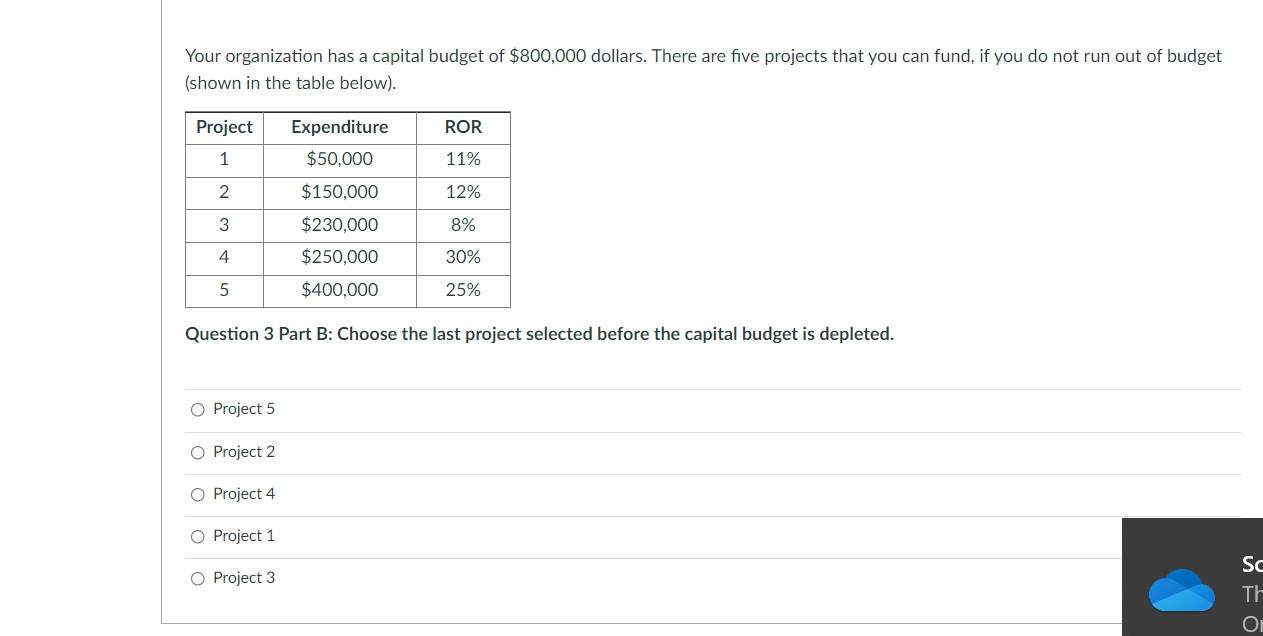

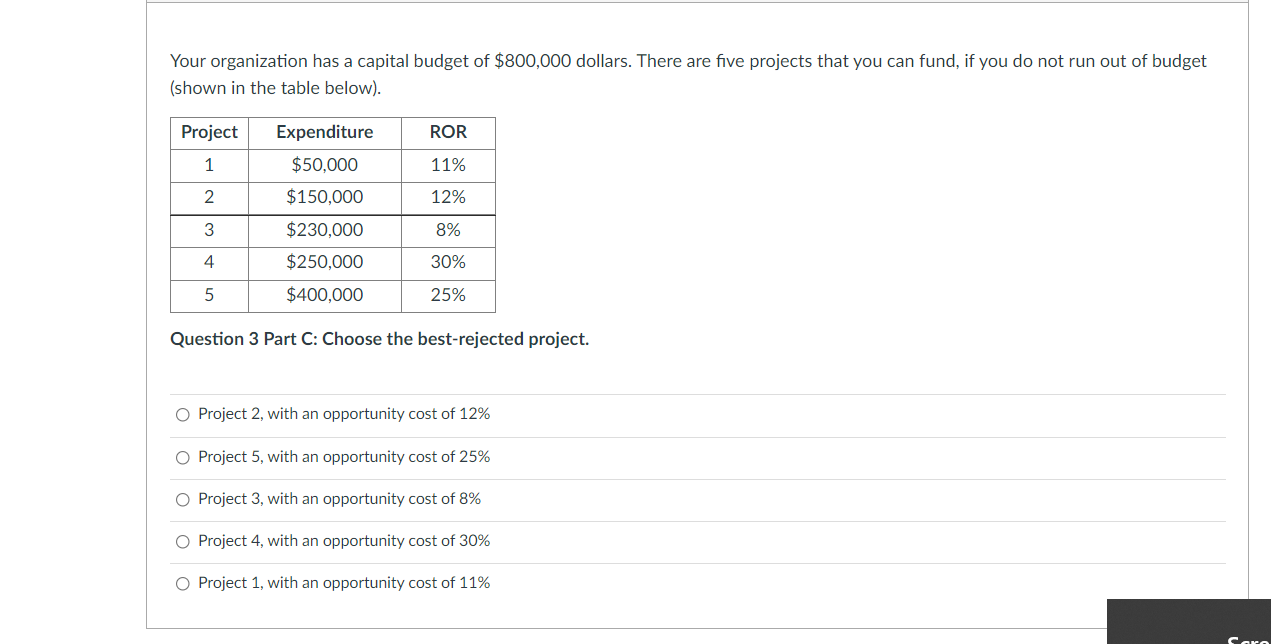

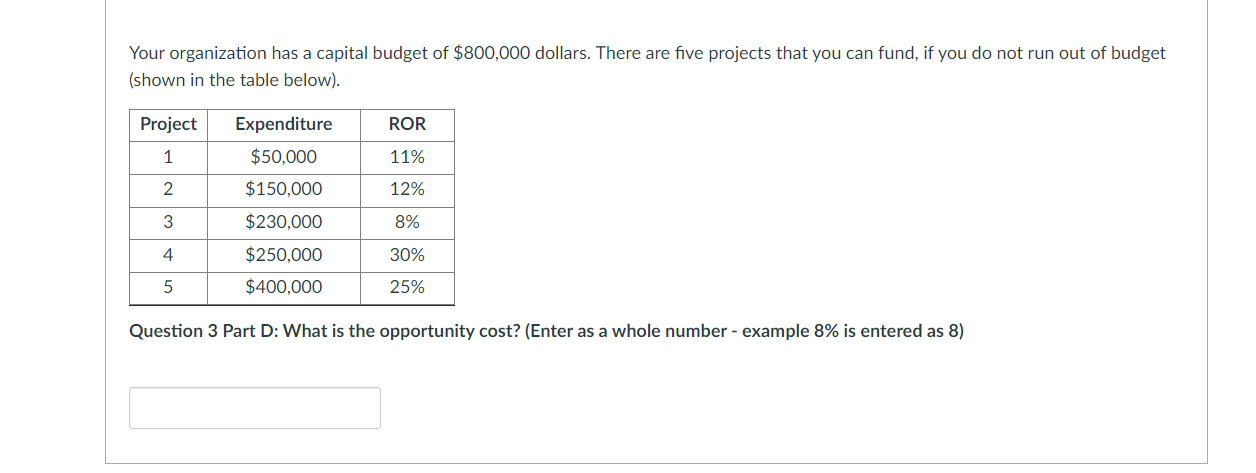

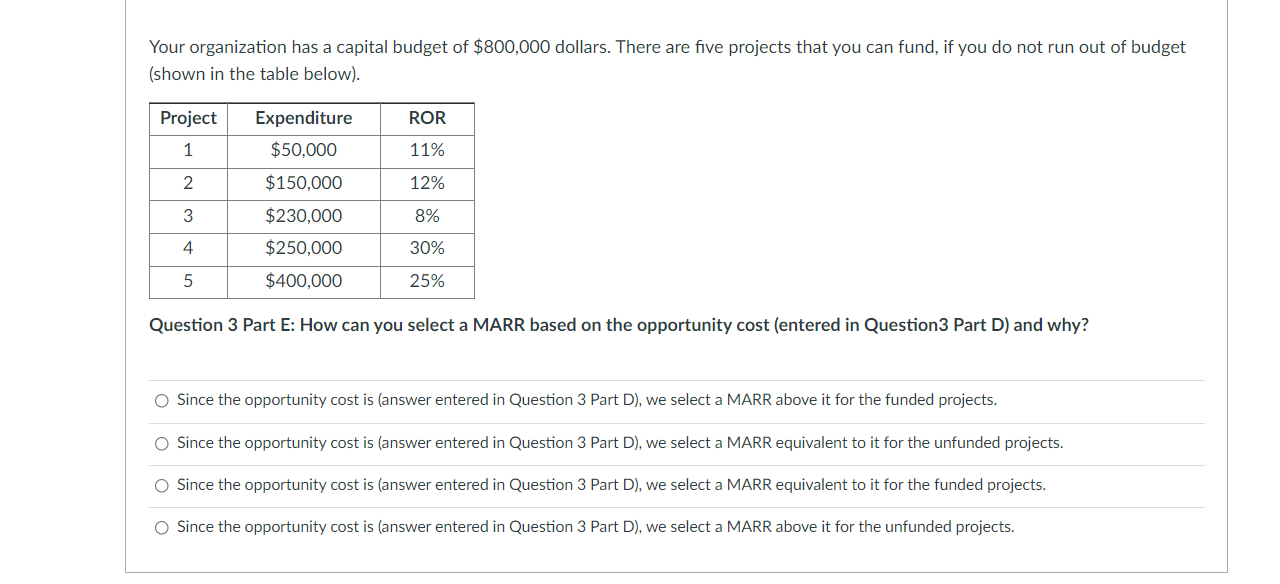

Your organization has a capital budget of $800,000 dollars. There are five projects that you can fund, if you do not run out of budget (shown in the table below). Project ROR Expenditure $50,000 1 11% 2 $150,000 12% 3 $230,000 8% 4 30% $250,000 $400,000 5 25% Question 3 Part A: Complete the following table (based on best rate at the top and then descending) and calculate the total expenditure (cumulative first cost), entering all answers as whole numbers. If there is no numerical answer, enter n/a. (Enter dollar amounts as whole numbers - example $50,000 is entered as 50000) (Enter ROR as a whole number - example 8% is entered as 8) Project Expenditure ROR Total Expenditure Your organization has a capital budget of $800,000 dollars. There are five projects that you can fund, if you do not run out of budget (shown in the table below). ROR Project 1 11% 2 12% Expenditure $50,000 $150,000 $230,000 $250,000 $400,000 3 8% 4. 30% 5 25% Question 3 Part B: Choose the last project selected before the capital budget is depleted. Project 5 Project 2 O Project 4 O Project 1 O Project 3 SC TH Oi Your organization has a capital budget of $800,000 dollars. There are five projects that you can fund, if you do not run out of budget (shown in the table below). Project ROR Expenditure $50,000 1 11% 2 $150,000 12% 3 $230,000 8% 4 $250,000 30% 5 $400,000 25% Question 3 Part C: Choose the best-rejected project. Project 2, with an opportunity cost of 12% O Project 5, with an opportunity cost of 25% Project 3, with an opportunity cost of 8% Project 4, with an opportunity cost of 30% O Project 1, with an opportunity cost of 11% Your organization has a capital budget of $800,000 dollars. There are five projects that you can fund, if you do not run out of budget (shown in the table below). Project ROR 1 Expenditure $50,000 $150,000 11% 2 12% 3 $230,000 8% 4 $250.000 30% 5 $400,000 25% Question 3 Part D: What is the opportunity cost? (Enter as a whole number - example 8% is entered as 8) Your organization has a capital budget of $800,000 dollars. There are five projects that you can fund, if you do not run out of budget (shown in the table below). Project ROR Expenditure $50,000 1 11% 2 $150,000 12% 3 8% 4 $230,000 $250,000 $400,000 30% 5 25% Question 3 Part E: How can you select a MARR based on the opportunity cost (entered in Question Part D) and why? Since the opportunity cost is (answer entered in Question 3 Part D), we select a MARR above it for the funded projects. Since the opportunity cost is (answer entered in Question 3 Part D), we select a MARR equivalent to it for the unfunded projects. Since the opportunity cost is (answer entered in Question 3 Part D), we select a MARR equivalent to it for the funded projects. O Since the opportunity cost is (answer entered in Question 3 Part D), we select a MARR above it for the unfunded projects