Question

Your predecessor left the firm in a hurry. Your primary responsibility is to finish the year-end financial statements. Specifically, you must complete: all the adjusting

Your predecessor left the firm in a hurry. Your primary responsibility is to finish the year-end financial statements. Specifically, you must complete:

all the adjusting journal entries

the Trial Balances

closing journal entries

a complete Multi-step Income Statement for the year ended Dec. 31, 2017

a Balance Sheet as of December 31, 2017.

You, of course, will include supporting documentation detailed calculation schedules (these will be helpful for earning partial credit).

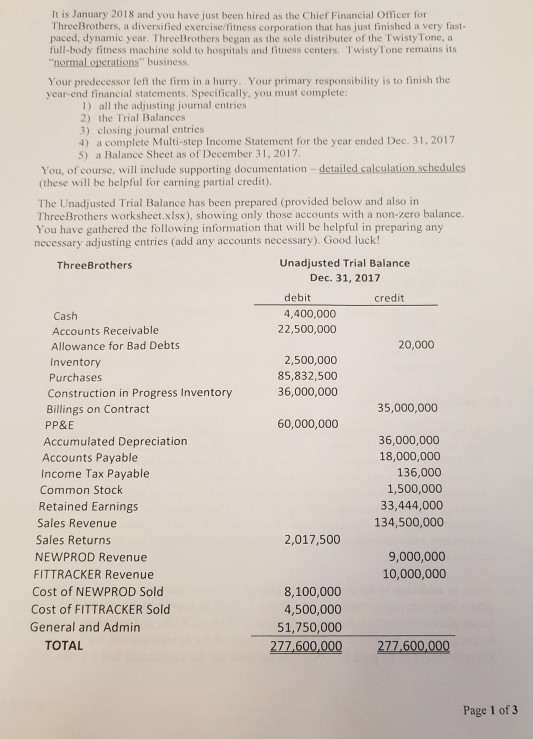

The Unadjusted Trial Balance has been prepared (provided below and also in ThreeBrothers worksheet.xlsx), showing only those accounts with a non-zero balance. You have gathered the following information that will be helpful in preparing any necessary adjusting entries (add any accounts necessary). Good luck!

| ThreeBrothers | Unadjusted Trial Balance | |

| Dec. 31, 2017 | ||

| debit | credit | |

| Cash | 4,400,000 | |

| Accounts Receivable | 22,500,000 | |

| Allowance for Bad Debts |

| 20,000 |

| Inventory | 2,500,000 | |

| Purchases | 85,832,500 | |

| Construction in Progress Inventory | 36,000,000 | |

| Billings on Contract | 35,000,000 | |

| PP&E | 60,000,000 | |

| Accumulated Depreciation | 36,000,000 | |

| Accounts Payable | 18,000,000 | |

| Income Tax Payable |

| 136,000 |

| Common Stock | 1,500,000 | |

| Retained Earnings | 33,444,000 | |

| Sales Revenue | 134,500,000 | |

| Sales Returns | 2,017,500 |

|

| NEWPROD Revenue | 9,000,000 | |

| FITTRACKER Revenue | 10,000,000 | |

| Cost of NEWPROD Sold | 8,100,000 | |

| Cost of FITTRACKER Sold | 4,500,000 | |

| General and Admin | 51,750,000 |

|

| TOTAL | 277,600,000 | 277,600,000 |

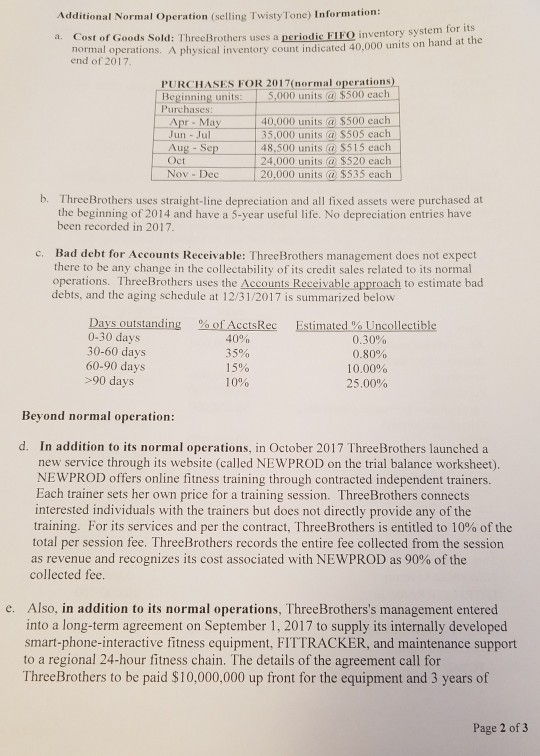

Additional Normal Operation (selling TwistyTone) Information:

Cost of Goods Sold: ThreeBrothers uses a periodic FIFO inventory system for its normal operations. A physical inventory count indicated 40,000 units on hand at the end of 2017.

PURCHASES FOR 2017(normal operations)

| Beginning units: | 5,000 units @ $500 each |

| Purchases: |

|

| Apr - May | 40,000 units @ $500 each |

| Jun - Jul | 35,000 units @ $505 each |

| Aug - Sep | 48,500 units @ $515 each |

| Oct | 24,000 units @ $520 each |

| Nov - Dec | 20,000 units @ $535 each |

ThreeBrothers uses straight-line depreciation and all fixed assets were purchased at the beginning of 2014 and have a 5-year useful life. No depreciation entries have been recorded in 2017.

Bad debt for Accounts Receivable: ThreeBrothers management does not expect there to be any change in the collectability of its credit sales related to its normal operations. ThreeBrothers uses the Accounts Receivable approach to estimate bad debts, and the aging schedule at 12/31/2017 is summarized below

Days outstanding % of AcctsRec Estimated % Uncollectible

0-30 days 40% 0.30%

30-60 days 35% 0.80%

60-90 days 15% 10.00%

>90 days 10% 25.00%

Beyond normal operation:

In addition to its normal operations, in October 2017 ThreeBrothers launched a new service through its website (called NEWPROD on the trial balance worksheet). NEWPROD offers online fitness training through contracted independent trainers. Each trainer sets her own price for a training session. ThreeBrothers connects interested individuals with the trainers but does not directly provide any of the training. For its services and per the contract, ThreeBrothers is entitled to 10% of the total per session fee. ThreeBrothers records the entire fee collected from the session as revenue and recognizes its cost associated with NEWPROD as 90% of the collected fee.

Also, in addition to its normal operations, ThreeBrothers's management entered into a long-term agreement on September 1, 2017 to supply its internally developed smart-phone-interactive fitness equipment, FITTRACKER, and maintenance support to a regional 24-hour fitness chain. The details of the agreement call for ThreeBrothers to be paid $10,000,000 up front for the equipment and 3 years of maintenance support (beginning on agreement date). The fitness chain could have bought just the equipment for $9,000,000 with no support, and they could have independently contracted for the maintenance support for $2,000,000 for the three-year period. ThreeBrothers has arranged with a 3rd-party manufacturer to make and ship the equipment direct to customers so ThreeBrothers does not carry any FITTRACKER inventory. The cost of the equipment sold to the fitness chain was $4,500,000. ThreeBrothers has recorded the $10,000,000 as a point-of-sale transaction.

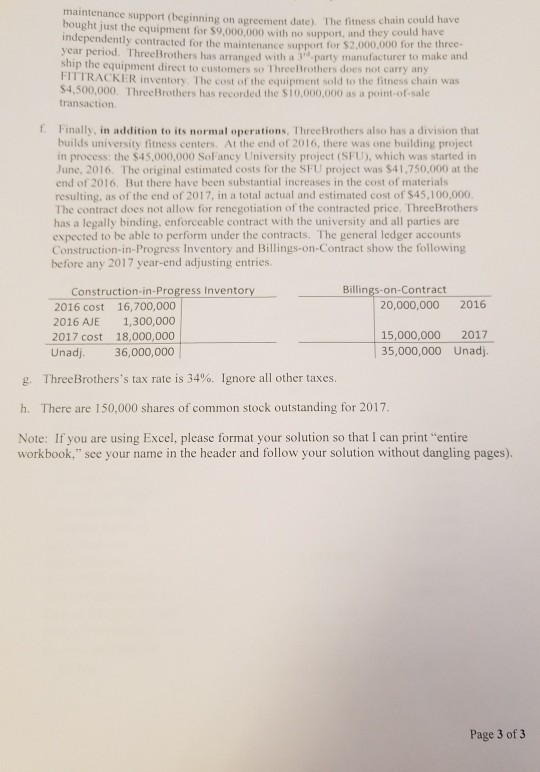

Finally, in addition to its normal operations, ThreeBrothers also has a division that builds university fitness centers. At the end of 2016, there was one building project in process: the $45,000,000 SoFancy University project (SFU), which was started in June, 2016. The original estimated costs for the SFU project was $41,750,000 at the end of 2016. But there have been substantial increases in the cost of materials resulting, as of the end of 2017, in a total actual and estimated cost of $45,100,000. The contract does not allow for renegotiation of the contracted price. ThreeBrothers has a legally binding, enforceable contract with the university and all parties are expected to be able to perform under the contracts. The general ledger accounts Construction-in-Progress Inventory and Billings-on-Contract show the following before any 2017 year-end adjusting entries.

| Construction-in-Progress Inventory |

| Billings-on-Contract | ||||

| 2016 cost | 16,700,000 |

|

|

| 20,000,000 | 2016 |

| 2016 AJE | 1,300,000 |

|

|

|

|

|

| 2017 cost | 18,000,000 |

|

|

| 15,000,000 | 2017 |

| Unadj. | 36,000,000 |

|

|

| 35,000,000 | Unadj. |

ThreeBrotherss tax rate is 34%. Ignore all other taxes.

There are 150,000 shares of common stock outstanding for 2017.

Need help with questions 1-5. Emphasis on 1-3. Thank you.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started