Whole Foods Markets financial statements from the chapter. The average common shareholders equity for 2012 was $3.397 billion, and a 40% income tax rate should

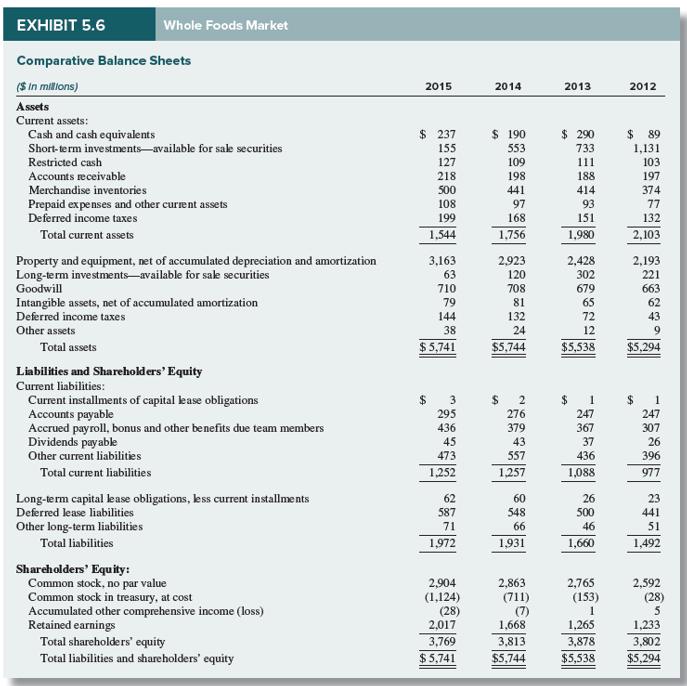

Whole Foods Market’s financial statements from the chapter. The average common shareholders’ equity for 2012 was $3.397 billion, and a 40% income tax rate should be used as needed. Required: Whole Foods earned a ROA of 9.7% in 2012. What was ROCE that year? (Round your answer to 1 decimal place.) ROA at the company fell to 9.4% in 2015. What was ROCE that year? (Round your answer to 1 decimal place.) Did financial leverage help or hurt Whole Foods Market in 2015? please show me the calculation! ty.. I updated the question with exhibits

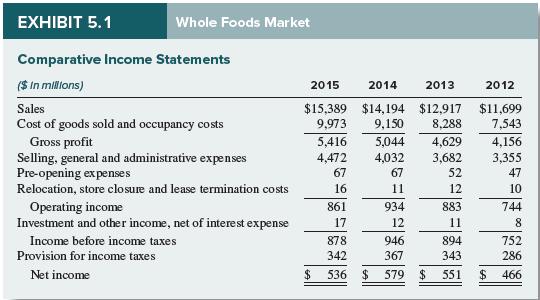

EXHIBIT 5.1 Whole Foods Market Comparative Income Statements ($ In millons) 2015 2014 2013 2012 $15,389 $14,194 $12,917 $11,699 9,150 Sales 8,288 Cost of goods sold and occupancy costs Gross profit Selling, general and administrative expen ses Pre-opening expenses Relocation, store closure and lease termination costs 9,973 7,543 5,416 4,472 5,044 4,629 3,682 4,156 3,355 4,032 67 67 52 47 16 11 12 10 Operating income Investment and other income, net of interest expense 861 934 883 744 17 12 11 8. Income before income taxes 878 946 894 752 Provision for income taxes 342 367 343 286 Net income $ 536 $ 579 2$ 551 $ 466

Step by Step Solution

3.36 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started