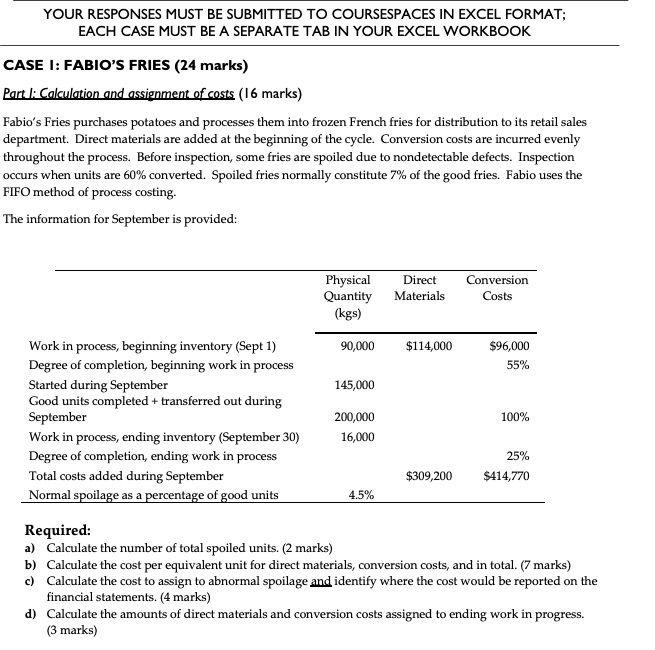

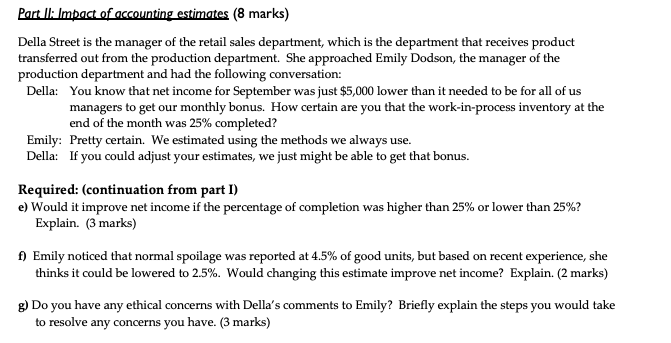

YOUR RESPONSES MUST BE SUBMITTED TO COURSESPACES IN EXCEL FORMAT; EACH CASE MUST BE A SEPARATE TAB IN YOUR EXCEL WORKBOOK CASE 1: FABIO'S FRIES (24 marks) Part I: Calculation and assignment of costs (16 marks) Fabio's Fries purchases potatoes and processes them into frozen French fries for distribution to its retail sales department. Direct materials are added at the beginning of the cycle. Conversion costs are incurred evenly throughout the process. Before inspection, some fries are spoiled due to nondetectable defects. Inspection occurs when units are 60% converted. Spoiled fries normally constitute 7% of the good fries. Fabio uses the FIFO method of process costing. The information for September is provided: Physical Quantity (kgs) Direct Materials Conversion Costs 90,000 $114,000 $96,000 55% 145,000 Work in process, beginning inventory (Sept 1) Degree of completion, beginning work in process Started during September Good units completed + transferred out during September Work in process, ending inventory (September 30) Degree of completion, ending work in process Total costs added during September Normal spoilage as a percentage of good units 100% 200,000 16,000 25% $414,770 $309,200 4.5% Required: a) Calculate the number of total spoiled units. (2 marks) b) Calculate the cost per equivalent unit for direct materials, conversion costs, and in total. (7 marks) c) Calculate the cost to assign to abnormal spoilage and identify where the cost would be reported on the financial statements. (4 marks) d) Calculate the amounts of direct materials and conversion costs assigned to ending work in progress. (3 marks) Part II: Impact of accounting estimates (8 marks) Della Street is the manager of the retail sales department, which is the department that receives product transferred out from the production department. She approached Emily Dodson, the manager of the production department and had the following conversation: Della: You know that net income for September was just $5,000 lower than it needed to be for all of us managers to get our monthly bonus. How certain are you that the work-in-process inventory at the end of the month was 25% completed? Emily: Pretty certain. We estimated using the methods we always use. Della: If you could adjust your estimates, we just might be able to get that bonus. Required: (continuation from part I) e) Would it improve net income if the percentage of completion was higher than 25% or lower than 25%? Explain. (3 marks) f) Emily noticed that normal spoilage was reported at 4.5% of good units, but based on recent experience, she thinks it could be lowered to 2.5%. Would changing this estimate improve net income? Explain. (2 marks) g) Do you have any ethical concerns with Della's comments to Emily? Briefly explain the steps you would take to resolve any concerns you have