Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Your retirement is something to start thinking about, even though it's years in the future! Here's how you're planning to save up for your

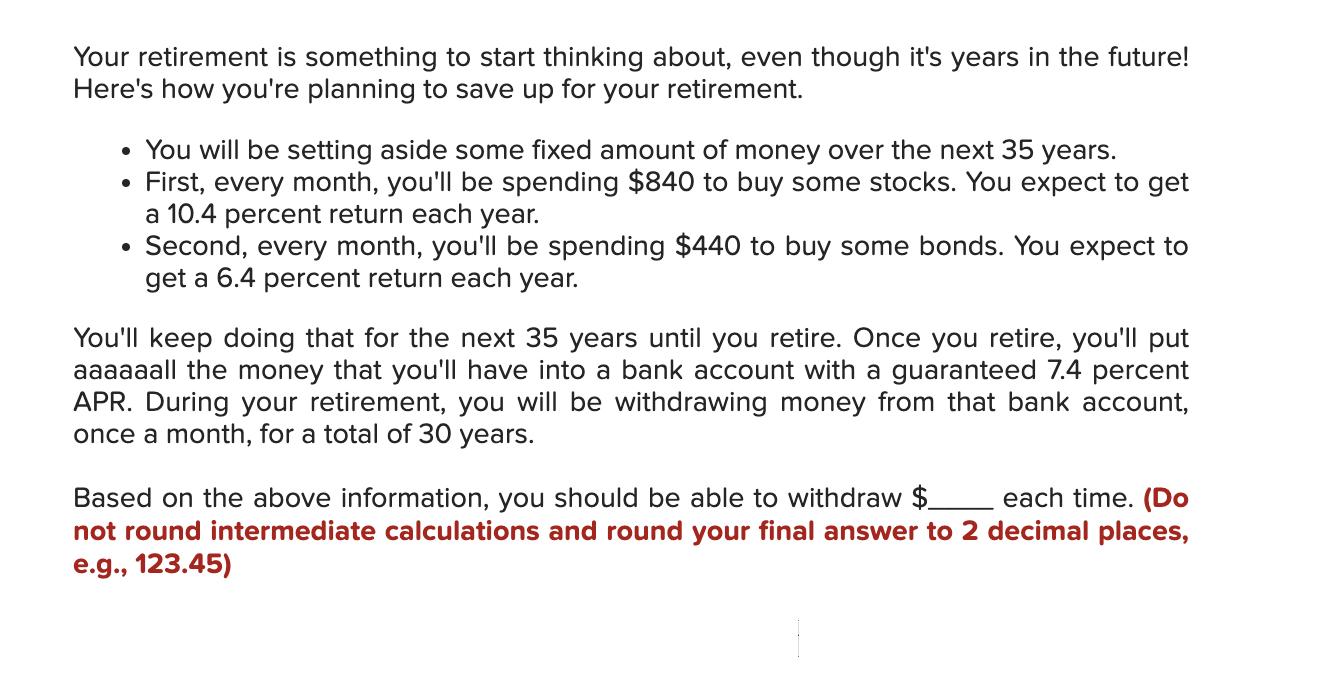

Your retirement is something to start thinking about, even though it's years in the future! Here's how you're planning to save up for your retirement. You will be setting aside some fixed amount of money over the next 35 years. First, every month, you'll be spending $840 to buy some stocks. You expect to get a 10.4 percent return each year. Second, every month, you'll be spending $440 to buy some bonds. You expect to get a 6.4 percent return each year. You'll keep doing that for the next 35 years until you retire. Once you retire, you'll put aaaaaall the money that you'll have into a bank account with a guaranteed 7.4 percent APR. During your retirement, you will be withdrawing money from that bank account, once a month, for a total of 30 years. Based on the above information, you should be able to withdraw $_ each time. (Do not round intermediate calculations and round your final answer to 2 decimal places, e.g., 123.45)

Step by Step Solution

★★★★★

3.40 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

To determine the amount you can withdraw each time during retirement we need to calculate the total ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started