Answered step by step

Verified Expert Solution

Question

1 Approved Answer

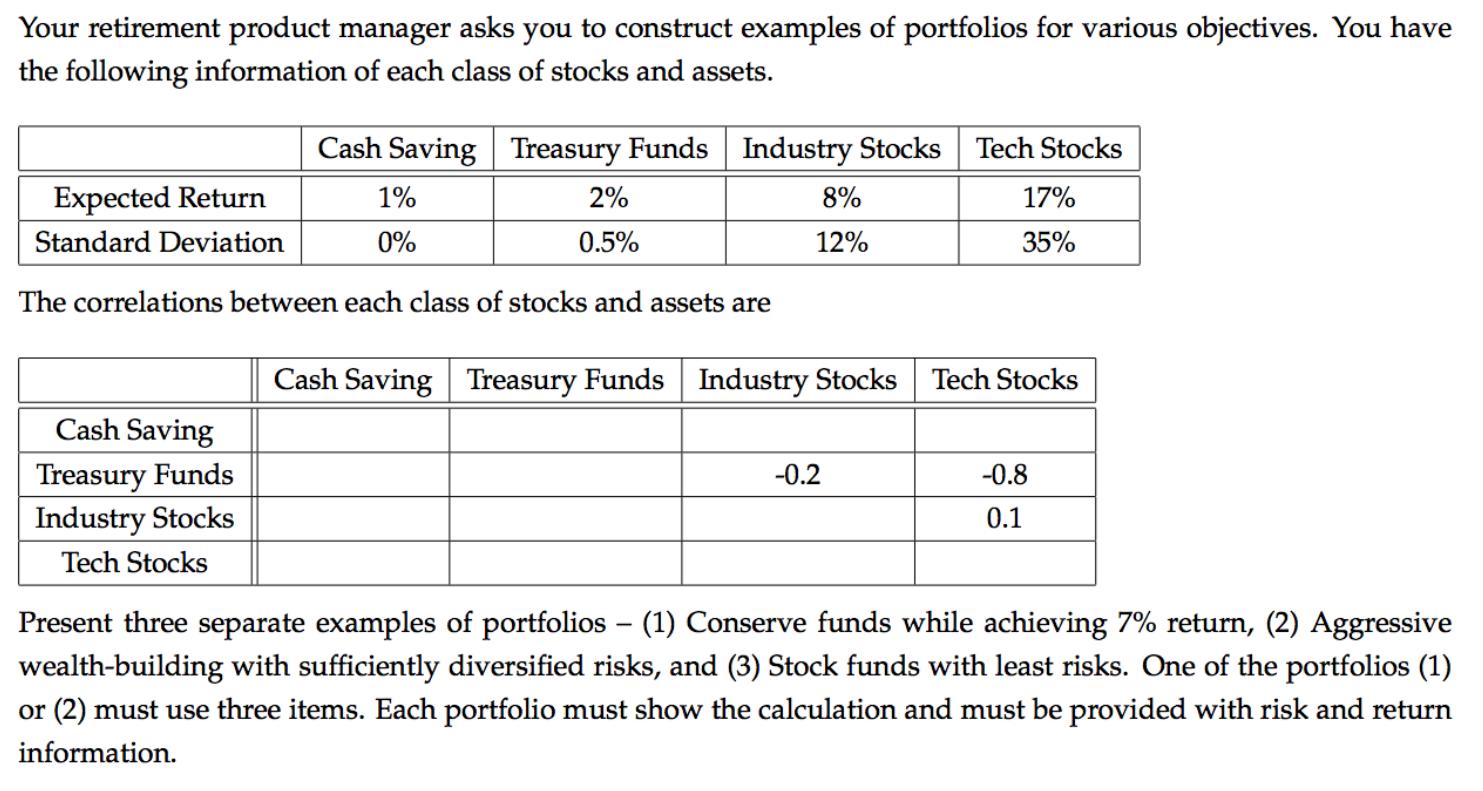

Your retirement product manager asks you to construct examples of portfolios for various objectives. You have the following information of each class of stocks

Your retirement product manager asks you to construct examples of portfolios for various objectives. You have the following information of each class of stocks and assets. Cash Saving Treasury Funds Industry Stocks Tech Stocks 1% 17% 2% 0.5% 0% 35% The correlations between each class of stocks and assets are Expected Return Standard Deviation Cash Saving Treasury Funds Industry Stocks Tech Stocks 8% 12% Cash Saving Treasury Funds Industry Stocks Tech Stocks -0.2 -0.8 0.1 Present three separate examples of portfolios - (1) Conserve funds while achieving 7% return, (2) Aggressive wealth-building with sufficiently diversified risks, and (3) Stock funds with least risks. One of the portfolios (1) or (2) must use three items. Each portfolio must show the calculation and must be provided with risk and return information.

Step by Step Solution

★★★★★

3.54 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

Conserve funds while achieving 7 return To achieve a 7 return while conserving funds we need to sele...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started