Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Your sister is looking to have a three-stock portfolio. She has $200,000 to invest and she has already selected two other stocks: $40,000 in

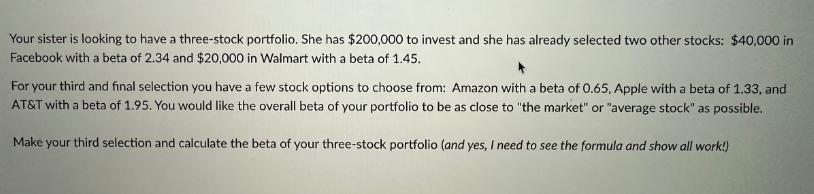

Your sister is looking to have a three-stock portfolio. She has $200,000 to invest and she has already selected two other stocks: $40,000 in Facebook with a beta of 2.34 and $20,000 in Walmart with a beta of 1.45. For your third and final selection you have a few stock options to choose from: Amazon with a beta of 0.65, Apple with a beta of 1.33, and AT&T with a beta of 1.95. You would like the overall beta of your portfolio to be as close to "the market" or "average stock" as possible. Make your third selection and calculate the beta of your three-stock portfolio (and yes, I need to see the formula and show all work!)

Step by Step Solution

★★★★★

3.41 Rating (145 Votes )

There are 3 Steps involved in it

Step: 1

Your sister has already invested 40000 in Facebook beta 234 and 60000 in Walmart beta 145 She has 10...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started