Question

Your supervisor has asked you to study and conduct an analysis of X Chemicals Ltd.'s Balance sheet for the last two years. (1) Calculate and

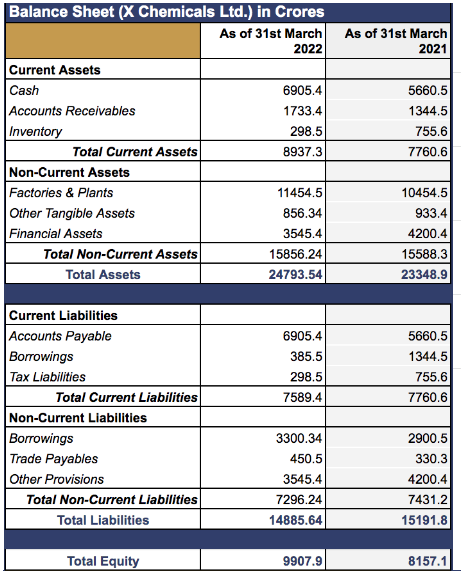

Your supervisor has asked you to study and conduct an analysis of X Chemicals Ltd.'s Balance sheet for the last two years.

(1) Calculate and select the change in current assets between FY2020-21 and FY2021-22. (2) Select the type of financial statement analysis performed.

Answer one correct from given options.

A. X Chemicals Ltd. witnessed a 6.2% increase in current assets between 2020-21 and 2021-22. This is a type of Horizontal analysis.

B. X Chemicals Ltd. witnessed an increase of INR1000 crore in current assets between 2020-21 and 2021-22. This is a type of Horizontal analysis.

C. X Chemicals Ltd. witnessed an increase of INR1000 crore in current assets between 2020-21 and 2021-22. This is a type of Vertical analysis.

D. X Chemicals Ltd. witnessed a 15.2% increase in current assets between 2020-21 and 2021-22. This is a type of Vertical analysis.

E. X Chemicals Ltd. witnessed a 15.2% increase in current assets between 2020-21 and 2021-22. This is a type of Horizontal analysis.

Balance Sheet (X Chemicals Ltd.) in Crores \begin{tabular}{|l|r|r|} \hline & As of 31st March \\ & 2022 & As of 31st March 2021 \\ \hline Current Assets & & \\ \hline Cash & 6905.4 & 5660.5 \\ Accounts Receivables & 1733.4 & 1344.5 \\ Inventory & 298.5 & 755.6 \\ \hline \multicolumn{1}{|c|}{ Total Current Assets } & 8937.3 & 7760.6 \\ \hline Non-Current Assets & & \\ \hline Factories \& Plants & 11454.5 & 10454.5 \\ Other Tangible Assets & 856.34 & 933.4 \\ Financial Assets & 3545.4 & 4200.4 \\ \hline \multicolumn{1}{|c|}{ Total Non-Current Assets } & 15856.24 & 15588.3 \\ \hline \multicolumn{1}{|c|}{ Total Assets } & 24793.54 & 23348.9 \\ \hline \end{tabular} \begin{tabular}{|l|r|r|} \hline Current Liabilities & & \\ \hline Accounts Payable & 6905.4 & 5660.5 \\ Borrowings & 385.5 & 1344.5 \\ Tax Liabilities & 298.5 & 755.6 \\ \hline \multicolumn{1}{|c|}{ Total Current Liabilities } & 7589.4 & 7760.6 \\ \hline Non-Current Liabilities & & \\ \hline Borrowings & 3300.34 & 2900.5 \\ Trade Payables & 450.5 & 330.3 \\ Other Provisions & 3545.4 & 4200.4 \\ \hline \multicolumn{1}{|c|}{ Total Non-Current Liabilities } & 7296.24 & 7431.2 \\ \hline \multicolumn{1}{|c|}{ Total Liabilities } & 14885.64 & 15191.8 \\ \hline \end{tabular} Total Equity 9907.9 8157.1Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started