Question

Your supervisor has recently promoted you to a financial analyst position in the bank. The chief financial officer (your supervisor's boss) is concerned about the

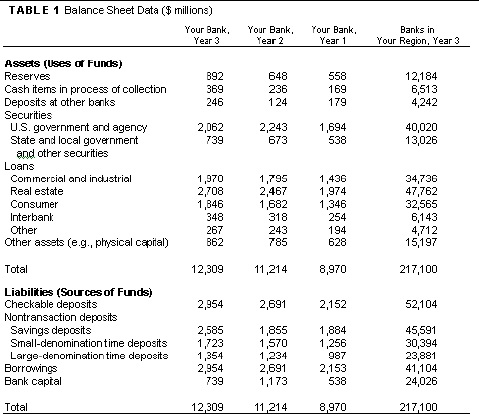

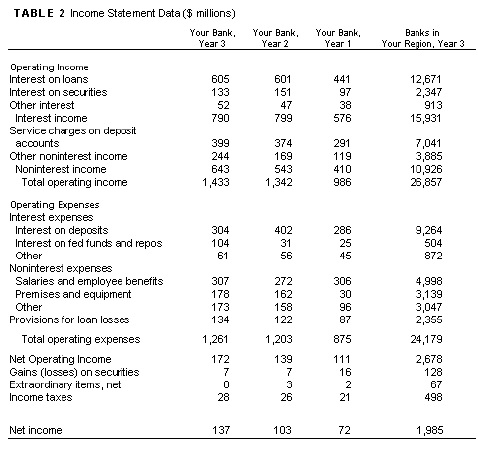

Your supervisor has recently promoted you to a financial analyst position in the bank. The chief financial officer (your supervisor's boss) is concerned about the bank's financial position in comparison with past trends and recent positions of similar banks in the region. To analyze the firm, you have been assigned the task of producing a bank performance analysis. You have done this type of report in your money and banking and finance classes, and you know that the first step is to collect financial data on your bank and similar banks in order to make the necessary comparisons and suggestions for performance improvements. You collect the data in Table 1 and Table 2 from internal annual reports and government publications.

Using balance sheet and income statement data, create a bank analysis and performance report for your supervisor that addresses the following issues:

1. Analyze the performance of the bank for each year.

a. Calculate the return on assets (ROA) for each year. How has the ROA trend changed over the last three years? How does your bank compare to the regional banks?

b. Calculate the return on equity (ROE) for each year. How has the ROE trend changed over the last three years? How does your bank compare to the regional banks?

2. Identify the strengths and weaknesses of your bank relative to trends over time and in year 3 for all regional banks. What is the relationship between your bank's trends and the year 3 comparison with the region?

TABL E 1 Balance Sheet Data($ millions) Your Bank, Year 3 Your Bank, Your Bank. Banks in Your Region, Year 3 Assets (Uses or Funds) Reserves Cash items in process of collection Deposits at other banks 648 236 124 558 169 179 12,184 6,513 4,242 369 246 U.S. government and agency State and local government 2,062 739 2,243 1,694 1 694 40,020 13,026 673 and other securities Loans 1,795 2,467 1,970 1,436 1,974 1,346 34,736 47,762 32,565 6,143 4,712 15,197 Commecrcial and industrial Real estate 1,B46 348 267 862 Interbanl 243 785 194 Other Other assets (e.g., physical capial) Total 12,309 8,970 217,100 Liabilities (Sources of Funds) Checkable deposits Nontransaction deposits 2,954 2,691 2,152 52,104 2,585 1,723 1,354 2,954 739 1,884 1,570 1,256 987 2153 538 45,591 30,394 23,881 41,104 24,026 1,855 Savings deposits Small-denominationtime deposits Large-denomination time deposite Borrowings Bank captal 1,234 2,691 1,173 Total 12,309 11,214 8970 217,100Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started