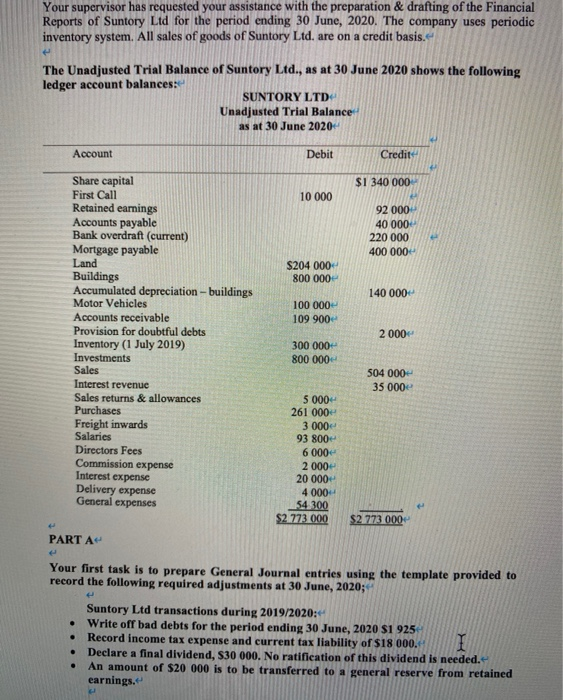

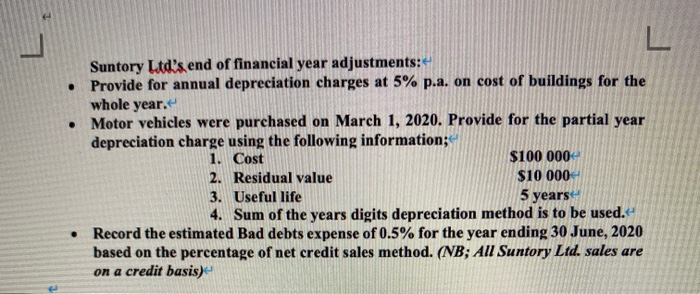

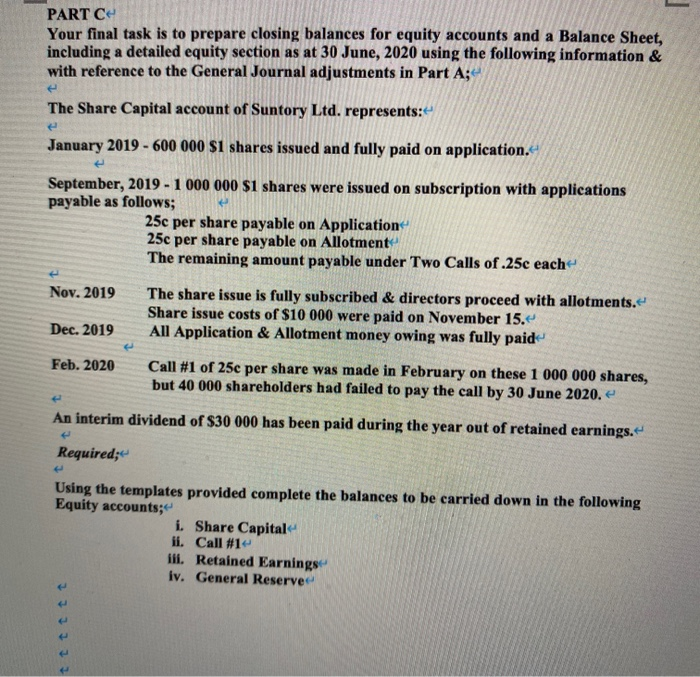

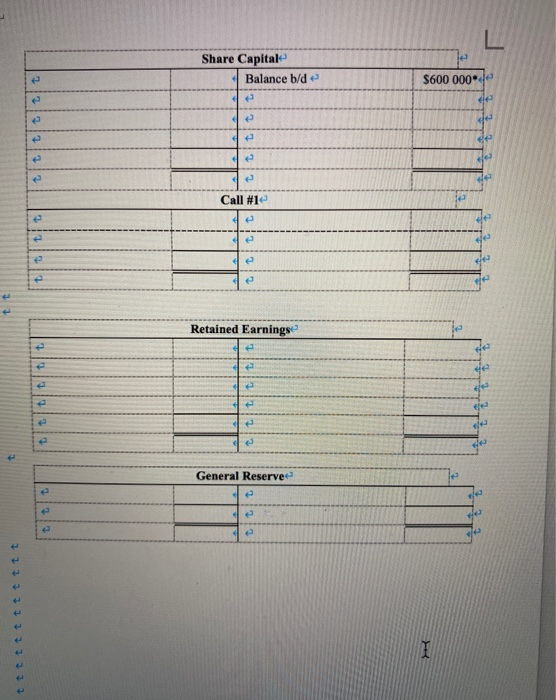

Your supervisor has requested your assistance with the preparation & drafting of the Financial Reports of Suntory Ltd for the period ending 30 June, 2020. The company uses periodic inventory system. All sales of goods of Suntory Ltd. are on a credit basis. The Unadjusted Trial Balance of Suntory Ltd., as at 30 June 2020 shows the following ledger account balances: SUNTORY LTD Unadjusted Trial Balance as at 30 June 2020 Account Debit Credit: $1 340 000 10 000 92 000 40 000 220 000 400 000 $204 000 800 000 140 000 100 000 109 900 2 000 Share capital First Call Retained earnings Accounts payable Bank overdraft (current) Mortgage payable Land Buildings Accumulated depreciation - buildings Motor Vehicles Accounts receivable Provision for doubtful debts Inventory (1 July 2019) Investments Sales Interest revenue Sales returns & allowances Purchases Freight inwards Salaries Directors Fees Commission expense Interest expense Delivery expense General expenses 300 000- 800 000 504 000 35 000e 5 000 261 000 3 000 93 800 6 000 2000- 20 000 4 000 54.300 $2 773 000 $2 773 000 PART A Your first task is to prepare General Journal entries using the template provided to record the following required adjustments at 30 June, 2020;- Suntory Ltd transactions during 2019/2020:44 Write off bad debts for the period ending 30 June, 2020 $1 925 Record income tax expense and current tax liability of $18 000. I Declare a final dividend, 530 000. No ratification of this dividend is needed. An amount of $20 000 is to be transferred to a general reserve from retained earnings. Suntory Ltd's end of financial year adjustments: Provide for annual depreciation charges at 5% p.a. on cost of buildings for the whole year. Motor vehicles were purchased on March 1, 2020. Provide for the partial year depreciation charge using the following information; 1. Cost $100 000 2. Residual value $10 000 3. Useful life 4. Sum of the years digits depreciation method is to be used. Record the estimated Bad debts expense of 0.5% for the year ending 30 June, 2020 based on the percentage of net credit sales method. (NB; All Suntory Ltd. sales are on a credit basis) 5 years PART Ce Your final task is to prepare closing balances for equity accounts and a Balance Sheet, including a detailed equity section as at 30 June, 2020 using the following information & with reference to the General Journal adjustments in Part A; The Share Capital account of Suntory Ltd. represents: January 2019 - 600 000 $1 shares issued and fully paid on application. September, 2019 - 1 000 000 $1 shares were issued on subscription with applications payable as follows; 25c per share payable on Application 25c per share payable on Allotment The remaining amount payable under Two Calls of.250 each Nov. 2019 The share issue is fully subscribed & directors proceed with allotments. Share issue costs of $10 000 were paid on November 15. All Application & Allotment money owing was fully paid Dec. 2019 Feb. 2020 Call #1 of 25e per share was made in February on these 1 000 000 shares, but 40 000 shareholders had failed to pay the call by 30 June 2020.e An interim dividend of $30 000 has been paid during the year out of retained earnings. Required; Using the templates provided complete the balances to be carried down in the following Equity accounts; i. Share Capital ii. Call #1 ili. Retained Earnings iv. General Reserve Share Capitale Balance b/de S600 000 de e e de e de Call #le tttt Retained Earnings e de General Reserve e ttttttttttt Your supervisor has requested your assistance with the preparation & drafting of the Financial Reports of Suntory Ltd for the period ending 30 June, 2020. The company uses periodic inventory system. All sales of goods of Suntory Ltd. are on a credit basis. The Unadjusted Trial Balance of Suntory Ltd., as at 30 June 2020 shows the following ledger account balances: SUNTORY LTD Unadjusted Trial Balance as at 30 June 2020 Account Debit Credit: $1 340 000 10 000 92 000 40 000 220 000 400 000 $204 000 800 000 140 000 100 000 109 900 2 000 Share capital First Call Retained earnings Accounts payable Bank overdraft (current) Mortgage payable Land Buildings Accumulated depreciation - buildings Motor Vehicles Accounts receivable Provision for doubtful debts Inventory (1 July 2019) Investments Sales Interest revenue Sales returns & allowances Purchases Freight inwards Salaries Directors Fees Commission expense Interest expense Delivery expense General expenses 300 000- 800 000 504 000 35 000e 5 000 261 000 3 000 93 800 6 000 2000- 20 000 4 000 54.300 $2 773 000 $2 773 000 PART A Your first task is to prepare General Journal entries using the template provided to record the following required adjustments at 30 June, 2020;- Suntory Ltd transactions during 2019/2020:44 Write off bad debts for the period ending 30 June, 2020 $1 925 Record income tax expense and current tax liability of $18 000. I Declare a final dividend, 530 000. No ratification of this dividend is needed. An amount of $20 000 is to be transferred to a general reserve from retained earnings. Suntory Ltd's end of financial year adjustments: Provide for annual depreciation charges at 5% p.a. on cost of buildings for the whole year. Motor vehicles were purchased on March 1, 2020. Provide for the partial year depreciation charge using the following information; 1. Cost $100 000 2. Residual value $10 000 3. Useful life 4. Sum of the years digits depreciation method is to be used. Record the estimated Bad debts expense of 0.5% for the year ending 30 June, 2020 based on the percentage of net credit sales method. (NB; All Suntory Ltd. sales are on a credit basis) 5 years PART Ce Your final task is to prepare closing balances for equity accounts and a Balance Sheet, including a detailed equity section as at 30 June, 2020 using the following information & with reference to the General Journal adjustments in Part A; The Share Capital account of Suntory Ltd. represents: January 2019 - 600 000 $1 shares issued and fully paid on application. September, 2019 - 1 000 000 $1 shares were issued on subscription with applications payable as follows; 25c per share payable on Application 25c per share payable on Allotment The remaining amount payable under Two Calls of.250 each Nov. 2019 The share issue is fully subscribed & directors proceed with allotments. Share issue costs of $10 000 were paid on November 15. All Application & Allotment money owing was fully paid Dec. 2019 Feb. 2020 Call #1 of 25e per share was made in February on these 1 000 000 shares, but 40 000 shareholders had failed to pay the call by 30 June 2020.e An interim dividend of $30 000 has been paid during the year out of retained earnings. Required; Using the templates provided complete the balances to be carried down in the following Equity accounts; i. Share Capital ii. Call #1 ili. Retained Earnings iv. General Reserve Share Capitale Balance b/de S600 000 de e e de e de Call #le tttt Retained Earnings e de General Reserve e ttttttttttt