Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Your task is to write a memorandum to each of these clients explaining (in a professional way) how they are misunderstanding the information presented in

Your task is to write a memorandum to each of these clients explaining (in a professional way) how they are misunderstanding the information presented in the slide and what the correct interpretation of the data is. If you wish, you can make a recommendation to invest or not, but your primary goal is to make sure that your client has a correct understanding of the situation so that they can make the best decision themselves.

Write a short memorandum (0.5 to 1 page) to each client explaining their misunderstanding and the correct interpretation of the slides.

You must use the ideas of "derivative/slope/rate of change" and/or "integral/area/accumulated change" in your explanation, but it must be understandable to your clients (who have never taken any calculus classes). WILL THUMBS UP

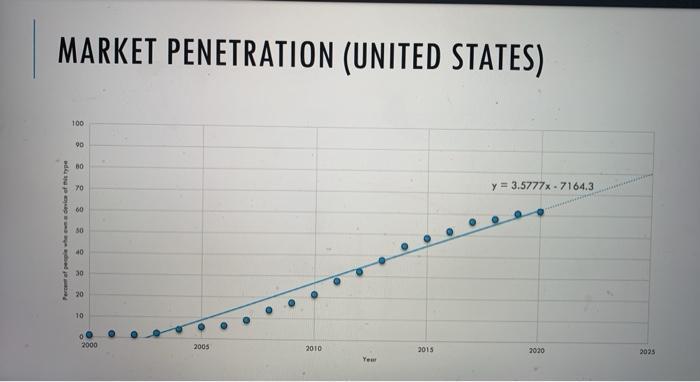

I am considering a significant investment in a company that manufactures a new electronic device. This device has been all the rage the last several years and as you can see in the chart they provided, over 60% of Americans already own one. This does still leave about 120 million Americans who don't, and so this company is making a heavy push to market to those potential customers. I added a trendline to the chart (like you taught me) and you can see that usage of this product has been growing by 3.577 percentage points per year. That's over 10 million people who have bought one every year. Projecting into the next 5 years, that is potential sales of 50 million units. With such a large potential for growth, I think that this is a slam dunk investment. I am considering a significant investment in a company that manufactures a new electronic device. This device has been all the rage the last several years and as you can see in the chart they provided, over 60% of Americans already own one. This does still leave about 120 million Americans who don't, and so this company is making a heavy push to market to those potential customers. I added a trendline to the chart (like you taught me) and you can see that usage of this product has been growing by 3.577 percentage points per year. That's over 10 million people who have bought one every year. Projecting into the next 5 years, that is potential sales of 50 million units. With such a large potential for growth, I think that this is a slam dunk investment. I am considering a significant investment in a company that manufactures a new electronic device. This device has been all the rage the last several years and as you can see in the chart they provided, over 60% of Americans already own one. This does still leave about 120 million Americans who don't, and so this company is making a heavy push to market to those potential customers. I added a trendline to the chart (like you taught me) and you can see that usage of this product has been growing by 3.577 percentage points per year. That's over 10 million people who have bought one every year. Projecting into the next 5 years, that is potential sales of 50 million units. With such a large potential for growth, I think that this is a slam dunk investment. I am considering a significant investment in a company that manufactures a new electronic device. This device has been all the rage the last several years and as you can see in the chart they provided, over 60% of Americans already own one. This does still leave about 120 million Americans who don't, and so this company is making a heavy push to market to those potential customers. I added a trendline to the chart (like you taught me) and you can see that usage of this product has been growing by 3.577 percentage points per year. That's over 10 million people who have bought one every year. Projecting into the next 5 years, that is potential sales of 50 million units. With such a large potential for growth, I think that this is a slam dunk investment. I am considering a significant investment in a company that manufactures a new electronic device. This device has been all the rage the last several years and as you can see in the chart they provided, over 60% of Americans already own one. This does still leave about 120 million Americans who don't, and so this company is making a heavy push to market to those potential customers. I added a trendline to the chart (like you taught me) and you can see that usage of this product has been growing by 3.577 percentage points per year. That's over 10 million people who have bought one every year. Projecting into the next 5 years, that is potential sales of 50 million units. With such a large potential for growth, I think that this is a slam dunk investment. I am considering a significant investment in a company that manufactures a new electronic device. This device has been all the rage the last several years and as you can see in the chart they provided, over 60% of Americans already own one. This does still leave about 120 million Americans who don't, and so this company is making a heavy push to market to those potential customers. I added a trendline to the chart (like you taught me) and you can see that usage of this product has been growing by 3.577 percentage points per year. That's over 10 million people who have bought one every year. Projecting into the next 5 years, that is potential sales of 50 million units. With such a large potential for growth, I think that this is a slam dunk investment. I am considering a significant investment in a company that manufactures a new electronic device. This device has been all the rage the last several years and as you can see in the chart they provided, over 60% of Americans already own one. This does still leave about 120 million Americans who don't, and so this company is making a heavy push to market to those potential customers. I added a trendline to the chart (like you taught me) and you can see that usage of this product has been growing by 3.577 percentage points per year. That's over 10 million people who have bought one every year. Projecting into the next 5 years, that is potential sales of 50 million units. With such a large potential for growth, I think that this is a slam dunk investment. I am considering a significant investment in a company that manufactures a new electronic device. This device has been all the rage the last several years and as you can see in the chart they provided, over 60% of Americans already own one. This does still leave about 120 million Americans who don't, and so this company is making a heavy push to market to those potential customers. I added a trendline to the chart (like you taught me) and you can see that usage of this product has been growing by 3.577 percentage points per year. That's over 10 million people who have bought one every year. Projecting into the next 5 years, that is potential sales of 50 million units. With such a large potential for growth, I think that this is a slam dunk investment.

Step by Step Solution

★★★★★

3.41 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

MEMORANDUM To Ms Grey Glients from abc Date 7th May 2021 spord Subject Proper und...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started