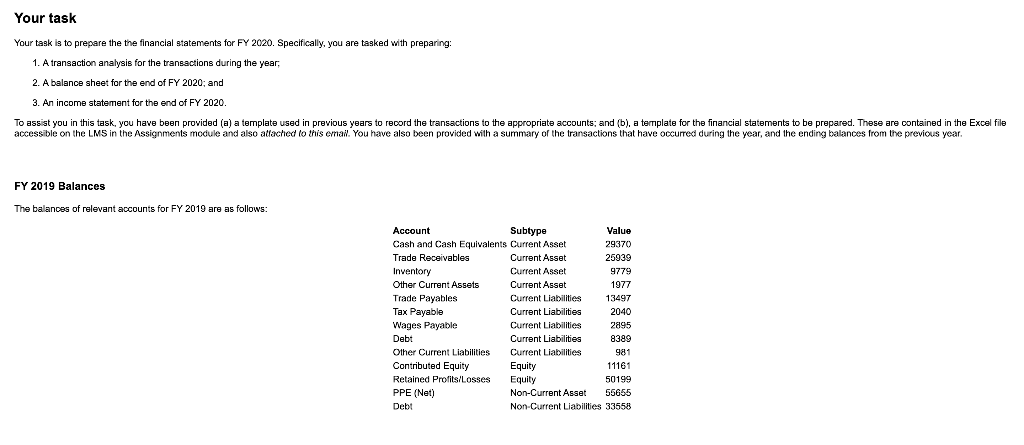

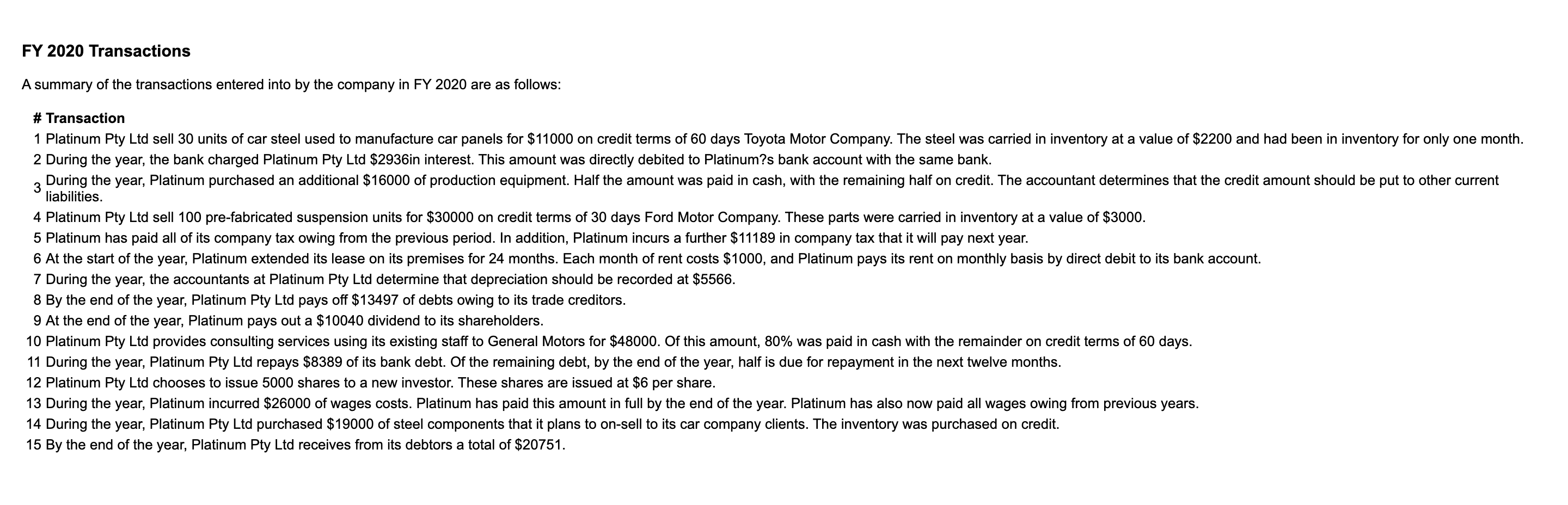

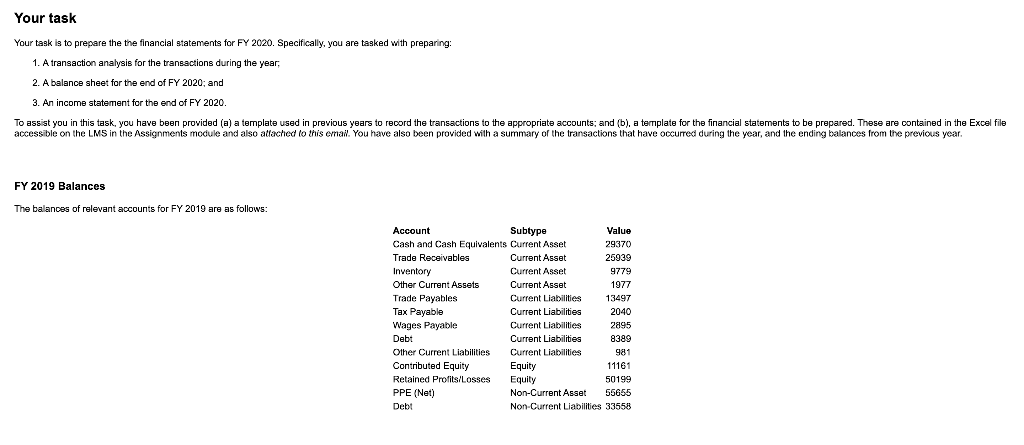

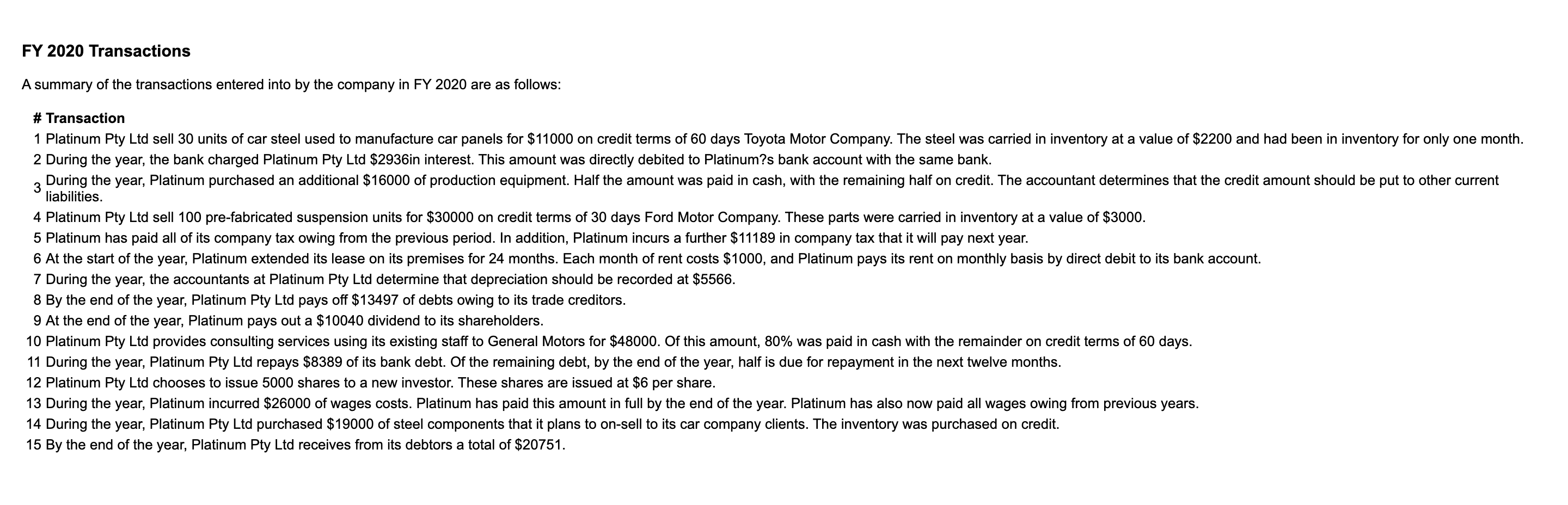

Your task Your task is to prepare the the financial statements for FY 2020. Specifically, you are tasked with preparing: 1. A transaction analysis for the transactions during the year, 2. A balance sheet for the end of FY 2020; and 3. An income statement for the end of FY 2020. To assist you in this task, you have been provided (a) a template used in previous years to record the transactions to the appropriate accounts; and (b), a template for the financial statements to be prepared. These are contained in the Excel file accessible on the LMS in the Assignments module and also attached to this email. You have also been provided with a summary of the transactions that have occurred during the year, and the ending balances from the previous year. FY 2019 Balances The balances of relevant accounts for FY 2019 are as follows: Account Subtype Value Cash and Cash Equivalents Current Asset 29370 Trade Receivables Current Asset 25939 Inventory Current Asset 9779 Other Current Assets Current Asset 1977 Trade Payables Current Liabilities 13497 Tax Payable Current Liabilities 2040 Wages Payable Current Liabilities 2895 Debt Current Liabilities 8389 Other Current Liabilities Current Liabilities 981 Contributed Equity Equity 11161 Retained Profits/Losses Equity 50199 PPE (Net) Non-Current Asset 55666 Debi Non-Current Liabilities 33558 FY 2020 Transactions A summary of the transactions entered into by the company in FY 2020 are as follows: # Transaction 1 Platinum Pty Ltd sell 30 units of car steel used to manufacture car panels for $11000 on credit terms of 60 days Toyota Motor Company. The steel was carried in inventory at a value of $2200 and had been in inventory for only one month. 2 During the year, the bank charged Platinum Pty Ltd $2936in interest. This amount was directly debited to Platinum?s bank account with the same bank. During the year, Platinum purchased an additional $16000 of production equipment. Half the amount was paid in cash, with the remaining half on credit. The accountant determines that the credit amount should be put to other current 3 liabilities. 4 Platinum Pty Ltd sell 100 pre-fabricated suspension units for $30000 on credit terms of 30 days Ford Motor Company. These parts were carried in inventory at a value of $3000. 5 Platinum has paid all of its company tax owing from the previous period. In addition, Platinum incurs a further $11189 in company tax that it will pay next year. 6 At the start of the year, Platinum extended its lease on its premises for 24 months. Each month of rent costs $1000, and Platinum pays its rent on monthly basis by direct debit to its bank account. 7 During the year, the accountants at Platinum Pty Ltd determine that depreciation should be recorded at $5566. 8 By the end of the year, Platinum Pty Ltd pays off $13497 of debts owing to its trade creditors. 9 At the end of the year, Platinum pays out a $10040 dividend to its shareholders. 10 Platinum Pty Ltd provides consulting services using its existing staff to General Motors for $48000. Of this amount, 80% was paid in cash with the remainder on credit terms of 60 days. 11 During the year, Platinum Pty Ltd repays $8389 of its bank debt. Of the remaining debt, by the end of the year, half is due for repayment in the next twelve months. 12 Platinum Pty Ltd chooses to issue 5000 shares to a new investor. These shares are issued at $6 per share. 13 During the year, Platinum incurred $26000 of wages costs. Platinum has paid this amount in full by the end of the year. Platinum has also now paid all wages owing from previous years. 14 During the year, Platinum Pty Ltd purchased $19000 of steel components that it plans to on-sell to its car company clients. The inventory was purchased on credit. 15 By the end of the year, Platinum Pty Ltd receives from its debtors a total of $20751. Your task Your task is to prepare the the financial statements for FY 2020. Specifically, you are tasked with preparing: 1. A transaction analysis for the transactions during the year, 2. A balance sheet for the end of FY 2020, and 3. An income statement for the end of FY 2020 To assist you in this task, you have been provided (a) a template used in previous years to record the transactions to the appropriate accounts and (b) a template for the financial statements to be prepared. These are contained in the Excel file accessible on the LMS in the Assignments module and also attached to this emak You have also been provided with a summary of the transactions that have occurred during the year, and the ending balances from the previous year FY 2019 Balances The balances of relevant accounts for FY 2019 are as follows: FY 2020 Transactions A summary of the transactions entered into by the company in FY 2020 are as follows: Platinum Pty Ltd sell 30 units of car stoel used to manufacture car panels for $11000 on credit terms of 60 days Toyota Motor Company. The steel was carried in inventory at a value of $2200 and had been in inventory for only one month During the year, the bank charged Platinum Pty Las $2936in interest. This amount was directly debited to Platinum?s bank account with the same bank During the year, Platinum purchased an additional $18000 of production equipment. Half the amount was paid in cash, with the remaining half on credit. The accountant determines that the credit amount should be put to other current liabilities Platinum Pty Ltd sell 100 pre-fabricated suspension units for $30000 on credit terms of 30 days Ford Motor Company. These parts were carried in inventory at a value of $3000 Platinum has paid all of its company tax owing from the previous period. In addition, Platinum incurs a further $11189 in company tax that it will pay next year. At the start of the year, Platinum extended is lease on its premises for 24 months. Each month of rent costs $1000, and Platinum pays is rent on monthly basis by direct debit to its bank account. During the year, the accountants at Platinum PyLad determine that depreciation should be recorded at $5566 By the end of the year. Platinum Pty Ltd pays of $13497 of debts owing to its trade creditors At the end of the year, Platinum pays out a $10040 dividend to its shareholders. Platinum Pty Ltd provides consulting services using its existing staff to General Motors for $48000. Of this amount 80% was paid in cash with the remainder on credit terms of 60 days. During the year, Platinum Pty Ltd repays $8389 of its bank debt. Of the remaining debt, by the end of the year, half is due for repayment in the next twelve months. Platinum Pty Ltd chooses to issue 5000 shares to a new investor. These shares are issued at $6 per share During the year. Platinum incurred S26000 of wages costs. Platinum has paid this amount in full by the end of the year. Platinum has also now paid all wages owing from previous years. During the year, Platinum Pty Ltd purchased $19000 of steel components that it plans to on sell to its car company clients. The inventory was purchased on credit By the end of the year, Platinum Pty Lid receives from its debtors a total of $20751. 11 12 Your task Your task is to prepare the the financial statements for FY 2020. Specifically, you are tasked with preparing: 1. A transaction analysis for the transactions during the year, 2. A balance sheet for the end of FY 2020; and 3. An income statement for the end of FY 2020. To assist you in this task, you have been provided (a) a template used in previous years to record the transactions to the appropriate accounts; and (b), a template for the financial statements to be prepared. These are contained in the Excel file accessible on the LMS in the Assignments module and also attached to this email. You have also been provided with a summary of the transactions that have occurred during the year, and the ending balances from the previous year. FY 2019 Balances The balances of relevant accounts for FY 2019 are as follows: Account Subtype Value Cash and Cash Equivalents Current Asset 29370 Trade Receivables Current Asset 25939 Inventory Current Asset 9779 Other Current Assets Current Asset 1977 Trade Payables Current Liabilities 13497 Tax Payable Current Liabilities 2040 Wages Payable Current Liabilities 2895 Debt Current Liabilities 8389 Other Current Liabilities Current Liabilities 981 Contributed Equity Equity 11161 Retained Profits/Losses Equity 50199 PPE (Net) Non-Current Asset 55666 Debi Non-Current Liabilities 33558 FY 2020 Transactions A summary of the transactions entered into by the company in FY 2020 are as follows: # Transaction 1 Platinum Pty Ltd sell 30 units of car steel used to manufacture car panels for $11000 on credit terms of 60 days Toyota Motor Company. The steel was carried in inventory at a value of $2200 and had been in inventory for only one month. 2 During the year, the bank charged Platinum Pty Ltd $2936in interest. This amount was directly debited to Platinum?s bank account with the same bank. During the year, Platinum purchased an additional $16000 of production equipment. Half the amount was paid in cash, with the remaining half on credit. The accountant determines that the credit amount should be put to other current 3 liabilities. 4 Platinum Pty Ltd sell 100 pre-fabricated suspension units for $30000 on credit terms of 30 days Ford Motor Company. These parts were carried in inventory at a value of $3000. 5 Platinum has paid all of its company tax owing from the previous period. In addition, Platinum incurs a further $11189 in company tax that it will pay next year. 6 At the start of the year, Platinum extended its lease on its premises for 24 months. Each month of rent costs $1000, and Platinum pays its rent on monthly basis by direct debit to its bank account. 7 During the year, the accountants at Platinum Pty Ltd determine that depreciation should be recorded at $5566. 8 By the end of the year, Platinum Pty Ltd pays off $13497 of debts owing to its trade creditors. 9 At the end of the year, Platinum pays out a $10040 dividend to its shareholders. 10 Platinum Pty Ltd provides consulting services using its existing staff to General Motors for $48000. Of this amount, 80% was paid in cash with the remainder on credit terms of 60 days. 11 During the year, Platinum Pty Ltd repays $8389 of its bank debt. Of the remaining debt, by the end of the year, half is due for repayment in the next twelve months. 12 Platinum Pty Ltd chooses to issue 5000 shares to a new investor. These shares are issued at $6 per share. 13 During the year, Platinum incurred $26000 of wages costs. Platinum has paid this amount in full by the end of the year. Platinum has also now paid all wages owing from previous years. 14 During the year, Platinum Pty Ltd purchased $19000 of steel components that it plans to on-sell to its car company clients. The inventory was purchased on credit. 15 By the end of the year, Platinum Pty Ltd receives from its debtors a total of $20751. Your task Your task is to prepare the the financial statements for FY 2020. Specifically, you are tasked with preparing: 1. A transaction analysis for the transactions during the year, 2. A balance sheet for the end of FY 2020, and 3. An income statement for the end of FY 2020 To assist you in this task, you have been provided (a) a template used in previous years to record the transactions to the appropriate accounts and (b) a template for the financial statements to be prepared. These are contained in the Excel file accessible on the LMS in the Assignments module and also attached to this emak You have also been provided with a summary of the transactions that have occurred during the year, and the ending balances from the previous year FY 2019 Balances The balances of relevant accounts for FY 2019 are as follows: FY 2020 Transactions A summary of the transactions entered into by the company in FY 2020 are as follows: Platinum Pty Ltd sell 30 units of car stoel used to manufacture car panels for $11000 on credit terms of 60 days Toyota Motor Company. The steel was carried in inventory at a value of $2200 and had been in inventory for only one month During the year, the bank charged Platinum Pty Las $2936in interest. This amount was directly debited to Platinum?s bank account with the same bank During the year, Platinum purchased an additional $18000 of production equipment. Half the amount was paid in cash, with the remaining half on credit. The accountant determines that the credit amount should be put to other current liabilities Platinum Pty Ltd sell 100 pre-fabricated suspension units for $30000 on credit terms of 30 days Ford Motor Company. These parts were carried in inventory at a value of $3000 Platinum has paid all of its company tax owing from the previous period. In addition, Platinum incurs a further $11189 in company tax that it will pay next year. At the start of the year, Platinum extended is lease on its premises for 24 months. Each month of rent costs $1000, and Platinum pays is rent on monthly basis by direct debit to its bank account. During the year, the accountants at Platinum PyLad determine that depreciation should be recorded at $5566 By the end of the year. Platinum Pty Ltd pays of $13497 of debts owing to its trade creditors At the end of the year, Platinum pays out a $10040 dividend to its shareholders. Platinum Pty Ltd provides consulting services using its existing staff to General Motors for $48000. Of this amount 80% was paid in cash with the remainder on credit terms of 60 days. During the year, Platinum Pty Ltd repays $8389 of its bank debt. Of the remaining debt, by the end of the year, half is due for repayment in the next twelve months. Platinum Pty Ltd chooses to issue 5000 shares to a new investor. These shares are issued at $6 per share During the year. Platinum incurred S26000 of wages costs. Platinum has paid this amount in full by the end of the year. Platinum has also now paid all wages owing from previous years. During the year, Platinum Pty Ltd purchased $19000 of steel components that it plans to on sell to its car company clients. The inventory was purchased on credit By the end of the year, Platinum Pty Lid receives from its debtors a total of $20751. 11 12