Answered step by step

Verified Expert Solution

Question

1 Approved Answer

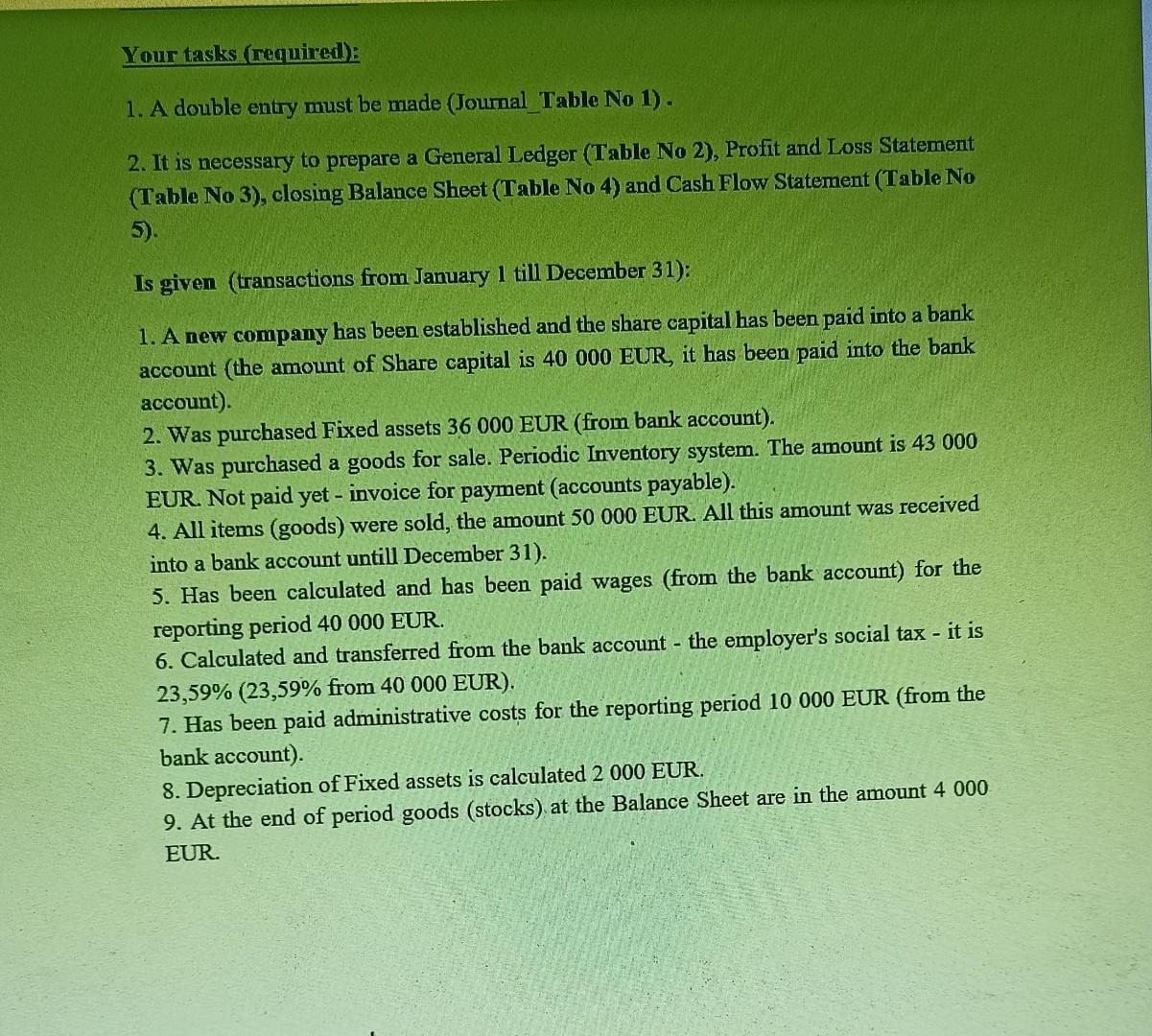

Your tasks required): 1. A double entry must be made (Journal Table No 1). 2. It is necessary to prepare a General Ledger (Table No

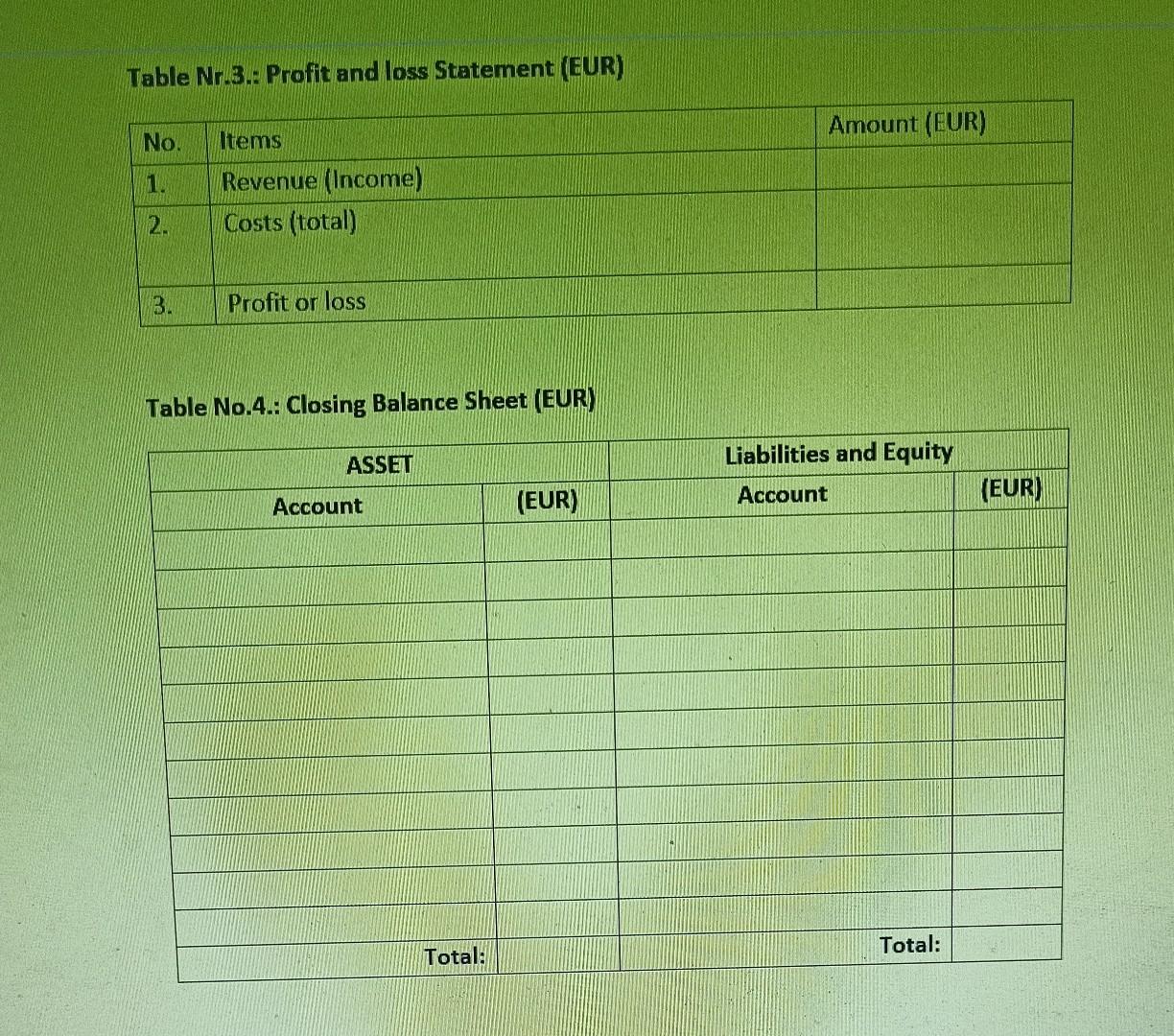

Your tasks required): 1. A double entry must be made (Journal Table No 1). 2. It is necessary to prepare a General Ledger (Table No 2), Profit and Loss Statement (Table No 3), closing Balance Sheet (Table No 4) and Cash Flow Statement (Table No 5). Is given (transactions from January 1 till December 31): 1. A new company has been established and the share capital has been paid into a bank account (the amount of Share capital is 40 000 EUR, it has been paid into the bank account). 2. Was purchased Fixed assets 36 000 EUR (from bank account). 3. Was purchased a goods for sale. Periodic Inventory system. The amount is 43 000 EUR. Not paid yet - invoice for payment (accounts payable). 4. All items (goods) were sold, the amount 50 000 EUR. All this amount was received into a bank account untill December 31). 5. Has been calculated and has been paid wages (from the bank account) for the reporting period 40 000 EUR. 6. Calculated and transferred from the bank account - the employer's social tax - it is 23,59% (23,59% from 40 000 EUR). 7. Has been paid administrative costs for the reporting period 10 000 EUR (from the bank account). 8. Depreciation of Fixed assets is calculated 2 000 EUR. 9. At the end of period goods (stocks) at the Balance Sheet are in the amount 4 000 EUR. Table Nr.3.: Profit and loss Statement (EUR) Amount (EUR) No. 1. Items Revenue (Income) Costs (total) 2 3. Profit or loss Table No.4.: Closing Balance Sheet (EUR) ASSET Liabilities and Equity Account (EUR) Account (EUR) Total: Total

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started