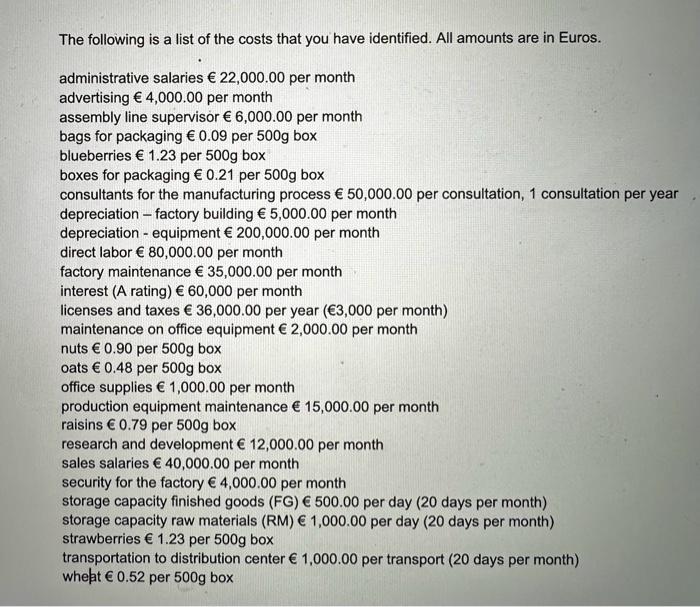

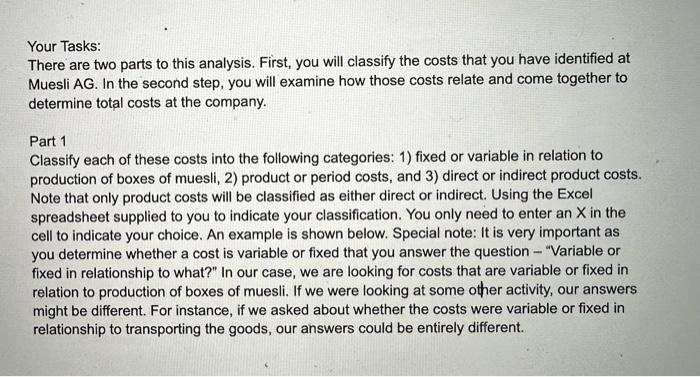

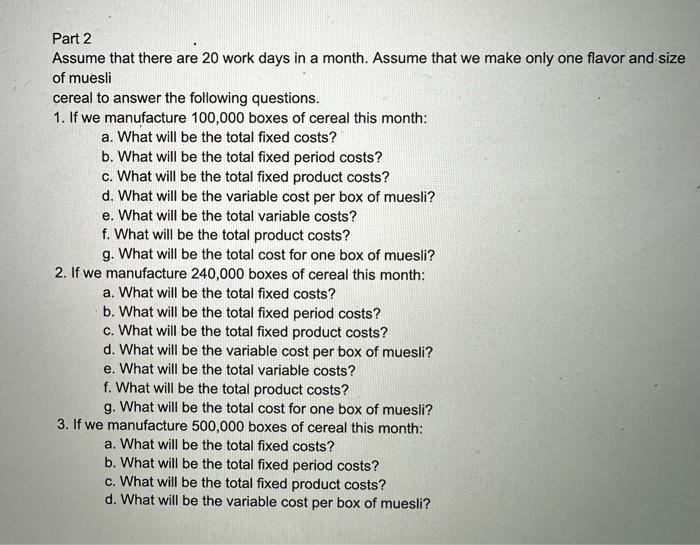

Your Tasks: There are two parts to this analysis. First, you will classify the costs that you have identified at Muesli AG. In the second step, you will examine how those costs relate and come together to determine total costs at the company. Part 1 Classify each of these costs into the following categories: 1) fixed or variable in relation to production of boxes of muesli, 2) product or period costs, and 3) direct or indirect product costs. Note that only product costs will be classified as either direct or indirect. Using the Excel spreadsheet supplied to you to indicate your classification. You only need to enter an X in the cell to indicate your choice. An example is shown below. Special note: It is very important as you determine whether a cost is variable or fixed that you answer the question - \"Variable or fixed in relationship to what?\" In our case, we are looking for costs that are variable or fixed in relation to production of boxes of muesli. If we were looking at some other activity, our answers might be different. For instance, if we asked about whether the costs were variable or fixed in relationship to transporting the goods, our answers could be entirely different. The following is a list of the costs that you have identified. All amounts are in Euros. administrative salaries \\( 22,000.00 \\) per month advertising \\( 4,000.00 \\) per month assembly line supervisor \\( 6,000.00 \\) per month bags for packaging \\( 0.09 \\) per \\( 500 \\mathrm{~g} \\) box blueberries \\( 1.23 \\) per \\( 500 \\mathrm{~g} \\) box boxes for packaging \\( 0.21 \\) per \\( 500 \\mathrm{~g} \\) box consultants for the manufacturing process \\( 50,000.00 \\) per consultation, 1 consultation per year depreciation - factory building \\( 5,000.00 \\) per month depreciation - equipment \\( 200,000.00 \\) per month direct labor \\( 80,000.00 \\) per month factory maintenance \\( 35,000.00 \\) per month interest (A rating) \\( 60,000 \\) per month licenses and taxes \\( 36,000.00 \\) per year ( \\( 3,000 \\) per month) maintenance on office equipment \\( 2,000.00 \\) per month nuts \\( 0.90 \\) per \\( 500 \\mathrm{~g} \\) box oats \\( 0.48 \\) per \\( 500 \\mathrm{~g} \\) box office supplies \\( 1,000.00 \\) per month production equipment maintenance \\( 15,000.00 \\) per month raisins \\( 0.79 \\) per \\( 500 \\mathrm{~g} \\) box research and development \\( 12,000.00 \\) per month sales salaries \\( 40,000.00 \\) per month security for the factory \\( 4,000.00 \\) per month storage capacity finished goods ( \\( F G) 500.00 \\) per day ( 20 days per month) storage capacity raw materials (RM) \\( 1,000.00 \\) per day ( 20 days per month) strawberries \\( 1.23 \\) per \\( 500 \\mathrm{~g} \\) box transportation to distribution center \\( 1,000.00 \\) per transport ( 20 days per month) whelat \\( 0.52 \\) per \\( 500 \\mathrm{~g} \\) box Part 2 Assume that there are 20 work days in a month. Assume that we make only one flavor and size of muesli cereal to answer the following questions. 1. If we manufacture 100,000 boxes of cereal this month: a. What will be the total fixed costs? b. What will be the total fixed period costs? c. What will be the total fixed product costs? d. What will be the variable cost per box of muesli? e. What will be the total variable costs? f. What will be the total product costs? g. What will be the total cost for one box of muesli? 2. If we manufacture 240,000 boxes of cereal this month: a. What will be the total fixed costs? b. What will be the total fixed period costs? c. What will be the total fixed product costs? d. What will be the variable cost per box of muesli? e. What will be the total variable costs? f. What will be the total product costs? g. What will be the total cost for one box of muesli? 3. If we manufacture 500,000 boxes of cereal this month: a. What will be the total fixed costs? b. What will be the total fixed period costs? c. What will be the total fixed product costs? d. What will be the variable cost per box of muesli