Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Your teacher will assign one of the scenarios below. How many hidden costs can you find in the employment scenario? Be prepared to report

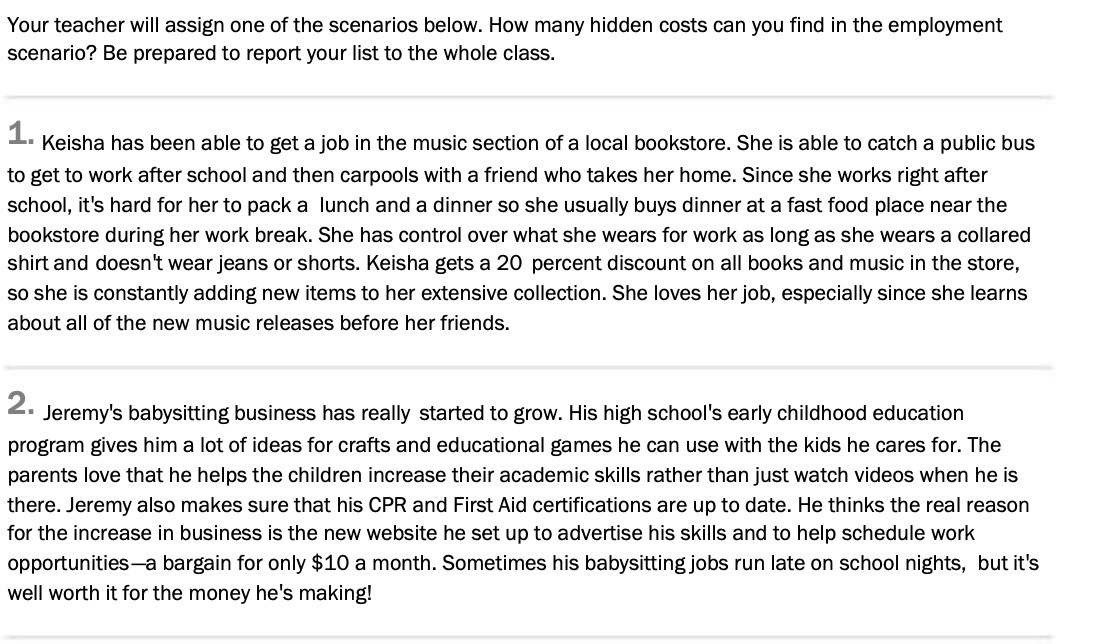

Your teacher will assign one of the scenarios below. How many hidden costs can you find in the employment scenario? Be prepared to report your list to the whole class. 1. Keisha has been able to get a job in the music section of a local bookstore. She is able to catch a public bus to get to work after school and then carpools with a friend who takes her home. Since she works right after school, it's hard for her to pack a lunch and a dinner so she usually buys dinner at a fast food place near the bookstore during her work break. She has control over what she wears for work as long as she wears a collared shirt and doesn't wear jeans or shorts. Keisha gets a 20 percent discount on all books and music in the store, so she is constantly adding new items to her extensive collection. She loves her job, especially since she learns about all of the new music releases before her friends. 2. Jeremy's babysitting business has really started to grow. His high school's early childhood education program gives him a lot of ideas for crafts and educational games he can use with the kids he cares for. The parents love that he helps the children increase their academic skills rather than just watch videos when he is there. Jeremy also makes sure that his CPR and First Aid certifications are up to date. He thinks the real reason for the increase in business is the new website he set up to advertise his skills and to help schedule work opportunities-a bargain for only $10 a month. Sometimes his babysitting jobs run late on school nights, but it's well worth it for the money he's making!

Step by Step Solution

There are 3 Steps involved in it

Step: 1

In scenario 1 1 Transportation Costs Keisha spends money on bus fares to get to work and might contr...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started