Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Your team of three works in the Finance division of the Hexa Manufacturing Ltd. The company is deciding on an investment in a new

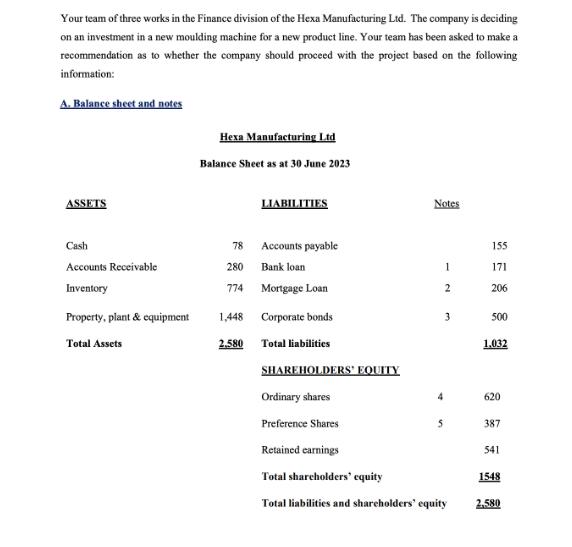

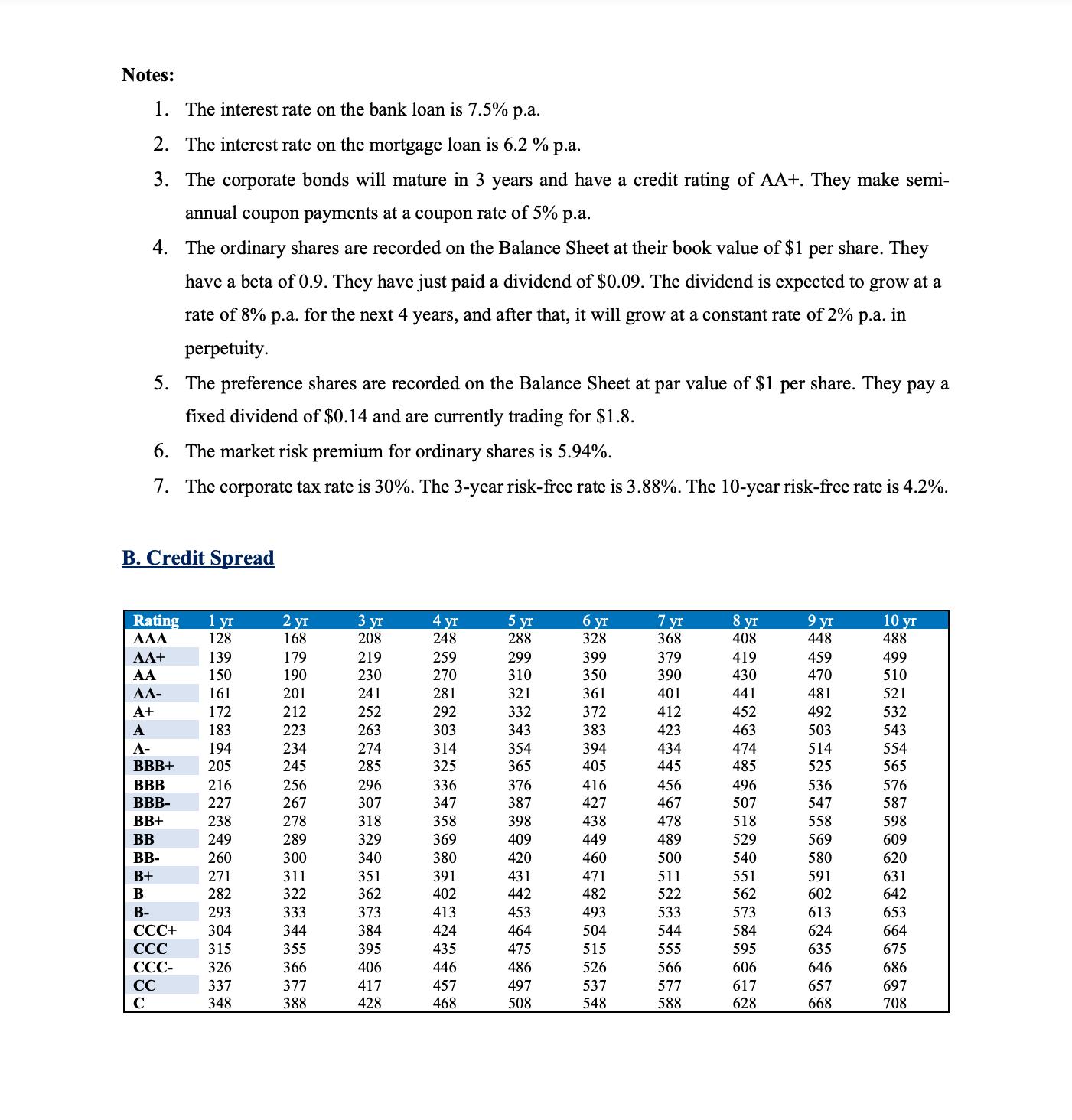

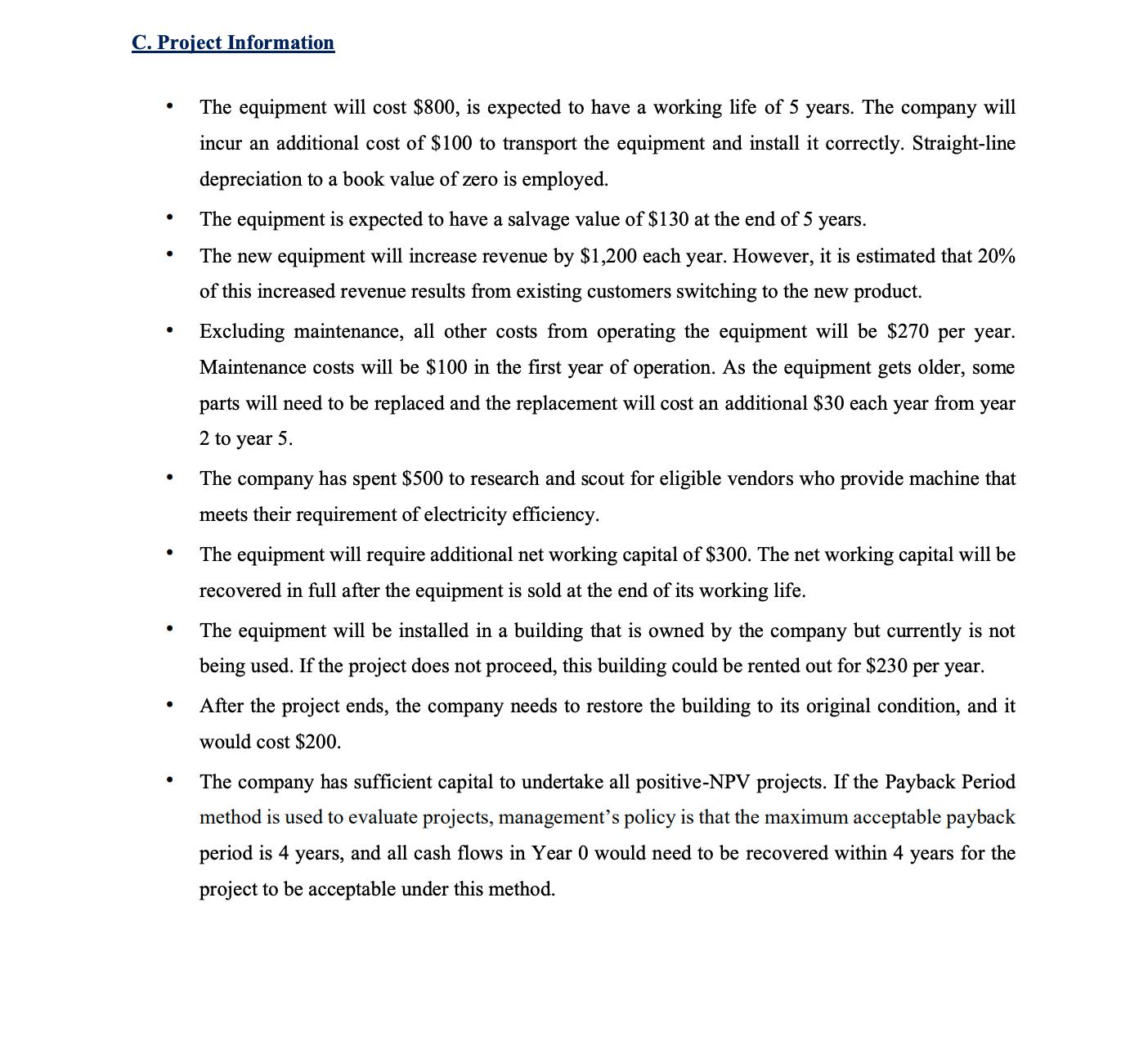

Your team of three works in the Finance division of the Hexa Manufacturing Ltd. The company is deciding on an investment in a new moulding machine for a new product line. Your team has been asked to make a recommendation as to whether the company should proceed with the project based on the following information: A. Balance sheet and notes ASSETS Cash Accounts Receivable Inventory Property, plant & equipment Total Assets Hexa Manufacturing Ltd Balance Sheet as at 30 June 2023 78 280 774 1,448 2.580 LIABILITIES Accounts payable Bank loan Mortgage Loan Corporate bonds Total liabilities SHAREHOLDERS' EQUITY Ordinary shares Preference Shares Notes 3 4 1 2 5 Retained earnings Total shareholders' equity Total liabilities and shareholders' equity 155 171 206 500 1,032 620 387 541 1548 2.580 Notes: 1. The interest rate on the bank loan is 7.5% p.a. 2. The interest rate on the mortgage loan is 6.2 % p.a. 3. The corporate bonds will mature in 3 years and have a credit rating of AA+. They make semi- annual coupon payments at a coupon rate of 5% p.a. 4. The ordinary shares are recorded on the Balance Sheet at their book value of $1 per share. They have a beta of 0.9. They have just paid a dividend of $0.09. The dividend is expected to grow at a rate of 8% p.a. for the next 4 years, and after that, it will grow at a constant rate of 2% p.a. in perpetuity. 5. The preference shares are recorded on the Balance Sheet at par value of $1 per share. They pay a fixed dividend of $0.14 and are currently trading for $1.8. 6. The market risk premium for ordinary shares is 5.94%. 7. The corporate tax rate is 30%. The 3-year risk-free rate is 3.88%. The 10-year risk-free rate is 4.2%. B. Credit Spread Rating AAA AA+ AA AA- A+ A A- BBB+ BBB BBB- BB+ BB BB- 1 yr 128 183 194 205 216 227 238 249 260 271 282 293 CCC+ 304 CCC 315 CCC- CC C B+ B B- 139 150 161 172 326 337 348 2 yr 168 179 190 201 212 223 234 245 256 267 278 289 300 311 322 333 344 355 366 377 388 3 yr 208 219 230 241 252 263 274 285 296 307 318 329 340 351 362 373 384 395 406 417 428 4 yr 248 259 270 281 292 303 314 325 336 347 358 369 380 391 402 413 424 435 446 457 468 5 yr 288 299 310 321 332 343 354 365 376 387 398 409 420 431 442 453 464 475 486 497 508 6 yr 328 399 350 361 372 383 394 405 416 427 438 449 460 471 482 493 504 515 526 537 548 7 yr 368 379 390 401 412 423 434 445 456 467 478 489 500 511 522 533 544 555 566 577 588 8 yr 408 419 430 441 452 463 474 485 496 507 518 529 540 551 562 573 584 595 606 617 628 9 yr 448 459 470 481 492 503 514 525 536 547 558 569 580 591 602 613 624 635 646 657 668 10 yr 488 499 510 521 532 543 554 565 576 587 598 609 620 631 642 653 664 675 686 697 708 C. Project Information The equipment will cost $800, is expected to have a working life of 5 years. The company will incur an additional cost of $100 to transport the equipment and install it correctly. Straight-line depreciation to a book value of zero is employed. The equipment is expected to have a salvage value of $130 at the end of 5 years. The new equipment will increase revenue by $1,200 each year. However, it is estimated that 20% of this increased revenue results from existing customers switching to the new product. Excluding maintenance, all other costs from operating the equipment will be $270 per year. Maintenance costs will be $100 in the first year of operation. As the equipment gets older, some parts will need to be replaced and the replacement will cost an additional $30 each year from year 2 to year 5. The company has spent $500 to research and scout for eligible vendors who provide machine that meets their requirement of electricity efficiency. The equipment will require additional net working capital of $300. The net working capital will be recovered in full after the equipment is sold at the end of its working life. The equipment will be installed in a building that is owned by the company but currently is not being used. If the project does not proceed, this building could be rented out for $230 per year. After the project ends, the company needs to restore the building to its original condition, and it would cost $200. The company has sufficient capital to undertake all positive-NPV projects. If the Payback Period method is used to evaluate projects, management's policy is that the maximum acceptable payback period is 4 years, and all cash flows in Year 0 would need to be recovered within 4 years for the project to be acceptable under this method.

Step by Step Solution

★★★★★

3.48 Rating (145 Votes )

There are 3 Steps involved in it

Step: 1

To determine whether the company should proceed with the investment in the new molding machine we will evaluate the project using several financial me...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started