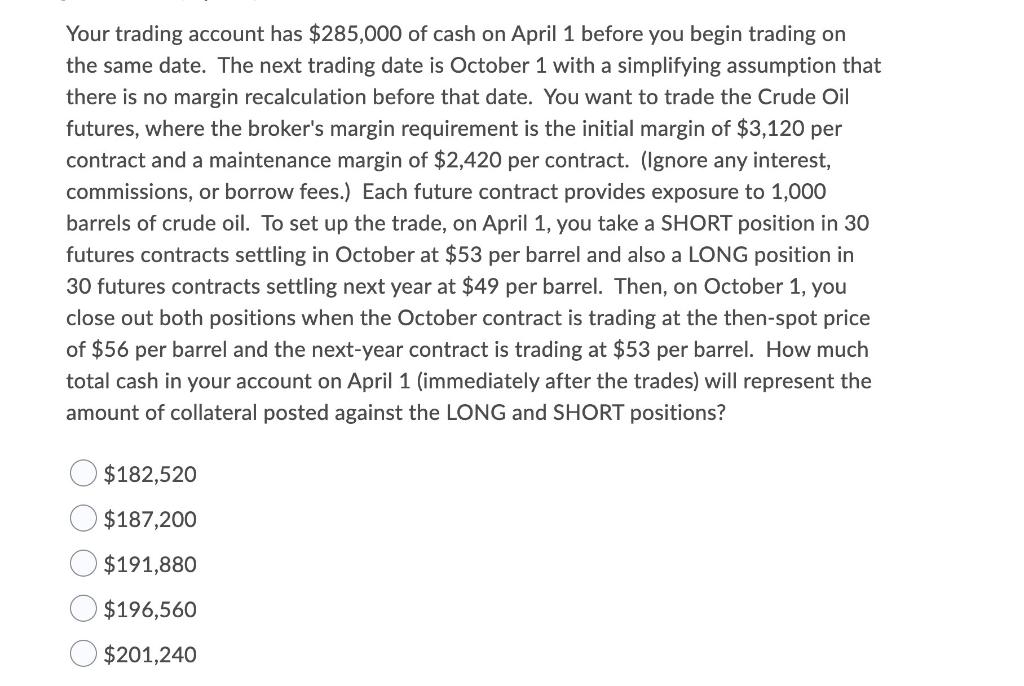

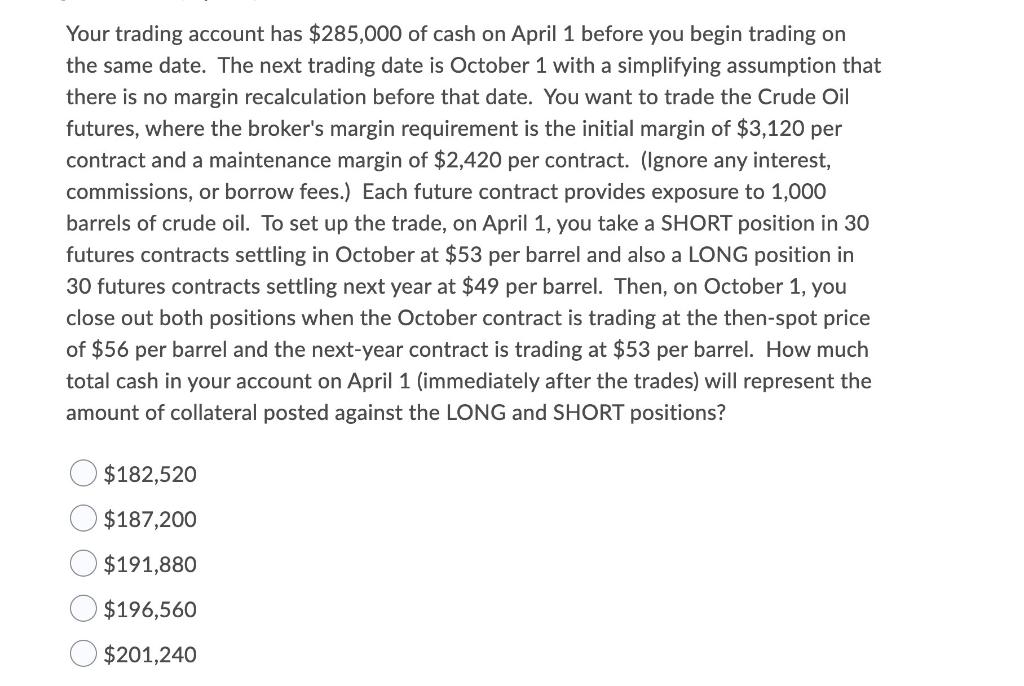

Your trading account has $285,000 of cash on April 1 before you begin trading on the same date. The next trading date is October 1 with a simplifying assumption that there is no margin recalculation before that date. You want to trade the Crude Oil futures, where the broker's margin requirement is the initial margin of $3,120 per contract and a maintenance margin of $2,420 per contract. (Ignore any interest, commissions, or borrow fees.) Each future contract provides exposure to 1,000 barrels of crude oil. To set up the trade, on April 1, you take a SHORT position in 30 futures contracts settling in October at $53 per barrel and also a LONG position in 30 futures contracts settling next year at $49 per barrel. Then, on October 1, you close out both positions when the October contract is trading at the then-spot price of $56 per barrel and the next-year contract is trading at $53 per barrel. How much total cash in your account on April 1 (immediately after the trades) will represent the amount of collateral posted against the LONG and SHORT positions? $182,520 $187,200 $191,880 $196,560 $201,240 Your trading account has $285,000 of cash on April 1 before you begin trading on the same date. The next trading date is October 1 with a simplifying assumption that there is no margin recalculation before that date. You want to trade the Crude Oil futures, where the broker's margin requirement is the initial margin of $3,120 per contract and a maintenance margin of $2,420 per contract. (Ignore any interest, commissions, or borrow fees.) Each future contract provides exposure to 1,000 barrels of crude oil. To set up the trade, on April 1, you take a SHORT position in 30 futures contracts settling in October at $53 per barrel and also a LONG position in 30 futures contracts settling next year at $49 per barrel. Then, on October 1, you close out both positions when the October contract is trading at the then-spot price of $56 per barrel and the next-year contract is trading at $53 per barrel. How much total cash in your account on April 1 (immediately after the trades) will represent the amount of collateral posted against the LONG and SHORT positions? $182,520 $187,200 $191,880 $196,560 $201,240