Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Your trading firm in Melbourne has recently signed a sales contract with a seller of rice in bags from Thailand to import 200 tons.

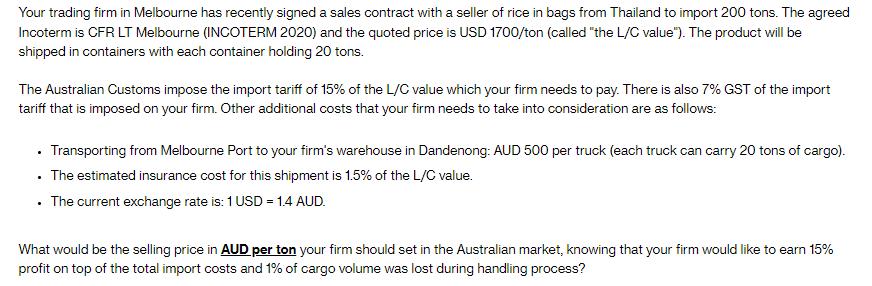

Your trading firm in Melbourne has recently signed a sales contract with a seller of rice in bags from Thailand to import 200 tons. The agreed Incoterm is CFR LT Melbourne (INCOTERM 2020) and the quoted price is USD 1700/ton (called "the L/C value"). The product will be shipped in containers with each container holding 20 tons. The Australian Customs impose the import tariff of 15% of the L/C value which your firm needs to pay. There is also 7% GST of the import tariff that is imposed on your firm. Other additional costs that your firm needs to take into consideration are as follows: Transporting from Melbourne Port to your firm's warehouse in Dandenong: AUD 500 per truck (each truck can carry 20 tons of cargo). . The estimated insurance cost for this shipment is 1.5% of the L/C value. . The current exchange rate is: 1 USD = 1.4 AUD. What would be the selling price in AUD per ton your firm should set in the Australian market, knowing that your firm would like to earn 15% profit on top of the total import costs and 1% of cargo volume was lost during handling process?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the selling price in AUD per ton that your firm should set in the Australian market you...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started