Answered step by step

Verified Expert Solution

Question

1 Approved Answer

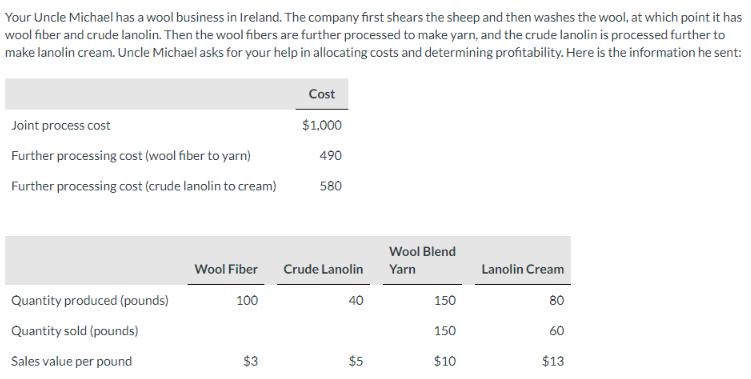

Your Uncle Michael has a wool business in Ireland. The company first shears the sheep and then washes the wool, at which point it

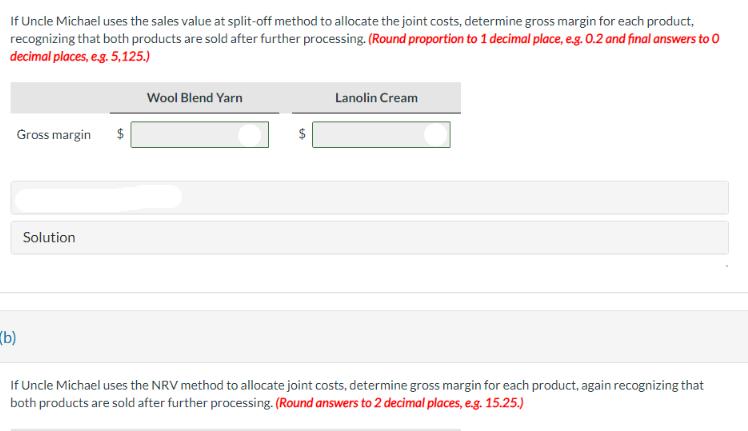

Your Uncle Michael has a wool business in Ireland. The company first shears the sheep and then washes the wool, at which point it has wool fiber and crude lanolin. Then the wool fibers are further processed to make yarn, and the crude lanolin is processed further to make lanolin cream. Uncle Michael asks for your help in allocating costs and determining profitability. Here is the information he sent: Joint process cost Further processing cost (wool fiber to yarn) Further processing cost (crude lanolin to cream) Quantity produced (pounds) Quantity sold (pounds) Sales value per pound Wool Fiber 100 $3 Cost $1,000 490 580 Crude Lanolin 40 $5 Wool Blend Yarn 150 150 $10 Lanolin Cream 80 60 $13 If Uncle Michael uses the sales value at split-off method to allocate the joint costs, determine gross margin for each product, recognizing that both products are sold after further processing. (Round proportion to 1 decimal place, e.g. 0.2 and final answers to 0 decimal places, e.g. 5,125.) Gross margin (b) Solution $ Wool Blend Yarn LA Lanolin Cream If Uncle Michael uses the NRV method to allocate joint costs, determine gross margin for each product, again recognizing that both products are sold after further processing. (Round answers to 2 decimal places, e.g. 15.25.)

Step by Step Solution

★★★★★

3.39 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

Determine the gross margin for each product using the sales value at splitoff method Total sales value ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started