your value mone 4.5%

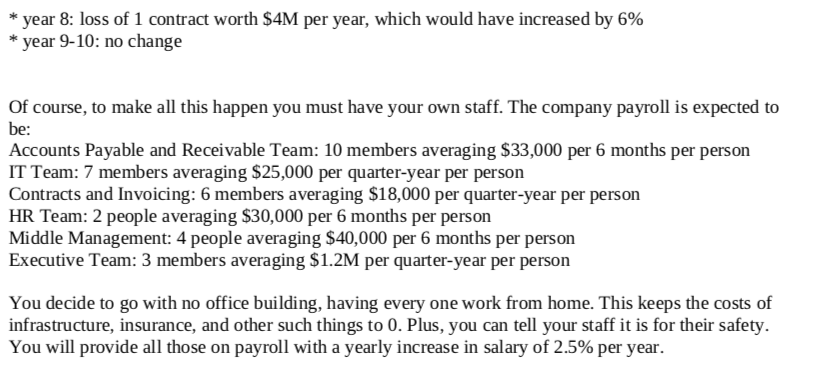

III. Consider the following and answer Moving on from Good Morning America's failure at basic math, you are lead decision maker for Effem Customer Service Corp - a corporation that offers other companies call center services. You notice a few ways to save money: - offer your employees no benefits by making them contractors so that legally they are not employees - do not pay your employees, I mean contractors, for training but instead make them pay you for their training - offer your employees, I mean contractors, an advertised wage but when you sign contracts with customers allow the customer to set a wage lower than what you advertised to the contractors To get away with this, you need the contractors to sign agreements that they will not sue. You will also probably get sued. So, you need a good lawyer, ok team of lawyers. The costs over time for a good legal team are expected to be: * 2 corporate lawyers working for your company at $130K each, expecting a 5% increase per year every year, and a bonus at the end of the year season of $10K, and that bonus must increase at 5% each year also. * a team of lawyers on retainer from Eggers Eggers Eggers & Eggers. You expect to need 3 lawyers at $350 per hour for approximately 200 hours per quarter-year for each lawyer. You can expect that hourly rate to increase by 8% per year. * all other legal costs (filing fees, etc) will be near $20K per year increasing by $5K per year every year. The marketing teams believe its possible for the company to: * year 1: secure 3 contracts worth $3M per year, increasing in value by 7% per year * year 2 - 7: secure 5 contracts worth $5M per year, increasing in value by 6% * year 8: loss of 1 contract worth $4M per year, which would have increased by 6% * year 9-10: no change Of course, to make all this happen you must have your own staff. The company payroll is expected to be: Accounts Payable and Receivable Team: 10 members averaging $33,000 per 6 months per person IT Team: 7 members averaging $25,000 per quarter-year per person Contracts and Invoicing: 6 members averaging $18,000 per quarter-year per person HR Team: 2 people averaging $30,000 per 6 months per person Middle Management: 4 people averaging $40,000 per 6 months per person Executive Team: 3 members averaging $1.2M per quarter-year per person You decide to go with no office building, having every one work from home. This keeps the costs of infrastructure, insurance, and other such things to 0. Plus, you can tell your staff it is for their safety. You will provide all those on payroll with a yearly increase in salary of 2.5% per year. 4. What is the present worth equivalent of your total costs over 20 years? III. Consider the following and answer Moving on from Good Morning America's failure at basic math, you are lead decision maker for Effem Customer Service Corp - a corporation that offers other companies call center services. You notice a few ways to save money: - offer your employees no benefits by making them contractors so that legally they are not employees - do not pay your employees, I mean contractors, for training but instead make them pay you for their training - offer your employees, I mean contractors, an advertised wage but when you sign contracts with customers allow the customer to set a wage lower than what you advertised to the contractors To get away with this, you need the contractors to sign agreements that they will not sue. You will also probably get sued. So, you need a good lawyer, ok team of lawyers. The costs over time for a good legal team are expected to be: * 2 corporate lawyers working for your company at $130K each, expecting a 5% increase per year every year, and a bonus at the end of the year season of $10K, and that bonus must increase at 5% each year also. * a team of lawyers on retainer from Eggers Eggers Eggers & Eggers. You expect to need 3 lawyers at $350 per hour for approximately 200 hours per quarter-year for each lawyer. You can expect that hourly rate to increase by 8% per year. * all other legal costs (filing fees, etc) will be near $20K per year increasing by $5K per year every year. The marketing teams believe its possible for the company to: * year 1: secure 3 contracts worth $3M per year, increasing in value by 7% per year * year 2 - 7: secure 5 contracts worth $5M per year, increasing in value by 6% * year 8: loss of 1 contract worth $4M per year, which would have increased by 6% * year 9-10: no change Of course, to make all this happen you must have your own staff. The company payroll is expected to be: Accounts Payable and Receivable Team: 10 members averaging $33,000 per 6 months per person IT Team: 7 members averaging $25,000 per quarter-year per person Contracts and Invoicing: 6 members averaging $18,000 per quarter-year per person HR Team: 2 people averaging $30,000 per 6 months per person Middle Management: 4 people averaging $40,000 per 6 months per person Executive Team: 3 members averaging $1.2M per quarter-year per person You decide to go with no office building, having every one work from home. This keeps the costs of infrastructure, insurance, and other such things to 0. Plus, you can tell your staff it is for their safety. You will provide all those on payroll with a yearly increase in salary of 2.5% per year. 4. What is the present worth equivalent of your total costs over 20 years