Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Your very wise Budgeting and Management instructor has convinced you that you should start saving money. You have decided to put away $500 per month

Your very wise Budgeting and Management instructor has convinced you that you should start saving money. You have decided to put away $500 per month and you are guaranteed a 6% interest rate that compounds monthly. You are committed to doing this for 20 years. At the end of those 20 years assuming you start with nothing and make your first $500 payment at the end of the first month, how much will you have total in the bank?

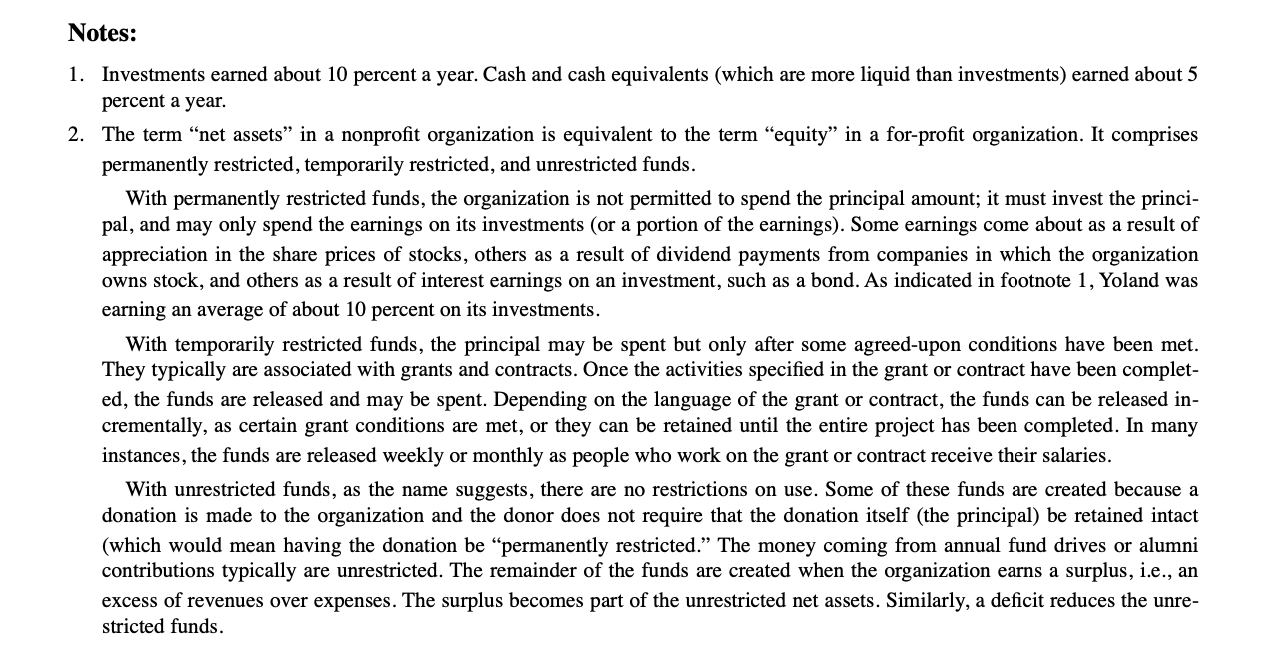

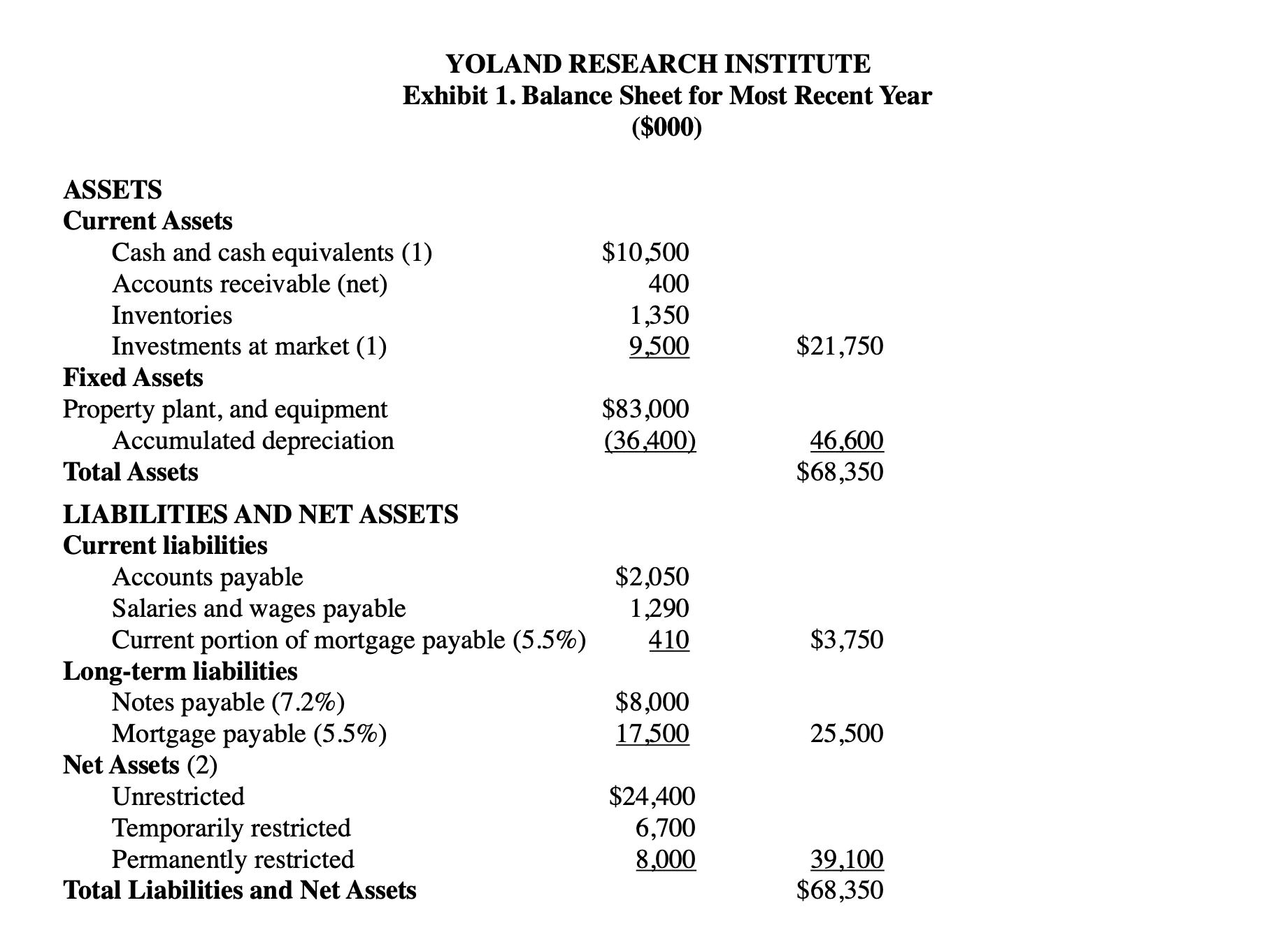

Notes: 1. Investments earned about 10 percent a year. Cash and cash equivalents (which are more liquid than investments) earned about 5 percent a year. 2. The term "net assets" in a nonprofit organization is equivalent to the term "equity" in a for-profit organization. It comprises permanently restricted, temporarily restricted, and unrestricted funds. With permanently restricted funds, the organization is not permitted to spend the principal amount; it must invest the princi- pal, and may only spend the earnings on its investments (or a portion of the earnings). Some earnings come about as a result of appreciation in the share prices of stocks, others as a result of dividend payments from companies in which the organization owns stock, and others as a result of interest earnings on an investment, such as a bond. As indicated in footnote 1, Yoland was earning an average of about 10 percent on its investments. With temporarily restricted funds, the principal may be spent but only after some agreed-upon conditions have been met. They typically are associated with grants and contracts. Once the activities specified in the grant or contract have been complet- ed, the funds are released and may be spent. Depending on the language of the grant or contract, the funds can be released in- crementally, as certain grant conditions are met, or they can be retained until the entire project has been completed. In many instances, the funds are released weekly or monthly as people who work on the grant or contract receive their salaries. With unrestricted funds, as the name suggests, there are no restrictions on use. Some of these funds are created because a donation is made to the organization and the donor does not require that the donation itself (the principal) be retained intact (which would mean having the donation be "permanently restricted." The money coming from annual fund drives or alumni contributions typically are unrestricted. The remainder of the funds are created when the organization earns a surplus, i.e., an excess of revenues over expenses. The surplus becomes part of the unrestricted net assets. Similarly, a deficit reduces the unre- stricted funds.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started