Answered step by step

Verified Expert Solution

Question

1 Approved Answer

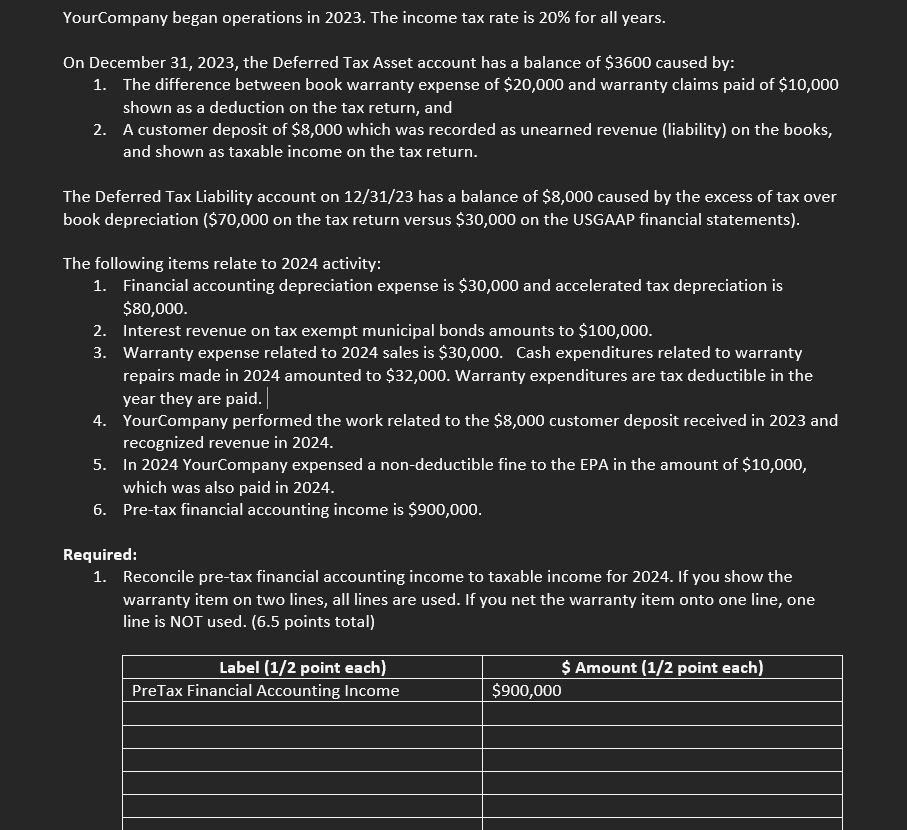

YourCompany began operations in 2 0 2 3 . The income tax rate is 2 0 % for all years. On December 3 1 ,

YourCompany began operations in The income tax rate is for all years.

On December the Deferred Tax Asset account has a balance of $ caused by:

The difference between book warranty expense of $ and warranty claims paid of $

shown as a deduction on the tax return, and

A customer deposit of $ which was recorded as unearned revenue liability on the books,

and shown as taxable income on the tax return.

The Deferred Tax Liability account on has a balance of $ caused by the excess of tax over

book depreciation $ on the tax return versus $ on the USGAAP financial statements

The following items relate to activity:

Financial accounting depreciation expense is $ and accelerated tax depreciation is

$

Interest revenue on tax exempt municipal bonds amounts to $

Warranty expense related to sales is $ Cash expenditures related to warranty

repairs made in amounted to $ Warranty expenditures are tax deductible in the

year they are paid.

YourCompany performed the work related to the $ customer deposit received in and

recognized revenue in

In YourCompany expensed a nondeductible fine to the EPA in the amount of $

which was also paid in

Pretax financial accounting income is $

Required:

Reconcile pretax financial accounting income to taxable income for If you show the

warranty item on two lines, all lines are used. If you net the warranty item onto one line, one

line is NOT used. points totalYourCompany began operations in The income tax rate is for all years.

On December the Deferred Tax Asset account has a balance of $ caused by:

The difference between book warranty expense of $ and warranty claims paid of $

shown as a deduction on the tax return, and

A customer deposit of $ which was recorded as unearned revenue liability on the books,

and shown as taxable income on the tax return.

The Deferred Tax Liability account on has a balance of $ caused by the excess of tax over

book depreciation $ on the tax return versus $ on the USGAAP financial statements

The following items relate to activity:

Financial accounting depreciation expense is $ and accelerated tax depreciation is

$

Interest revenue on tax exempt municipal bonds amounts to $

Warranty expense related to sales is $ Cash expenditures related to warranty

repairs made in amounted to $ Warranty expenditures are tax deductible in the

year they are paid.

YourCompany performed the work related to the $ customer deposit received in and

recognized revenue in

In YourCompany expensed a nondeductible fine to the EPA in the amount of $

which was also paid in

Pretax financial accounting income is $

Required:

Reconcile pretax financial accounting income to taxable income for If you show the

warranty item on two lines, all lines are used. If you net the warranty item onto one line, one

line is NOT used. points total

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started