Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You're a FX trader working in Japan. The following prices were observed in the market. Bid Spot rate (Yen/USD) 1-year Forward rate (Yen/USD) Yen

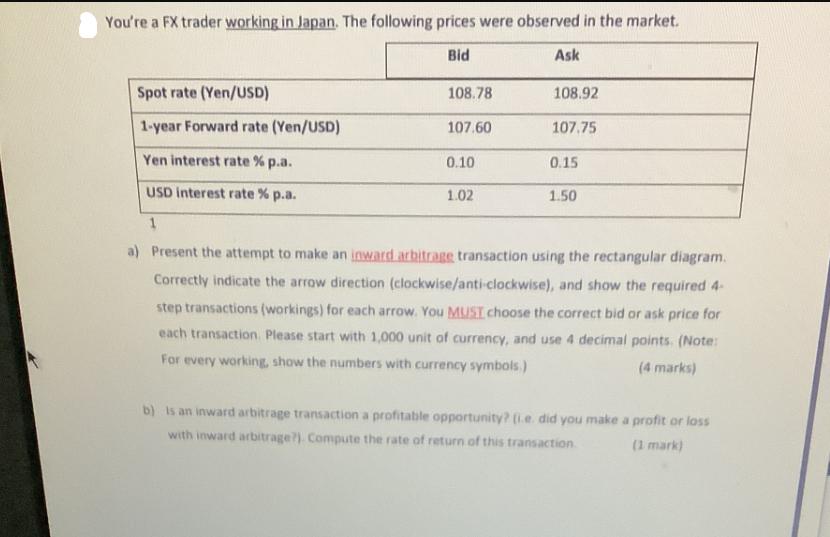

You're a FX trader working in Japan. The following prices were observed in the market. Bid Spot rate (Yen/USD) 1-year Forward rate (Yen/USD) Yen interest rate % p.a. USD interest rate % p.a. 1 a) Present the attempt to make an inward arbitrage transaction using the rectangular diagram. Correctly indicate the arrow direction (clockwise/anti-clockwise), and show the required 4- step transactions (workings) for each arrow. You MUSI choose the correct bid or ask price for each transaction. Please start with 1,000 unit of currency, and use 4 decimal points. (Note: For every working, show the numbers with currency symbols) (4 marks) 108.78 107.60 0.10 Ask 1.02 108.92 107.75 0.15 1.50 b) is an inward arbitrage transaction a profitable opportunity? (i.e. did you make a profit or loss with inward arbitrage?). Compute the rate of return of this transaction. (1 mark)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Certainly Lets walk through the steps of an inward arbitrage transaction using the provided bid and ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started