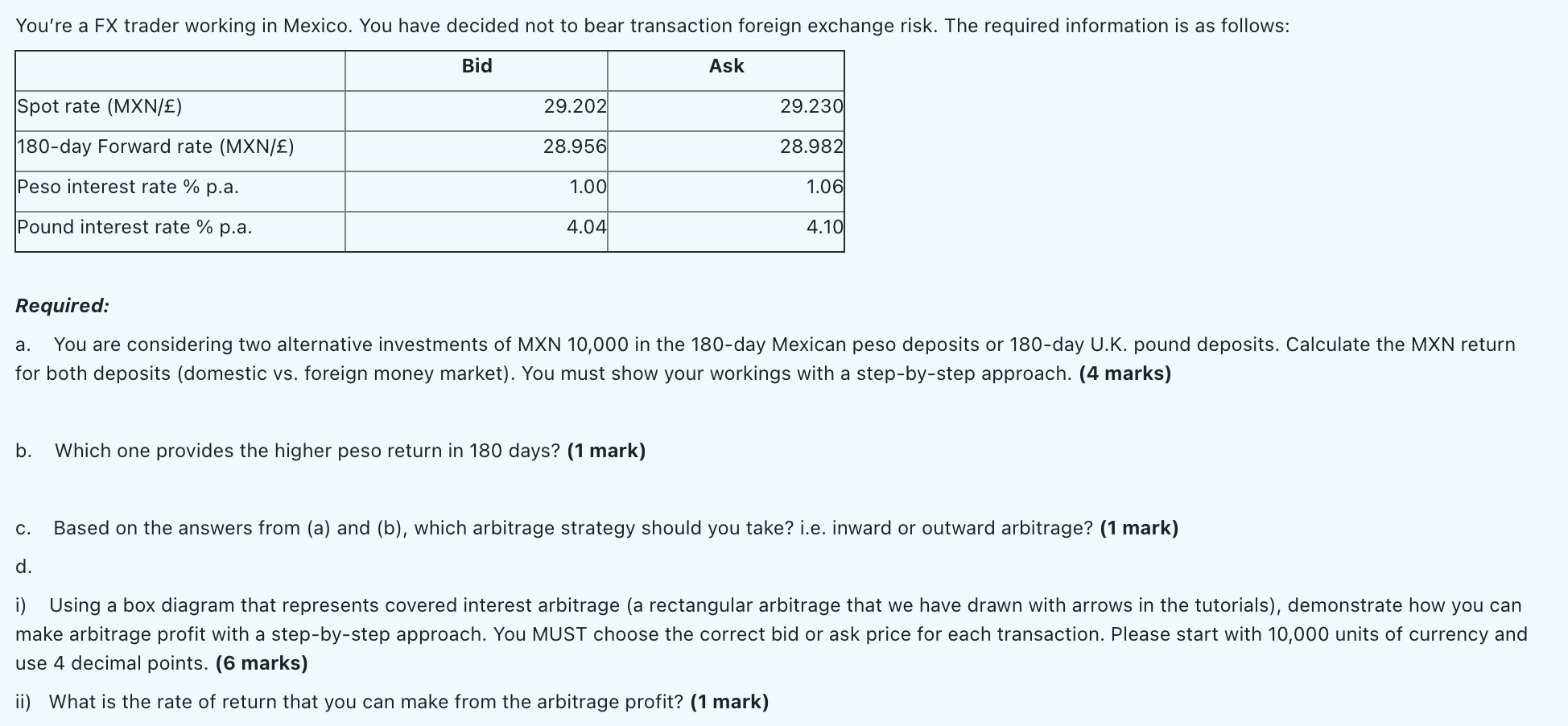

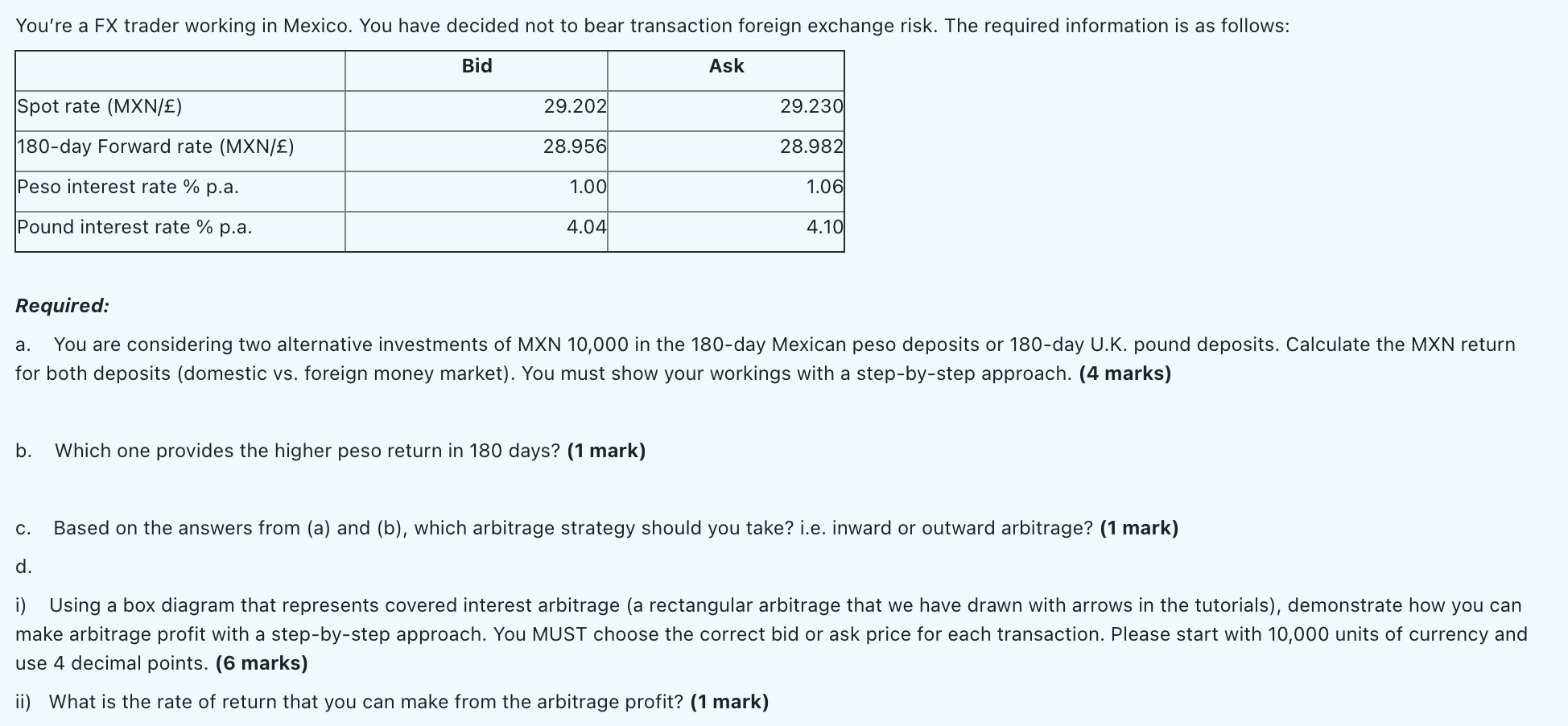

You're a FX trader working in Mexico. You have decided not to bear transaction foreign exchange risk. The required information is as follows: Bid Ask Spot rate (MXN/) 29.202 29.230 180-day Forward rate (MXN/) 28.956 28.982 Peso interest rate % p.a. 1.00 1.06 Pound interest rate % p.a. 4.04 4.10 Required: a. You are considering two alternative investments of MXN 10,000 in the 180-day Mexican peso deposits or 180-day U.K. pound deposits. Calculate the MXN return for both deposits (domestic vs. foreign money market). You must show your workings with a step-by-step approach. (4 marks) b. Which one provides the higher peso return in 180 days? (1 mark) C. Based on the answers from (a) and (b), which arbitrage strategy should you take? i.e. inward or outward arbitrage? (1 mark) d. i) Using a box diagram that represents covered interest arbitrage (a rectangular arbitrage that we have drawn with arrows in the tutorials), demonstrate how you can make arbitrage profit with a step-by-step approach. You MUST choose the correct bid or ask price for each transaction. Please start with 10,000 units of currency and use 4 decimal points. (6 marks) ii) What is the rate of return that you can make from the arbitrage profit? (1 mark) You're a FX trader working in Mexico. You have decided not to bear transaction foreign exchange risk. The required information is as follows: Bid Ask Spot rate (MXN/) 29.202 29.230 180-day Forward rate (MXN/) 28.956 28.982 Peso interest rate % p.a. 1.00 1.06 Pound interest rate % p.a. 4.04 4.10 Required: a. You are considering two alternative investments of MXN 10,000 in the 180-day Mexican peso deposits or 180-day U.K. pound deposits. Calculate the MXN return for both deposits (domestic vs. foreign money market). You must show your workings with a step-by-step approach. (4 marks) b. Which one provides the higher peso return in 180 days? (1 mark) C. Based on the answers from (a) and (b), which arbitrage strategy should you take? i.e. inward or outward arbitrage? (1 mark) d. i) Using a box diagram that represents covered interest arbitrage (a rectangular arbitrage that we have drawn with arrows in the tutorials), demonstrate how you can make arbitrage profit with a step-by-step approach. You MUST choose the correct bid or ask price for each transaction. Please start with 10,000 units of currency and use 4 decimal points. (6 marks) ii) What is the rate of return that you can make from the arbitrage profit? (1 mark)