Question

Youre a junior investment banker, chatting to a client of yours, the CEO of a major import/export business. She informs you that she was recentlyapproached

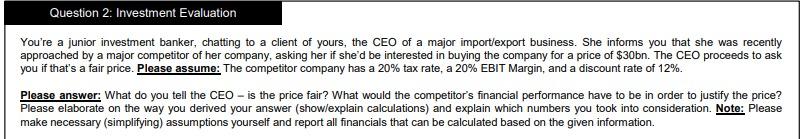

Youre a junior investment banker, chatting to a client of yours, the CEO of a major import/export business. She informs you that she was recentlyapproached by a major competitor of her company, asking her if shed be interested in buying the company for a price of $30bn. The CEO proceeds to askyou if thats a fair price. Please assume: The competitor company has a 20% tax rate, a 20% EBIT Margin, and a discount rate of 12%. Please answer: What do you tell the CEO is the price fair? What would the competitors financial performance have to be in order to justify the price?Please elaborate on the way you derived your answer (show/explain calculations) and explain which numbers you took into consideration. Note:Pleasemake necessary (simplifying) assumptions yourself and report all financials that can be calculated based on the given information.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started