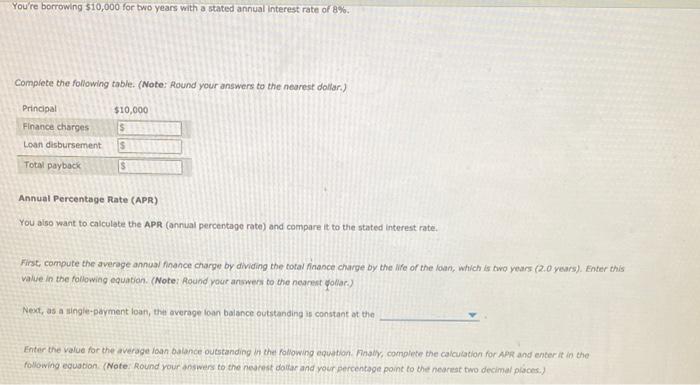

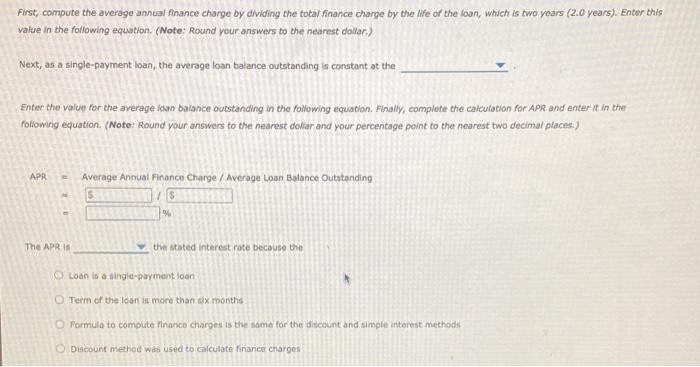

You're borrowing $10,000 for two years with a stated annual Interest rate of 8%. Complete the following table. (Note: Round your answers to the nearest dollar) Principal Finance charges Loan disbursement $10,000 5 s Total payback S Annual Percentage Rate (APR) You also want to calculate the APR (annual percentage rate) and compare it to the stated interest rate. First, compute the average annual finance charge by dividing the total finance charge by the Ne of the low, which a two years (2.0 years). Enter this value in the following equation. (Note: Round your answers to the nearest polar) Next, as a single-payment loan, the average loan balance outstanding is constant at the Enter the value for the average loan balance outstanding in the following equation. Finally, complete the calculation for APR and enter it in the following equation (Note: Round your answers to the nearest dotar and your percentage point to the nearest two decimal places.) First, compute the average annusat finance charge by dividing the total finance charge by the Me or the loan, which is two years (2.0 years). Enter this value in the following equation. (Note: Round your answers to the nearest dollar) Next, as a single-payment loan, the average loan balance outstanding is constant at the Enter the value for the average foun balance outstanding in the following equation. Finally, complete the calculation for APR and enter it in the Following equation. (Note: Round your answers to the nearest dollar and your percentage point to the nearest two decimal places.) APR Average Annual Finance Charge / Average Loan Balance Outstanding 15 S % The APRIS the stated interest rate because the Loan is a single-payment loan Term of the loan is more than six months Formula to compute Finance charges is the same for the discount and simple interest methods Discount method was used to calculate finance charges You're borrowing $10,000 for two years with a stated annual Interest rate of 8%. Complete the following table. (Note: Round your answers to the nearest dollar) Principal Finance charges Loan disbursement $10,000 5 s Total payback S Annual Percentage Rate (APR) You also want to calculate the APR (annual percentage rate) and compare it to the stated interest rate. First, compute the average annual finance charge by dividing the total finance charge by the Ne of the low, which a two years (2.0 years). Enter this value in the following equation. (Note: Round your answers to the nearest polar) Next, as a single-payment loan, the average loan balance outstanding is constant at the Enter the value for the average loan balance outstanding in the following equation. Finally, complete the calculation for APR and enter it in the following equation (Note: Round your answers to the nearest dotar and your percentage point to the nearest two decimal places.) First, compute the average annusat finance charge by dividing the total finance charge by the Me or the loan, which is two years (2.0 years). Enter this value in the following equation. (Note: Round your answers to the nearest dollar) Next, as a single-payment loan, the average loan balance outstanding is constant at the Enter the value for the average foun balance outstanding in the following equation. Finally, complete the calculation for APR and enter it in the Following equation. (Note: Round your answers to the nearest dollar and your percentage point to the nearest two decimal places.) APR Average Annual Finance Charge / Average Loan Balance Outstanding 15 S % The APRIS the stated interest rate because the Loan is a single-payment loan Term of the loan is more than six months Formula to compute Finance charges is the same for the discount and simple interest methods Discount method was used to calculate finance charges