Answered step by step

Verified Expert Solution

Question

1 Approved Answer

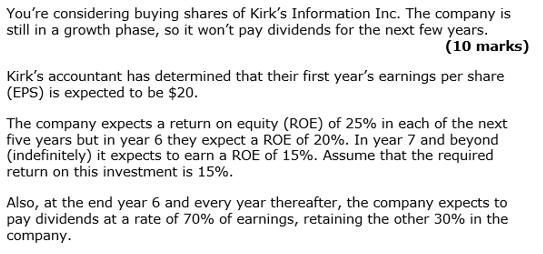

You're considering buying shares of Kirk's Information Inc. The company is still in a growth phase, so it won't pay dividends for the next

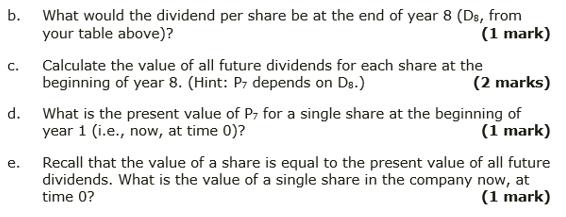

You're considering buying shares of Kirk's Information Inc. The company is still in a growth phase, so it won't pay dividends for the next few years. (10 marks) Kirk's accountant has determined that their first year's earnings per share (EPS) is expected to be $20. The company expects a return on equity (ROE) of 25% in each of the next five years but in year 6 they expect a ROE of 20%. In year 7 and beyond (indefinitely) it expects to earn a ROE of 15%. Assume that the required return on this investment is 15%. Also, at the end year 6 and every year thereafter, the company expects to pay dividends at a rate of 70% of earnings, retaining the other 30% in the company. . Complete the following table (all values per share): (5 marks) Owners' equity, beginning Owners' Expected dividend (end of year) Year EPS ROE equity, ending 1 80 20 25% 100 2 100 100 x 0.25 25% 125 = 25 %3D 125 25% 4 25% 25% 20% 7 15% 8 15% b. What would the dividend per share be at the end of year 8 (Ds, from your table above)? (1 mark) C. Calculate the value of all future dividends for each share at the beginning of year 8. (Hint: P7 depends on Ds.) (2 marks) d. What is the present value of P7 for a single share at the beginning of year 1 (i.e., now, at time 0)? (1 mark) Recall that the value of a share is equal to the present value of all future dividends. What is the value of a single share in the company now, at (1 mark) time 0? aj

Step by Step Solution

★★★★★

3.41 Rating (170 Votes )

There are 3 Steps involved in it

Step: 1

a From the above table we can see that the Dividend at the yearend ie D8 is 28...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started