Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You're the tax advisor to a group of entrepreneurs from the Worcester Polytechnic Institute (WPI). The group has developed artificial intelligence technology that, it

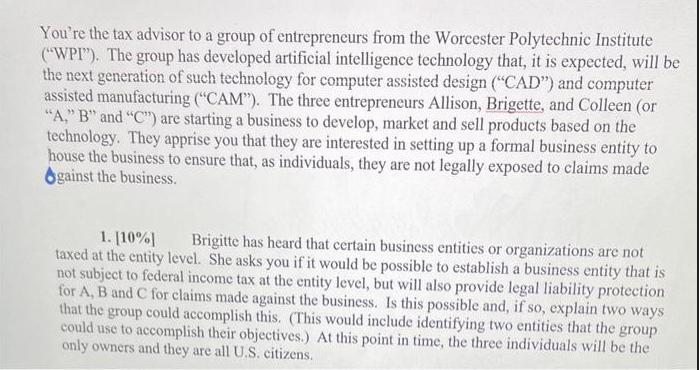

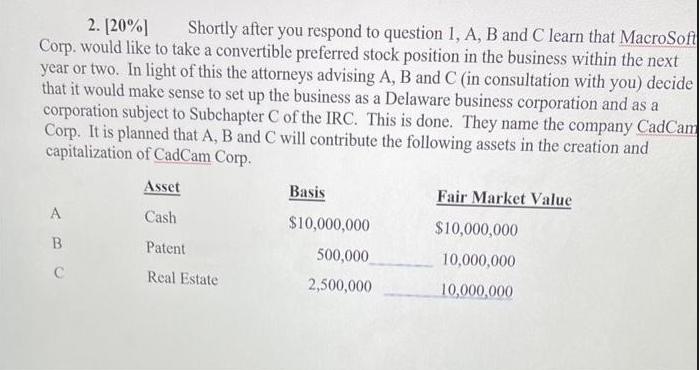

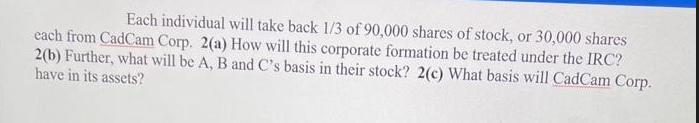

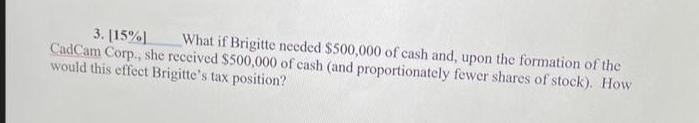

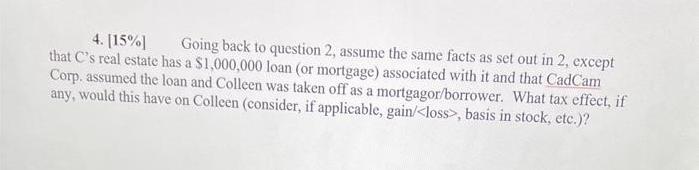

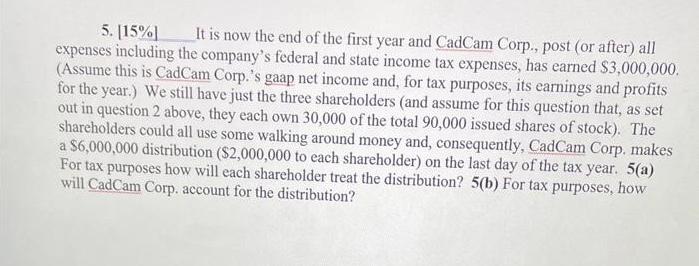

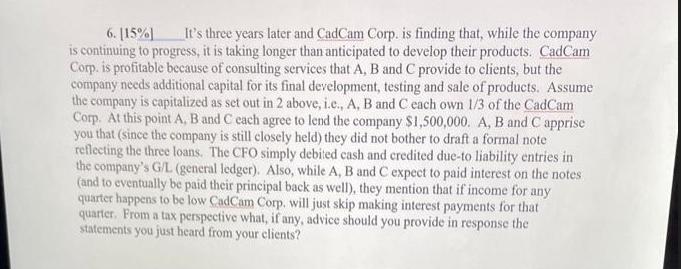

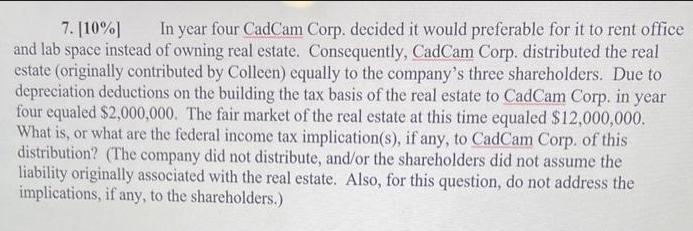

You're the tax advisor to a group of entrepreneurs from the Worcester Polytechnic Institute ("WPI"). The group has developed artificial intelligence technology that, it is expected, will be the next generation of such technology for computer assisted design ("CAD") and computer assisted manufacturing ("CAM"). The three entrepreneurs Allison, Brigette, and Colleen (or "A," B" and "C") are starting a business to develop, market and sell products based on the technology. They apprise you that they are interested in setting up a formal business entity to house the business to ensure that, as individuals, they are not legally exposed to claims made gainst the business. 1. [10% ] Brigitte has heard that certain business entities or organizations are not taxed at the entity level. She asks you if it would be possible to establish a business entity that is not subject to federal income tax at the entity level, but will also provide legal liability protection for A, B and C for claims made against the business. Is this possible and, if so, explain two ways that the group could accomplish this. (This would include identifying two entities that the group could use to accomplish their objectives.) At this point in time, the three individuals will be the only owners and they are all U.S. citizens. 2. [20%] Shortly after you respond to question 1, A, B and C learn that MacroSoft Corp. would like to take a convertible preferred stock position in the business within the next year or two. In light of this the attorneys advising A, B and C (in consultation with you) decide that it would make sense to set up the business as a Delaware business corporation and as a corporation subject to Subchapter C of the IRC. This is done. They name the company CadCam Corp. It is planned that A, B and C will contribute the following assets in the creation and capitalization of CadCam Corp. A ABC Asset Cash Patent Real Estate Basis $10,000,000 500,000 2,500,000 Fair Market Value $10,000,000 10,000,000 10,000,000 Each individual will take back 1/3 of 90,000 shares of stock, or 30,000 shares each from CadCam Corp. 2(a) How will this corporate formation be treated under the IRC? 2(b) Further, what will be A, B and C's basis in their stock? 2(c) What basis will CadCam Corp. have in its assets? 3. [15%] What if Brigitte needed $500,000 of cash and, upon the formation of the CadCam Corp., she received $500,000 of cash (and proportionately fewer shares of stock). How would this effect Brigitte's tax position? 4. [15%] Going back to question 2, assume the same facts as set out in 2, except that C's real estate has a $1,000,000 loan (or mortgage) associated with it and that CadCam Corp. assumed the loan and Colleen was taken off as a mortgagor/borrower. What tax effect, if any, would this have on Colleen (consider, if applicable, gain/ , basis in stock, etc.)? 5. [15%] It is now the end of the first year and CadCam Corp., post (or after) all expenses including the company's federal and state income tax expenses, has earned $3,000,000. (Assume this is CadCam Corp.'s gaap net income and, for tax purposes, its earnings and profits for the year.) We still have just the three shareholders (and assume for this question that, as set out in question 2 above, they each own 30,000 of the total 90,000 issued shares of stock). The shareholders could all use some walking around money and, consequently, CadCam Corp. makes a $6,000,000 distribution ($2,000,000 to each shareholder) on the last day of the tax year. 5(a) For tax purposes how will each shareholder treat the distribution? 5(b) For tax purposes, how will CadCam Corp. account for the distribution? 6. [15%] It's three years later and CadCam Corp. is finding that, while the company is continuing to progress, it is taking longer than anticipated to develop their products. CadCam Corp. is profitable because of consulting services that A, B and C provide to clients, but the company needs additional capital for its final development, testing and sale of products. Assume the company is capitalized as set out in 2 above, i.e., A, B and C each own 1/3 of the CadCam Corp. At this point A, B and C each agree to lend the company $1,500,000. A, B and C apprise you that (since the company is still closely held) they did not bother to draft a formal note reflecting the three loans. The CFO simply debited cash and credited due-to liability entries in the company's G/L (general ledger). Also, while A, B and C expect to paid interest on the notes (and to eventually be paid their principal back as well), they mention that if income for any quarter happens to be low CadCam Corp. will just skip making interest payments for that quarter. From a tax perspective what, if any, advice should you provide in response the statements you just heard from your clients? 7. [10%] In year four CadCam Corp. decided it would preferable for it to rent office and lab space instead of owning real estate. Consequently, CadCam Corp. distributed the real estate (originally contributed by Colleen) equally to the company's three shareholders. Due to depreciation deductions on the building the tax basis of the real estate to CadCam Corp. in year four equaled $2,000,000. The fair market of the real estate at this time equaled $12,000,000. What is, or what are the federal income tax implication(s), if any, to CadCam Corp. of this distribution? (The company did not distribute, and/or the shareholders did not assume the liability originally associated with the real estate. Also, for this question, do not address the implications, if any, to the shareholders.)

Step by Step Solution

★★★★★

3.50 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

1 It is possible for the entrepreneurs to establish a business entity that is not subject to federal income tax at the entity level while providing legal liability protection for themselves Two common ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started