Question

You're very bullish about NVDA and want to initiate a bull spread with the company's stock options. The premium for options that mature in

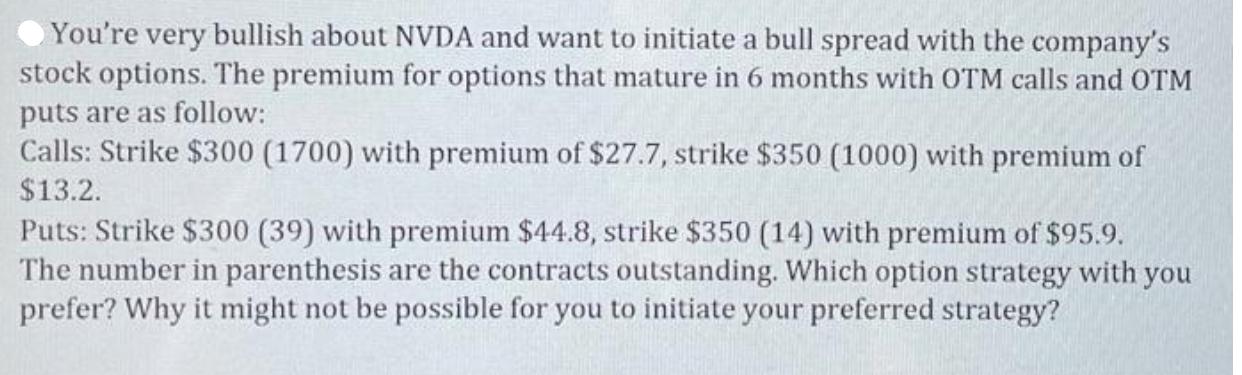

You're very bullish about NVDA and want to initiate a bull spread with the company's stock options. The premium for options that mature in 6 months with OTM calls and OTM puts are as follow: Calls: Strike $300 (1700) with premium of $27.7, strike $350 (1000) with premium of $13.2. Puts: Strike $300 (39) with premium $44.8, strike $350 (14) with premium of $95.9. The number in parenthesis are the contracts outstanding. Which option strategy with you prefer? Why it might not be possible for you to initiate your preferred strategy?

Step by Step Solution

3.40 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

The question appears to be incomplete as no specific data is presented or asked for in relation to the evaluation of the option strategies provided Ho...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Intermediate Financial Management

Authors: Eugene F. Brigham, Phillip R. Daves

12th edition

1285850033, 978-1305480698, 1305480694, 978-0357688236, 978-1285850030

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App