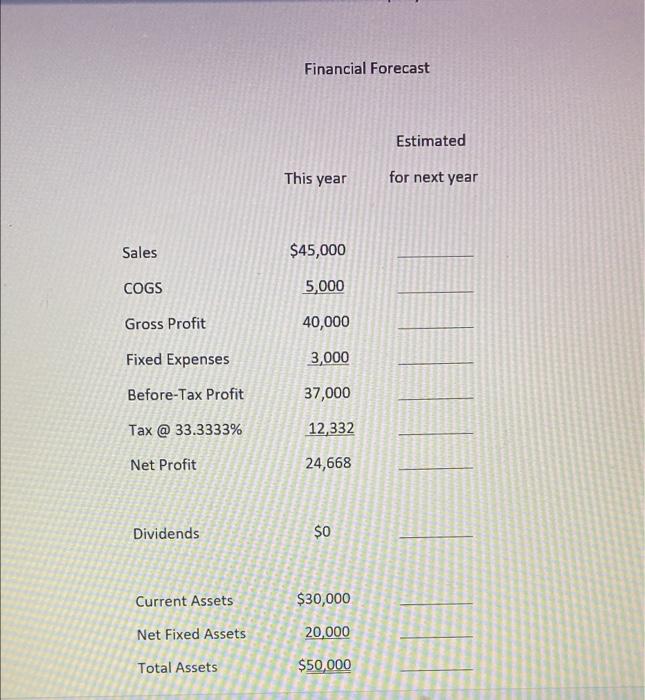

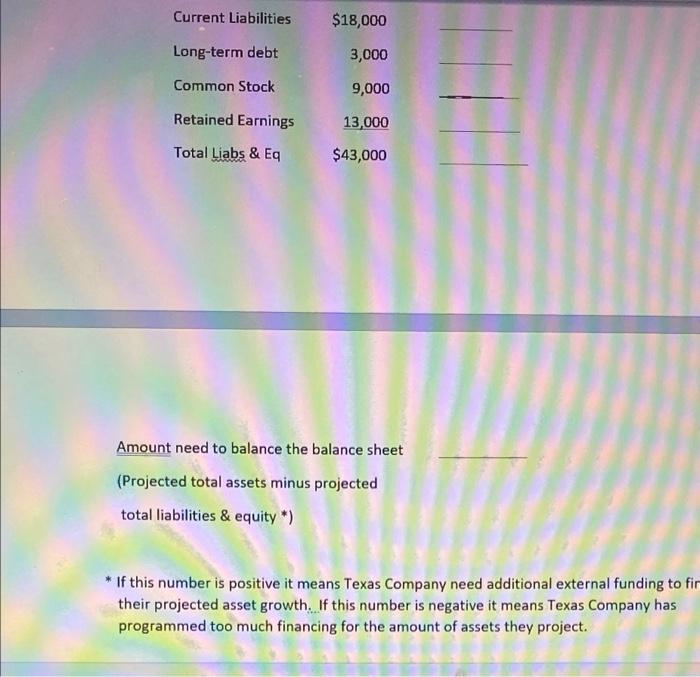

yout Mences Vw Help 15. Texas Company has begunselling a new charge and they want you to help them with next year's budgeted financial statemente in the worksheet low, complete Ten Company forecast and awer the questions which foliow Assumption To begin with Tears Company is sure sales wil grow 40% next year. Assure that is true. Then that COGS, Current Assets, and Current Liabilities will vary deectly with Sailes that means it all certain percent, then the accountington will grow by the same percentage) Arine that feed expenses will remain unchanged and that $1,000 worth of new set will be obtained rest year Lastly, the current dividend policy will be continued estar o e a G acer OG C-1 1 7 17 * 00 8 8 9 9 0 5 6 U 4 0 6 5 H 3 1 2 N B M 0 V Financial Forecast Estimated This year for next year Sales $45,000 COGS 5,000 Gross Profit 40,000 Fixed Expenses 3,000 Before-Tax Profit 37,000 Tax @ 33.3333% 12,332 Net Profit 24,668 Dividends $0 Current Assets $30,000 20,000 Net Fixed Assets Total Assets $50,000 Current Liabilities $18,000 Long-term debt 3,000 Common Stock 9,000 Retained Earnings 13,000 Total Liabs & Eq $43,000 Amount need to balance the balance sheet (Projected total assets minus projected total liabilities & equity *) * If this number is positive it means Texas Company need additional external funding to fir their projected asset growth. If this number is negative it means Texas Company has programmed too much financing for the amount of assets they project. yout Mences Vw Help 15. Texas Company has begunselling a new charge and they want you to help them with next year's budgeted financial statemente in the worksheet low, complete Ten Company forecast and awer the questions which foliow Assumption To begin with Tears Company is sure sales wil grow 40% next year. Assure that is true. Then that COGS, Current Assets, and Current Liabilities will vary deectly with Sailes that means it all certain percent, then the accountington will grow by the same percentage) Arine that feed expenses will remain unchanged and that $1,000 worth of new set will be obtained rest year Lastly, the current dividend policy will be continued estar o e a G acer OG C-1 1 7 17 * 00 8 8 9 9 0 5 6 U 4 0 6 5 H 3 1 2 N B M 0 V Financial Forecast Estimated This year for next year Sales $45,000 COGS 5,000 Gross Profit 40,000 Fixed Expenses 3,000 Before-Tax Profit 37,000 Tax @ 33.3333% 12,332 Net Profit 24,668 Dividends $0 Current Assets $30,000 20,000 Net Fixed Assets Total Assets $50,000 Current Liabilities $18,000 Long-term debt 3,000 Common Stock 9,000 Retained Earnings 13,000 Total Liabs & Eq $43,000 Amount need to balance the balance sheet (Projected total assets minus projected total liabilities & equity *) * If this number is positive it means Texas Company need additional external funding to fir their projected asset growth. If this number is negative it means Texas Company has programmed too much financing for the amount of assets they project