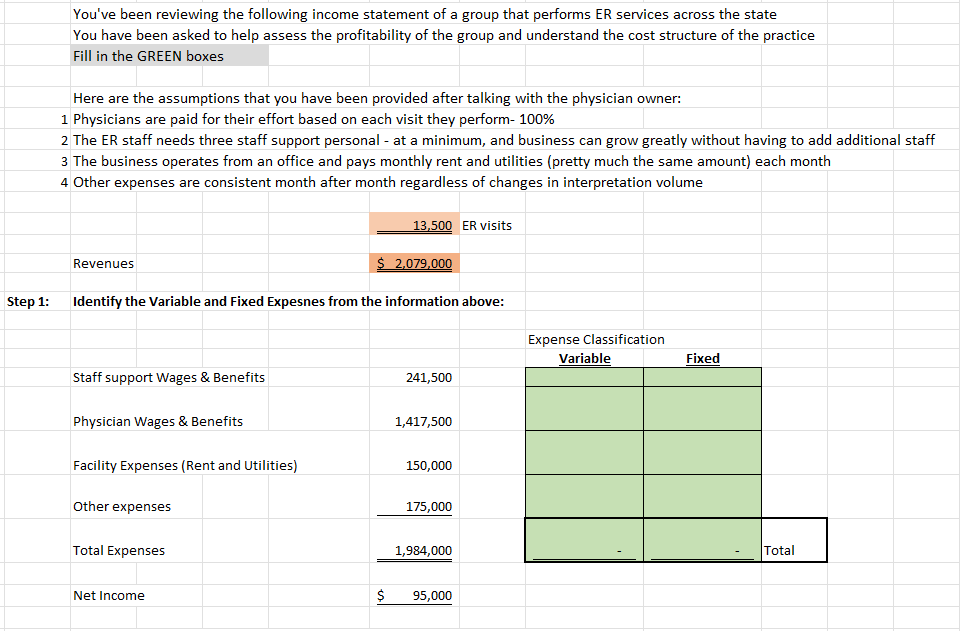

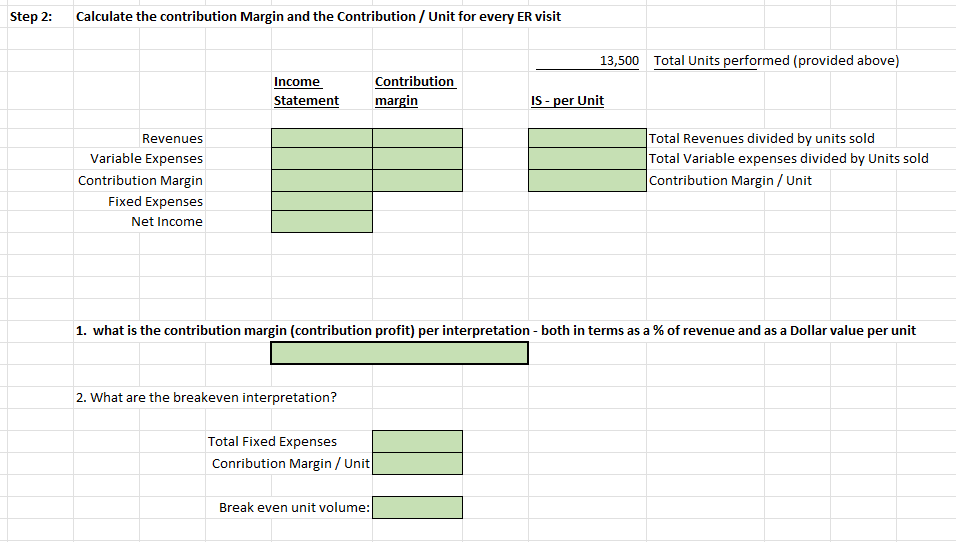

You've been reviewing the following income statement of a group that performs ER services across the state You have been asked to help assess the profitability of the group and understand the cost structure of the practice Fill in the GREEN boxes Here are the assumptions that you have been provided after talking with the physician owner: 1 Physicians are paid for their effort based on each visit they perform- 100% 2 The ER staff needs three staff support personal - at a minimum, and business can grow greatly without having to add additional staff 3 The business operates from an office and pays monthly rent and utilities (pretty much the same amount) each month 4 Other expenses are consistent month after month regardless of changes in interpretation volume 13,500 ER visits Revenues $ 2,079.000 Step 1: Identify the Variable and Fixed Expesnes from the information above: Expense Classification Variable Fixed Staff support Wages & Benefits 241,500 Physician Wages & Benefits 1,417,500 Facility Expenses (Rent and Utilities) 150,000 Other expenses 175,000 Total Expenses 1,984,000 Total Net Income $ 95,000 Step 2: Calculate the contribution Margin and the Contribution / Unit for every ER visit 13,500 Total Units performed (provided above) Income Statement Contribution margin IS - per Unit Revenues Variable Expenses Contribution Margin Fixed Expenses Net Income Total Revenues divided by units sold Total Variable expenses divided by Units sold Contribution Margin / Unit 1. what is the contribution margin (contribution profit) per interpretation - both in terms as a % of revenue and as a Dollar value per unit 2. What are the breakeven interpretation? Total Fixed Expenses Conribution Margin / Unit Break even unit volume: You've been reviewing the following income statement of a group that performs ER services across the state You have been asked to help assess the profitability of the group and understand the cost structure of the practice Fill in the GREEN boxes Here are the assumptions that you have been provided after talking with the physician owner: 1 Physicians are paid for their effort based on each visit they perform- 100% 2 The ER staff needs three staff support personal - at a minimum, and business can grow greatly without having to add additional staff 3 The business operates from an office and pays monthly rent and utilities (pretty much the same amount) each month 4 Other expenses are consistent month after month regardless of changes in interpretation volume 13,500 ER visits Revenues $ 2,079.000 Step 1: Identify the Variable and Fixed Expesnes from the information above: Expense Classification Variable Fixed Staff support Wages & Benefits 241,500 Physician Wages & Benefits 1,417,500 Facility Expenses (Rent and Utilities) 150,000 Other expenses 175,000 Total Expenses 1,984,000 Total Net Income $ 95,000 Step 2: Calculate the contribution Margin and the Contribution / Unit for every ER visit 13,500 Total Units performed (provided above) Income Statement Contribution margin IS - per Unit Revenues Variable Expenses Contribution Margin Fixed Expenses Net Income Total Revenues divided by units sold Total Variable expenses divided by Units sold Contribution Margin / Unit 1. what is the contribution margin (contribution profit) per interpretation - both in terms as a % of revenue and as a Dollar value per unit 2. What are the breakeven interpretation? Total Fixed Expenses Conribution Margin / Unit Break even unit volume