Answered step by step

Verified Expert Solution

Question

1 Approved Answer

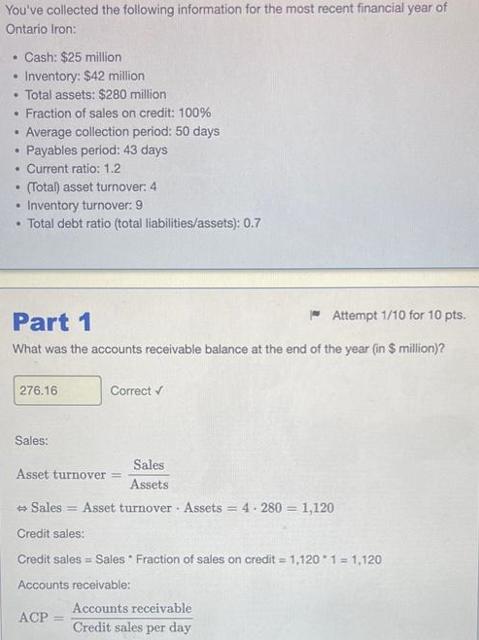

You've collected the following information for the most recent financial year of Ontario Iron: . Cash: $25 million Inventory: $42 million Total assets: $280

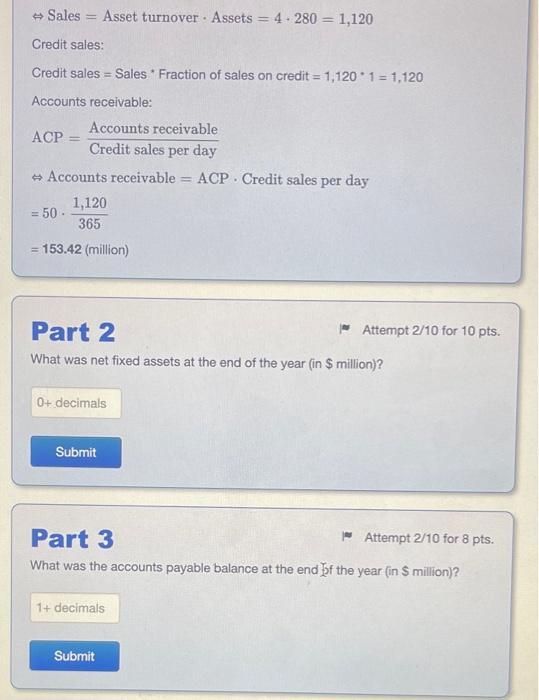

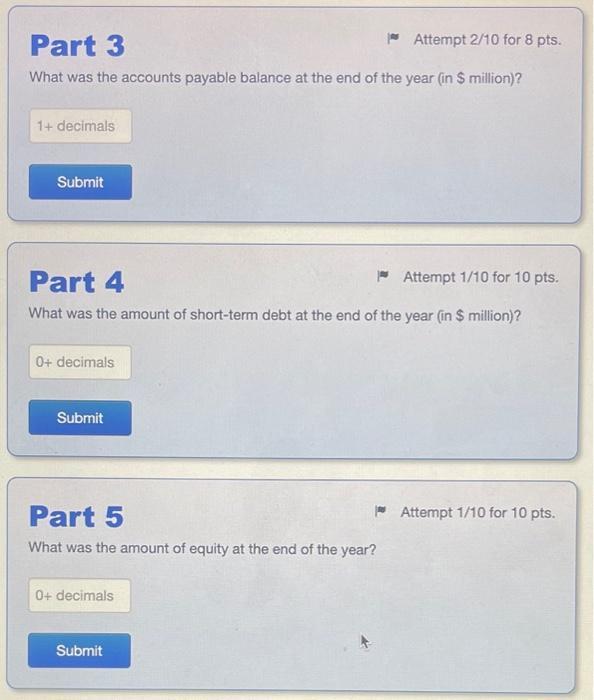

You've collected the following information for the most recent financial year of Ontario Iron: . Cash: $25 million Inventory: $42 million Total assets: $280 million Fraction of sales on credit: 100% Average collection period: 50 days Payables period: 43 days . Current ratio: 1.2 . (Total) asset turnover: 4 Inventory turnover: 9 Total debt ratio (total liabilities/assets): 0.7 . . Attempt 1/10 for 10 pts. Part 1 What was the accounts receivable balance at the end of the year (in $ million)? 276.16 Sales: Correct Sales Asset turnover = Assets + Sales Asset turnover Assets=4-280 = 1,120 Credit sales: Credit sales Sales Fraction of sales on credit = 1,120*1 = 1,120 Accounts receivable: ACP= Accounts receivable Credit sales per day Sales Asset turnover Assets = 4.280= 1,120 = Credit sales: Credit sales Sales Fraction of sales on credit = 1,120 1=1,120 Accounts receivable: ACP = F Accounts receivable Credit sales per day Accounts receivable ACP Credit sales per day = 50- 1,120 365 = 153.42 (million) 0+ decimals Submit Part 2 What was net fixed assets at the end of the year (in $ million)? . = 1+ decimals Submit Part 3 Attempt 2/10 for 8 pts. What was the accounts payable balance at the end of the year (in $ million)? Attempt 2/10 for 10 pts. Part 3 Attempt 2/10 for 8 pts. What was the accounts payable balance at the end of the year (in $ million)? 1+ decimals Submit Part 4 Attempt 1/10 for 10 pts. What was the amount of short-term debt at the end of the year (in $ million)? 0+ decimals Submit Part 5 What was the amount of equity at the end of the year? 0+ decimals Submit Attempt 1/10 for 10 pts.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

SOLUTION Part 1 To find the accounts receivable balance at the end of the year we can use the equation Accounts receivable Sales x Fraction of sales o...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started