Answered step by step

Verified Expert Solution

Question

1 Approved Answer

- You've just graduated from TRSM with a degree in Business Management and you're excited to start your new career as a teller with

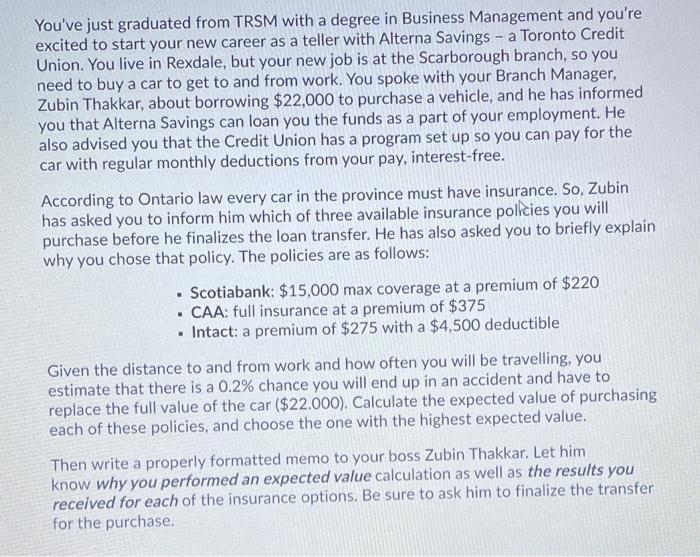

- You've just graduated from TRSM with a degree in Business Management and you're excited to start your new career as a teller with Alterna Savings a Toronto Credit Union. You live in Rexdale, but your new job is at the Scarborough branch, so you need to buy a car to get to and from work. You spoke with your Branch Manager, Zubin Thakkar, about borrowing $22,000 to purchase a vehicle, and he has informed you that Alterna Savings can loan you the funds as a part of your employment. He also advised you that the Credit Union has a program set up so you can pay for the car with regular monthly deductions from your pay, interest-free. According to Ontario law every car in the province must have insurance. So, Zubin has asked you to inform him which of three available insurance policies you will purchase before he finalizes the loan transfer. He has also asked you to briefly explain why you chose that policy. The policies are as follows: . Scotiabank: $15,000 max coverage at a premium of $220 . CAA: full insurance at a premium of $375 Intact: a premium of $275 with a $4,500 deductible Given the distance to and from work and how often you will be travelling, you estimate that there is a 0.2% chance you will end up in an accident and have to replace the full value of the car ($22.000). Calculate the expected value of purchasing each of these policies, and choose the one with the highest expected value. Then write a properly formatted memo to your boss Zubin Thakkar. Let him know why you performed an expected value calculation as well as the results you received for each of the insurance options. Be sure to ask him to finalize the transfer for the purchase.

Step by Step Solution

★★★★★

3.42 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

X Scotia banks Insurance X Accident occurs Doen not OCCUY EC EX 15000 Ex3 x3 3f X3 X XP ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started