Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You've just won a lottery! First, they will transfer to your bank account $2,520,000 immediately. Second, they will also transfer to you a total

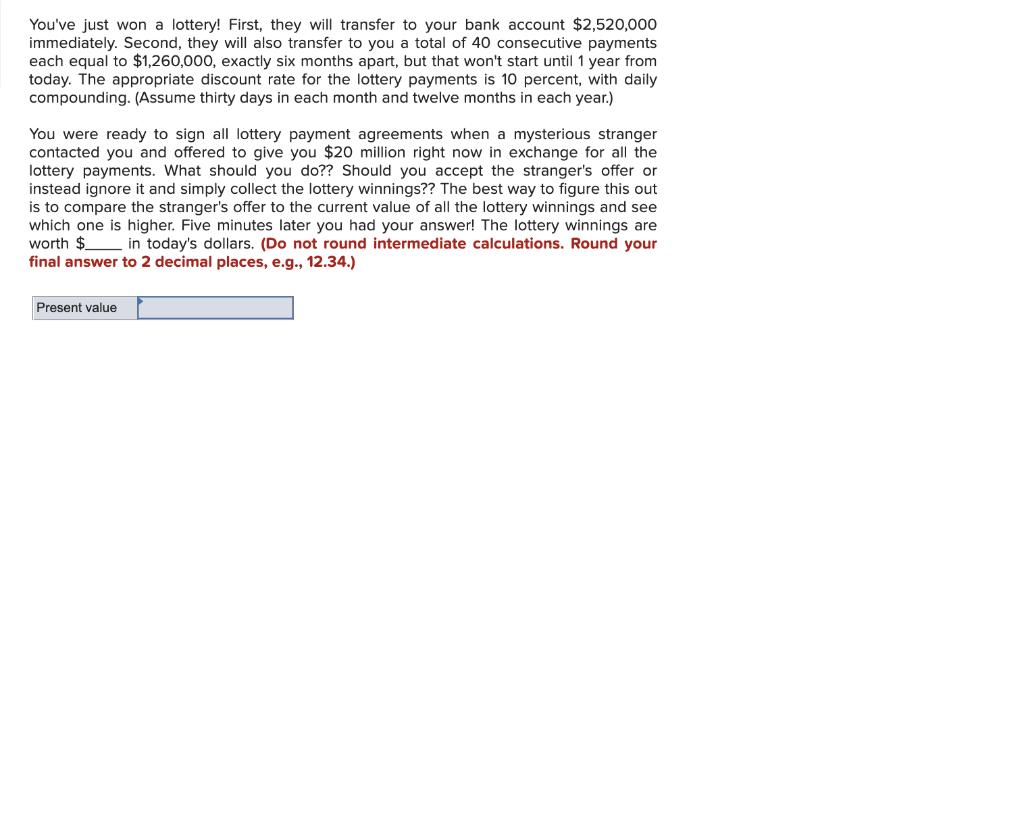

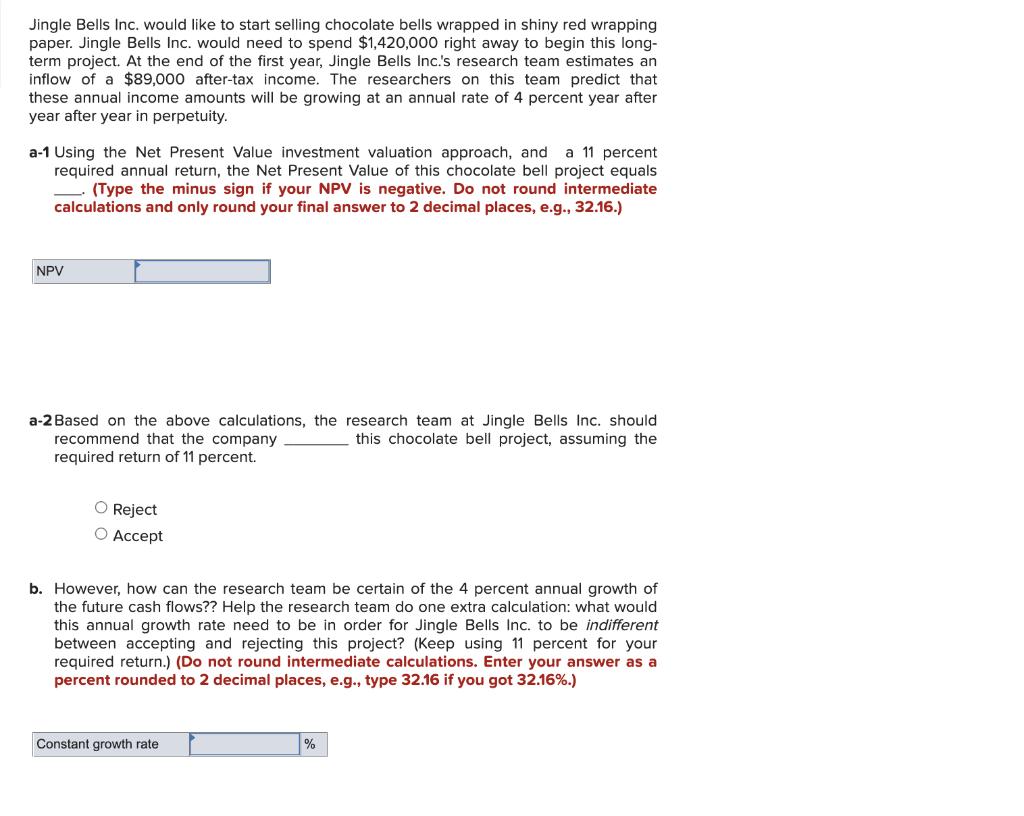

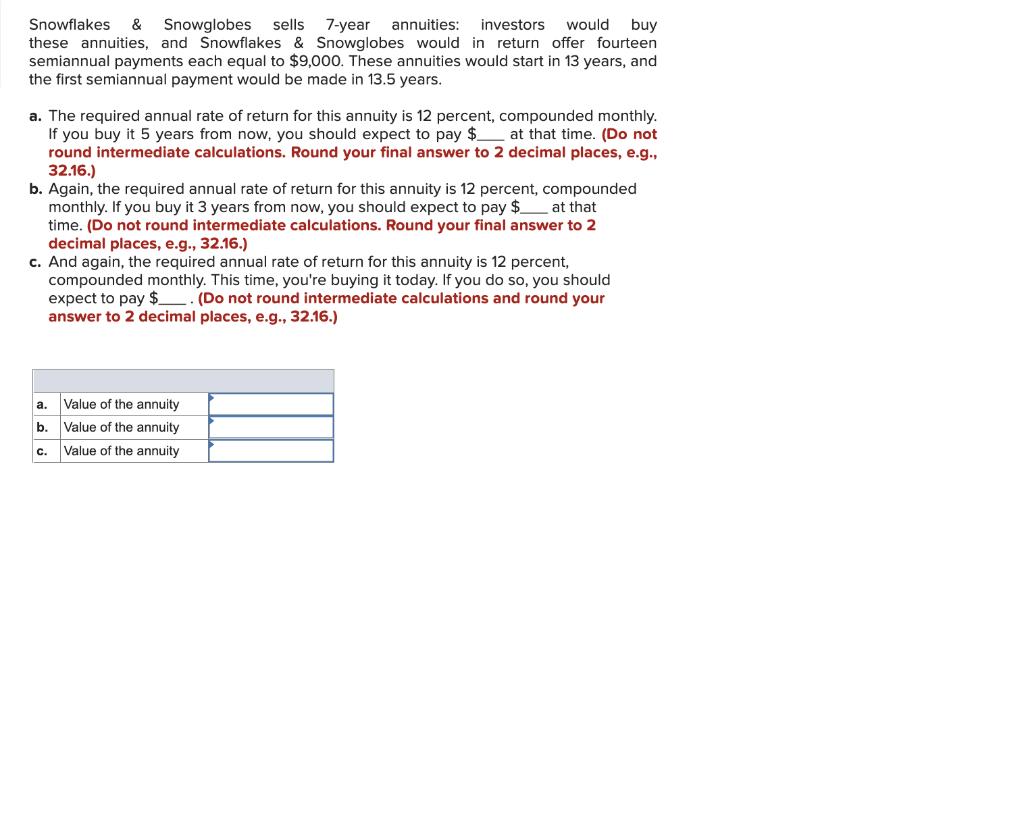

You've just won a lottery! First, they will transfer to your bank account $2,520,000 immediately. Second, they will also transfer to you a total of 40 consecutive payments each equal to $1,260,000, exactly six months apart, but that won't start until 1 year from today. The appropriate discount rate for the lottery payments is 10 percent, with daily compounding. (Assume thirty days in each month and twelve months in each year.) You were ready to sign all lottery payment agreements when a mysterious stranger contacted you and offered to give you $20 million right now in exchange for all the lottery payments. What should you do?? Should you accept the stranger's offer or instead ignore it and simply collect the lottery winnings?? The best way to figure this out is to compare the stranger's offer to the current value of all the lottery winnings and see which one is higher. Five minutes later you had your answer! The lottery winnings are worth $ in today's dollars. (Do not round intermediate calculations. Round your final answer to 2 decimal places, e.g., 12.34.) Present value Jingle Bells Inc. would like to start selling chocolate bells wrapped in shiny red wrapping paper. Jingle Bells Inc. would need to spend $1,420,000 right away to begin this long- term project. At the end of the first year, Jingle Bells Inc.'s research team estimates an inflow of a $89,000 after-tax income. The researchers on this team predict that these annual income amounts will be growing at an annual rate of 4 percent year after year after year in perpetuity. a-1 Using the Net Present Value investment valuation approach, and a 11 percent required annual return, the Net Present Value of this chocolate bell project equals (Type the minus sign if your NPV is negative. Do not round intermediate calculations and only round your final answer to 2 decimal places, e.g., 32.16.) NPV a-2 Based on the above calculations, the research team at Jingle Bells Inc. should. this chocolate bell project, assuming the recommend that the company required return of 11 percent. O Reject O Accept b. However, how can the research team be certain of the 4 percent annual growth of the future cash flows?? Help the research team do one extra calculation: what would this annual growth rate need to be in order for Jingle Bells Inc. to be indifferent between accepting and rejecting this project? (Keep using 11 percent for your required return.) (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places, e.g., type 32.16 if you got 32.16%.) Constant growth rate % Snowflakes & Snowglobes sells 7-year annuities: investors I would buy these annuities, and Snowflakes & Snowglobes would in return offer fourteen semiannual payments each equal to $9,000. These annuities would start in 13 years, and the first semiannual payment would be made in 13.5 years. a. The required annual rate of return for this annuity is 12 percent, compounded monthly. If you buy it 5 years from now, you should expect to pay $ at that time. (Do not round intermediate calculations. Round your final answer to 2 decimal places, e.g., 32.16.) b. Again, the required annual rate of return for this annuity is 12 percent, compounded monthly. If you buy it 3 years from now, you should expect to pay $_______ at that time. (Do not round intermediate calculations. Round your final answer to 2 decimal places, e.g., 32.16.) c. And again, the required annual rate of return for this annuity is 12 percent, compounded monthly. This time, you're buying it today. If you do so, you should expect to pay $. (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) a. b. C. Value of the annuity Value of the annuity Value of the annuity

Step by Step Solution

★★★★★

3.48 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Present value of consecutive 40 payments can be computed using formula for PV of ordinary annuity as ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started